Record Plastic Prices May Go "Stratospheric" As Hurricane Approaches Gulf Coast

Tropical Storm Ida has strengthened into a Category 1 hurricane, making landfall on Isla de la Juventud, the second-largest Cuban island. The hurricane is expected to strike Louisiana late Sunday or early Monday.

At 1315 ET, the National Hurricane Center (NHC) said data from an Air Force Reserve Hurricane Hunter aircraft indicated Ida was upgraded from a tropical storm to a hurricane. NHC said the storm has maximum sustained winds of 75 mph.

1:15 PM EDT: Data from an Air Force Reserve Hurricane Hunter aircraft indicate that #Ida has strengthened to a hurricane, with maximum sustained winds of 75 mph. Tropical storm conditions are occurring on Cayo Largo, Cuba https://t.co/tW4KeFW0gB pic.twitter.com/aYXq5lRDq1

— National Hurricane Center (@NHC_Atlantic) August 27, 2021

Ahead of Ida's arrival, offshore oil and natural gas explorers are shuttering platforms and evacuating workers as per SOP. There's also concern that the hurricane could disrupt major chemical plants along the Gulf Coast that may send record plastic prices to "stratospheric" levels.

Ida could strike parts of the central Gulf Coast as a major hurricane (Category 3 or stronger) on Sunday evening or Monday. Landfall projections are currently for Louisiana.

The rapid intensification from Tropical Depression 9 to Tropical Storm Ida to Hurricane Ida occurred in about a day.

Already, Bloomberg data shows about 1.3 million barrels per day of U.S. Gulf Coast production capacity has been halted. Here's the list so far of offshore rigs and their capacity in barrels per day taken offline:

- BP

- Atlantis, 200,000 b/d

- Mad Dog, 100,000 b/d

- Na Kika, 130,000 b/d

- Thunder Horse, 250,000 b/d

- Shell

- Turritella (including Stones field) 50,000 boe/d (at peak)

- Mars, 60,000 boe/d

- Olympus, 100,000 boe/d

- Appomattox, 175,000 boe/d

- Ursa, 150,000 boe/d

- Equinor

- Titan, 2,000 boe/d (producing rate in the second quarter)

- BHP

- Shenzi, 100,000 b/d and 50 mmcf/d gas

With more than a million barrels per day of Gulf of Mexico output offline, this could place upward pressure on crude futures at a time when prices have fallen 5% over the past month.

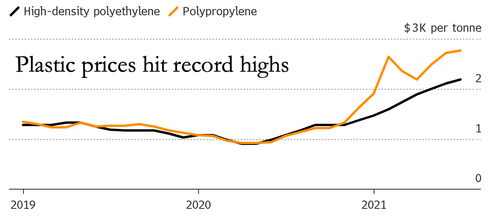

Another concern is assets onshore such as chemical plants, operated by Exxon, Dow and others which are located in the hurricane's path. These plants produce polypropylene, high-density polyethylene, and PVC. Readers may recall plastic prices soared after the Arctic blast in February severely damaged pipes at chemical plants across the Gulf Coast.

Polypropylene is found in anything from plastic parts for machinery and equipment and even fibers and textiles. Any disruption to these plants because of weather-related issues could cause shortages and send prices even higher.

"Long-term outages induced by tropical weather could fuel stratospheric price rises that downstream supply chains and consumers cannot easily afford," Jeremy Pafford, head of North America market development at data provider ICIS, said. "With the majority of U.S. commodity plastic resin capacity stationed on the Texas and Louisiana coasts, one devastating hit could bring months' worth of polyethylene, polypropylene and/or polystyrene shortages."

The US economy is already facing unprecedented pressure from frozen supply chains and record shortages: could yet another unexpected price spike be the straw that finally breaks the middle class' back?

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more