State Taxes Are Driving People To Moving To Other States?

A rewrite by me combining several articles . . .

“Go woke, go broke,” cited by one billionaire.”

The implication? The ongoing culture war and economic policies of northeastern states had facilitated the migration of wealth and economic power to the South. California has the highest marginal tax rate in the nation. California also has had the second lowest out-migration rate among households earning $200,000 or more during roughly the past decade.” As taken from:

State Taxes Have a Minimal Impact on People’s Interstate Moves, Center on Budget and Policy Priorities, Michael Mazerov.

Michael Mazerov at the Center on Budeget and Policy writes, state tax levels have little effect on whether and where people move. So little effect such movement out-of-state should not cause policymakers to enact unaffordable tax cuts to attract people. Much less, avoid enacting productive tax increases focusing on the wealthy.

Historically, U.S. residents have been moving away from the Northeast, the industrial Midwest, and the Great Plains to the Sun Belt and West for decades. The pattern of movement is substantially independent of state tax levels or the presence of an income tax. California has the highest marginal tax rate in the nation. It also has had the second lowest out-migration rate among households earning $200,000 or more during roughly the past decade.

(Click on image to enlarge)

Job-and Family-Related Reasons Are People’s Primary Explanations for an Interstate Move, Center on Budget and Policy Priorities

People will move to other states for financial gains from employment opportunities and also for family reasons. They may also move for less expensive housing, as many retirees do to a warmer, snow-free climate. In our case, 120 degrees on a few days kept us inside. A trip to the garbage units was exhilarating warm. In the past and more recently, there has also been a trend of migration to coastal states like Maine, Oregon, and Washington in addition to states in the Rocky Mountain West like Colorado, Idaho, and Montana. Much of this movement appears to be a desire for an outdoors-oriented lifestyle.

Policymakers in states like California, Connecticut, Illinois, Massachusetts, Minnesota, and New York should not give credence to anti-government advocates claiming state taxes cause massive “tax flight.”

Other states cutting taxes?

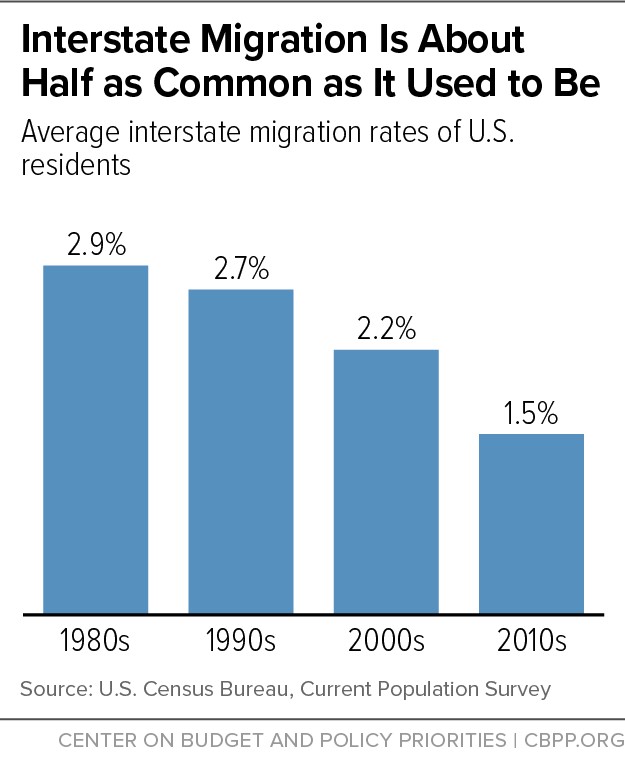

State lawmakers in Iowa, Mississippi, Nebraska, and West Virginia having recently cut income taxes may find such actions did not stem or reverse their states’ net out-migration trends. Data shows interstate migration has been decreasing.

(Click on image to enlarge)

Job-and Family-Related Reasons Are People’s Primary Explanations for an Interstate Move, Center on Budget and Policy Priorities.

Quite the opposite can occur from deep tax cuts. If substantial deterioration in education, public safety, parks, roads, and other critical services and infrastructure occurs, these states may render themselves less and not more desirable places to live and raise a family.

High Income families are findiing?

The evidence fails to support claims of interstate migration is driven by high-income people. Or anyone else — moving because of taxes. A careful look at Census and IRS data on interstate migration, and a review of academic studies reveals otherwise (supporting data can be found on the site recognized in the title).

More By This Author:

Mao With Money

The Current Economic “Big Picture”: By No Means Are We Out Of The Woods

F-35 Maintenance Costs