Recession Probability Falls After Hitting Double-Top

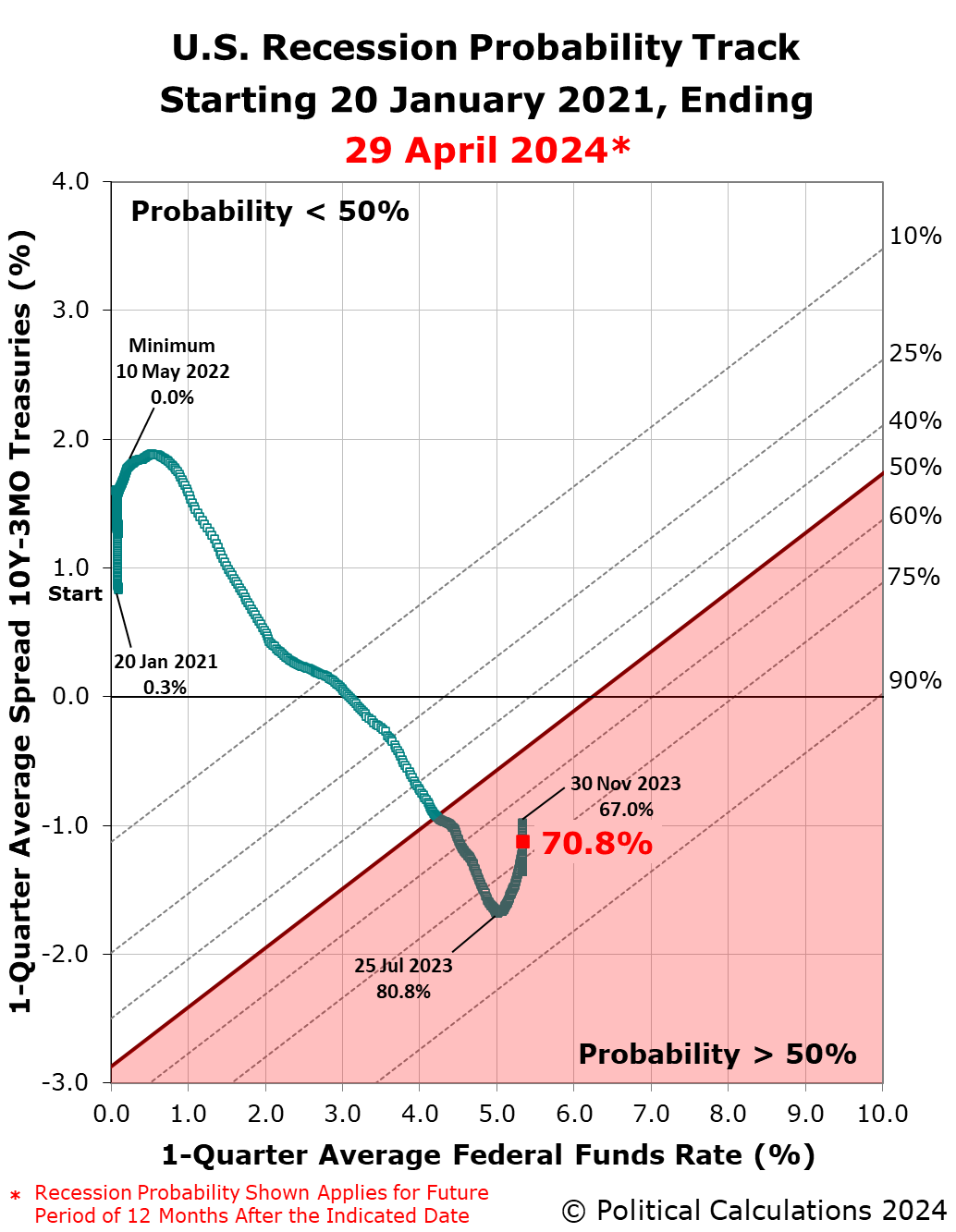

The probability the U.S. economy will see a recession begin sometime in the next twelve months has started to fall again during the past six weeks. after having hit a double-top.

Since our previous update, the probability has dropped from over 76% to just under 71%, confirming the double-top after having previously peaked at 81% in July 2023.

These probabilities are determined using a recession forecasting method developed for the Federal Reserve Board in 2006. They represent a portion of the economic data and forecasts Federal Reserve officials will consider as they meet from 30 April to 1 May 2024 to review how they will set the level of short term interest rates in the United States in the months ahead. The expected timing of rate cuts by the Fed has been slipping later and later during the past six weeks.

The following chart presents the latest update of the Recession Probability Track. It reveals how that probability appears as the Federal Reserve's Open Market Committee (FOMC) goes into its April 2024 meetings to review and potentially change the Federal Funds Rate (FFR). The FOMC is expected to continue holding the FFR steady at this meeting, but is expected to start lowering this core interest rate at later meetings in 2024. Markets anticipate the Fed may cut this interest rate at its September 2024 meeting.

(Click on image to enlarge)

The Recession Probability Track indicates the probability a recession will someday be officially determined to have begun sometime in the next 12 months. For this update, that applies to the dates between 29 April 2024 and 29 April 2025.

The double-top pattern we've described at the beginning of this article can be better seen by simply tracking the recession probability over time. The next chart shows that forecast probability using the data available from 30 April 1983 through 29 April 2024, with the probabilities shown shifted 12 months into the future to coincide with the end of the period in which they apply.

(Click on image to enlarge)

The probability of recession peaked at nearly 81% on 25 July 2023, making the period from July 2023 through July 2024 the mostly likely period in which the National Bureau of Economic Research will someday identify a point of time marking the peak in the U.S. business cycle before it entered a period of contraction. The prolonged elevation of the Federal Funds Rate combined the deepened inversion of the U.S. Treasury yield curve in recent weeks has made the period between 18 March 2024 and 18 March 2025 the second most-likely period that will include the peak of a business cycle that marks when a recession began.

Another way to interpret the double-top pattern is to consider that it extends the period in which the highest probability of recession is elevated. Under that interpretation, the period in which the probability of an official recession starting would be greater than 70% is running from 25 July 2023 through at least 29 April 2025.

Only time will tell if that's an appropriate way to interpret the data. Looking at the underlying data that's used to determine the recession probability, we anticipate it will continue falling in the near term, making a "triple-top" event unlikely.

More By This Author:

S&P 500 Jumps On AI-Powered Earnings, Alphabet Dividend And September Rate CutHow Long Might It Take A Hacker To Crack Your Password By Brute Force In 2024?

Climbing Limo GDP Forecast For 2024-Q1

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more