Silly Idea Of The Day: The Price Of Gold In China Is The Accurate Price

It is amazing how much complete economic garbage gets posted and retweeted on Twitter.

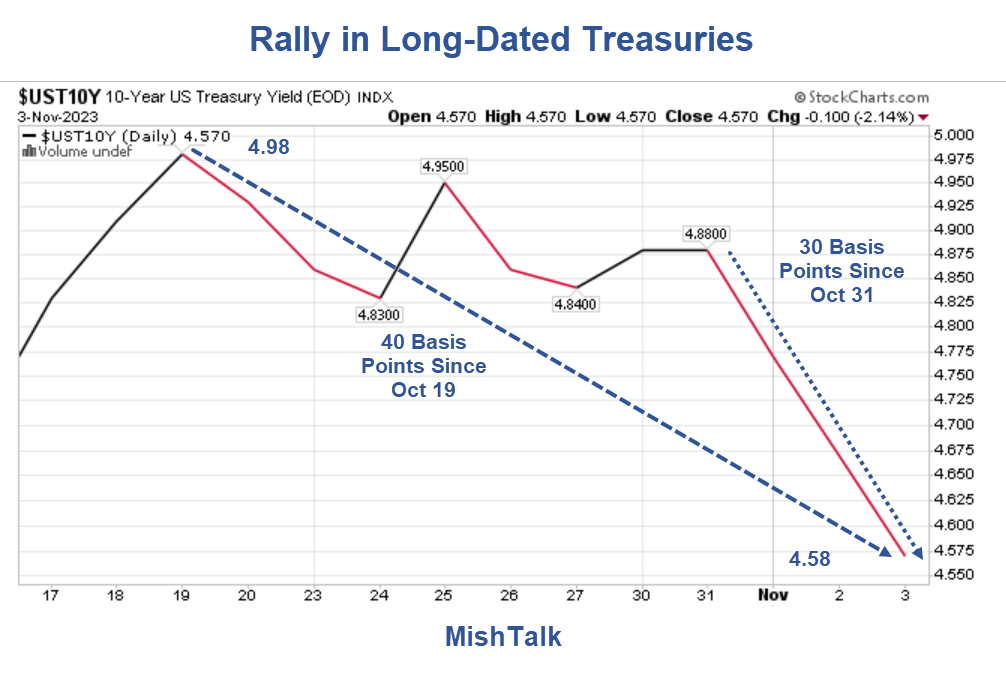

Image courtesy of StockCharts.Com, annotations by Mish

Please consider this pair of absurd Tweets.

(Click on image to enlarge)

The first Tweet above had over 120,000 views with 433 likes and 87 Tweets.

It took precisely 5 seconds to debunk the above nonsense with a simple search.

China Resumes Gold Imports

China Resumes Gold Imports Following Renminbi Stabilization

On September 28, the Oxford Gold Group reported China Resumes Gold Imports Following Renminbi Stabilization

The People’s Bank of China recently lifted its temporary restraints on gold imports that were placed on specific lenders in an attempt to protect the renminbi. The action caused local gold prices to rise in China, leading to the central bank lifting the imposed restraints last Thursday.

The difference between the Shanghai and London gold prices reached an astonishing $121 per ounce based on public trading prices last Thursday. By Monday, the spread dropped back down to a more relaxed $76 per ounce, following China’s movement back to more open gold import policies on state and specific commercialized banks.

Back in August, China began reducing the number of quotas it would grant for international gold imports as a way to defend the renminbi and hedge against the rising inflation rates by easing purchases. With this policy, though, in early September, the renminbi plummeted to its lowest level against the U.S. dollar in 16 years, according to recent economic data.

After this disappointing data came out, the People’s Bank of China released a warning against bets regarding renminbi depreciation. The central bank initiated numerous measures to defend the currency’s strength, including lifting foreign reserve requirements and enacting state bank purchasing. Following these actions, the renminbi quickly regained its footing, reaching around Rmb7.286 against the U.S. dollar on late Monday.

China’s central bank directly controls how much gold can enter the nation’s domestic market using a series of quotas provided to commercial banks. The quota system acts as an unofficial tool for controlling precious metal flows and currency market performance rates.

China Is Defending the Yuan

The renminbi fell to the lowest level in 16 years and China reacted by blocking gold imports.

And people actually believe the price in China is the “real” price.

Of course, this fits the general theory that the dollar will go to hell so why bother doing spending 5 seconds to look for an explanation.

Enormous Irony

The amazing thing about these ideas is how easily they are disproved.

The associated irony is what’s really happening is 180 degrees removed from the idea behind the Tweets. The yuan, not the dollar is imploding.

People have been talking about this story for months because it fits their beliefs. But is China that is seriously manipulating it’s currency and gold responded.

One can buy real allocated and audited gold at Goldmoney or Bullion Vault, or via the symbol OUNZ ( VanEck’s Physical Gold ETF) with minimal markup.

Technically Speaking

The lead chart is the prettiest cup-and-handle formation you will ever see.

It’s a bullish chart and I expect the next big move will be up. The fundamentals align as well.

Gold vs the US Dollar

(Click on image to enlarge)

On a short term basis, gold usually moves with the dollar but there are major exceptions. For example in 2005-2006 and 2011-2012 gold and the dollar rose simultaneously.

Importantly, with the US dollar index at 92 gold has been at $500, $1200, and $1900.

So the belief gold tracks the dollar is more myth than reality. If not the dollar, then what?

The Driver for Gold

(Click on image to enlarge)

I need to update that chart but it still properly conveys the idea.

Gold is not correlated to the dollar as most people seem to believe . Rather it’s correlated to faith in central banks.

With massive treasury issuance on the horizon, and with no reason to have any faith in the Fed, Bank of China, or Bank of Japan, the fundamentals and technicals are in alignment.

Still More Gold Silliness

(Click on image to enlarge)

Yeah, just imagine. It’s far more likely all the banks in China close. But don’t expect that either.

People like doom and gloom click-bait articles because it matches their belief the US is going to hell and China is the ascendent power.

Arbitrage Opportunities

If China had a free open market in gold and the yuan floated, the price of gold in China would exactly match the price in the US at any moment.

If it didn’t there would be an arbitrage opportunity and a guaranteed profit.

The Price of Gold?

The best representation of the price of gold is not the current price in China. It’s the current price in the US on the futures market.

That price is $1990 as I type (roughly 10:14 PM mountain time). Whether or not you think gold is being slammed slammed, the fact of the matter is you can buy physical, audited, allocated gold near that price at the moment.

Past slamming and collusion in the US, although admitted, does not affect my previous statement. You can buy physical gold very close to the spot price. Period.

If you can’t buy gold near the spot price in China, chalk it up to blatant currency manipulation in China.

US vs China Capital Markets

The US has the largest, most free capital markets in the world. China has capital controls, resorts to import controls on gold, has no bond market to speak of, and the yuan does not even float.

But hey, let’s praise China for having the true price of gold. What a hoot!

What’s Driving the Rally in Long-Duration US Treasuries? Will it Last?

(Click on image to enlarge)

10-year US Treasury yield courtesy of StockCharts.Com, annotations by Mish

More By This Author:

What’s Driving The Rally In Long-Duration US Treasuries? Will It Last?Under What Conditions Would China Dump US Treasuries Or Dollar Holdings?

Missing Crypto Fraud In Plain Sight

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more