Reading The Signs: Is The US Economy Headed For Recession?

Yesterday’s events of the U.S. dollar making yet more gains whilst gold and silver prices tumbled, have caught the attention of investors around the world. This sudden shift in the markets is attributed to Fed Chair Jerome Powell’s testimony to Congress, where he increased the likelihood of further rate hikes… With this news, investors are left wondering what the future of the US economy looks like and how this will further impact the wider economy.

Gold and silver prices, along with U.S. equity markets tumbled as the U.S. dollar rallied on Tuesday after Fed Chair Jerome Powell’s testimony to Congress increased the probability of ‘a couple of more 50 basis point’ interest increases at the next two meetings.

The CME Fed Watch Tool showed that the probability of a 50-basis point increased to almost 75% at the March 21-22 meeting, up from 31% the previous day, and virtually zero before the release of the U.S. January employment report on February 3 reported that 517, 000 jobs were created in January – much higher than the around 180,000 that were expected.

There is debate among economists as to whether the reported 517,000 jobs created were a fluke due to annual population adjustments by the U.S. Bureau of Labour Statistics.

Is the U.S. economy heading for recession?

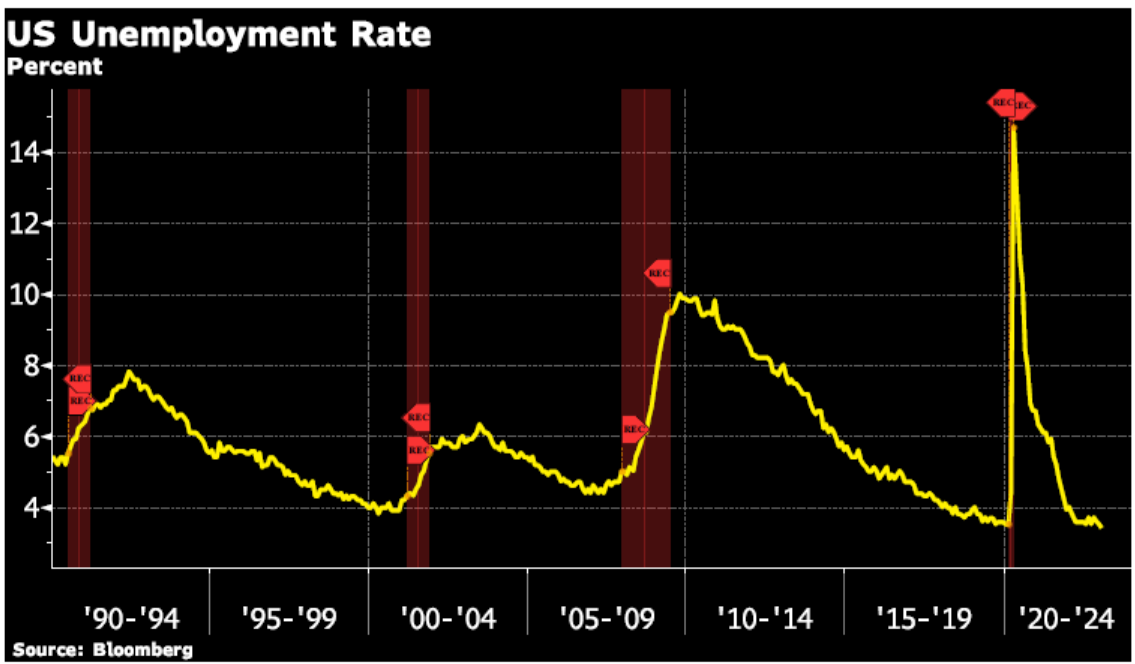

Even with the large jobs creation number the U.S. unemployment rate was little changed at 3.4%, which does appear to be a cyclical low. However, looking at past cycles this number reaches the cyclical low right before a recession and then rises quickly. The chart below shows the U.S. unemployment rate back to 1990 with U.S. recessions (red bars).

US Unemployment Rate Chart

Not only is it possible that the January jobs creation number was a statistics fluke, meaning that February’s Job creation number could be much lower (some economists think even negative) but the job creation numbers, unemployment rate and even the inflation data the Fed relies upon to make policy decisions are all lagging indicators.

They are what has happened in the past months, looking at leading indicators there are significant signals that the U.S. economy is heading for recession.

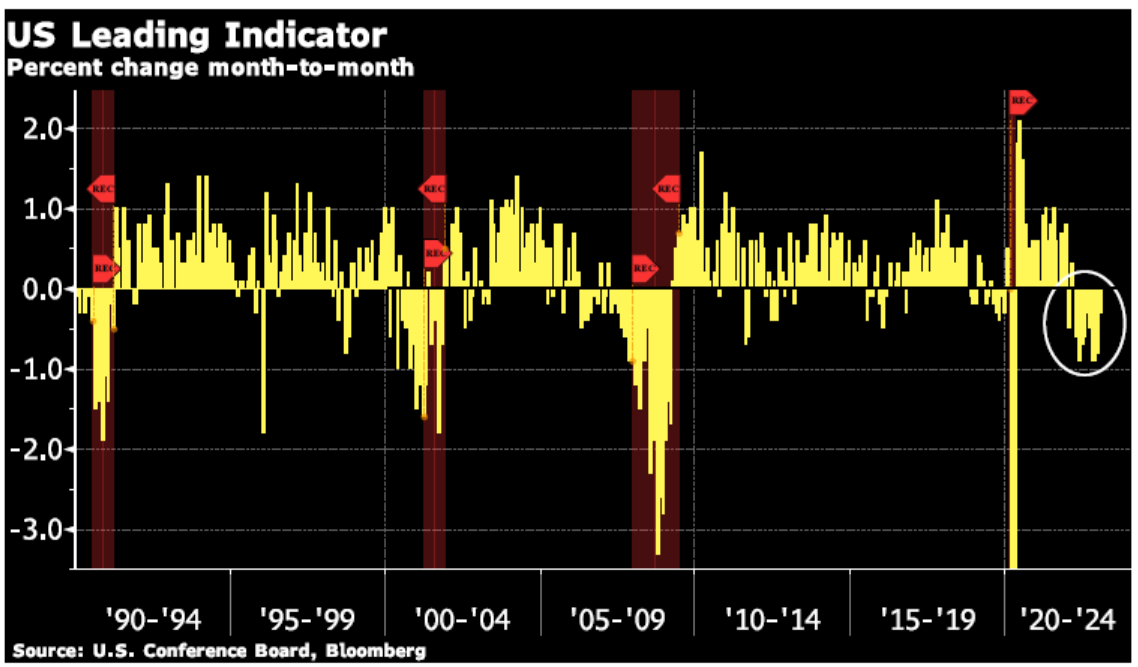

The U.S. leading indicator

Starting with the U.S. Conference Board’s Leading Economic Index (known as the U.S. Leading Indicator) the forward-looking trends are poor. The U.S. leading indicator is a composite index comprised of indicators such as the Leading Credit Index, Building Permits, S&P 500 Index, Average Weekly Hours, and New Orders.

This indicator has been negative month-over-month for the last 10 months. And as the chart below shows, long periods of the indictor in the negative territory has been associated with a U.S. recession.

US Leading Indicator Chart

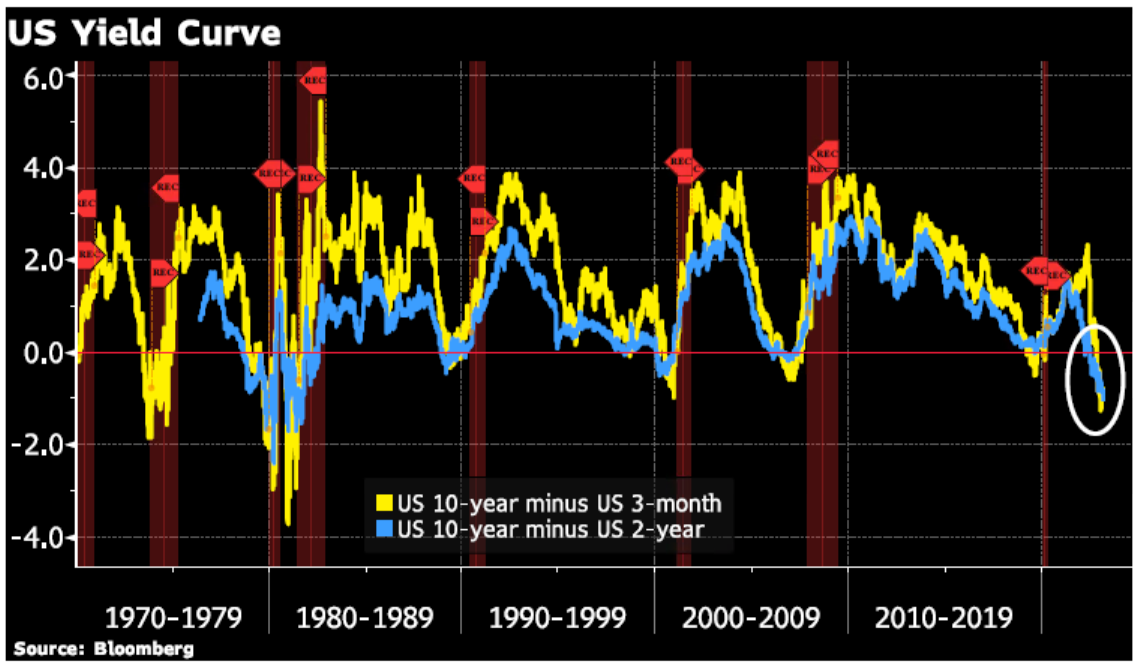

One of the best known and relied upon indicators of recession has been the yield curve. During times of healthy economic expansion, the yield curve is positive (upward sloping), meaning that investors require a higher yield to hold longer-term US government bonds than shorter term.

However, during times of distress and slowing economic activity, the yield curve becomes inverted, meaning that short-term rates are higher than longer-term rates.

US Yield Curve Chart

Powell has acknowledged that there is going to be ‘more pain to come’ including a higher unemployment rate but writes this pain off as part of the process.

Moreover, Senator Elizabeth Warren challenged this assumption and repeatedly pressed Powell for an answer of what about the estimated 2 million workers that will lose their jobs as the U.S. economy slows.

Powell’s response was that the high inflation rate is ‘hurting all workers’ and after a heated back and forth Senator Warren asked if that meant that the workers that lose their jobs are the ones that will “just have to bear it”.

There is no easy way out of the inflation mess that central banks created and are now trying to solve. Powell is also correct that 5%+ inflation is hurting all workers as their paychecks are being diluted.

However, the signs of recession are already apparent – but certainly, no one believes raising rates until the financial system and economic environment crumbles is the answer – this will lead to a yo-yo in rates as the Fed has to cut quickly to resolve the new crisis it created.

Therefore, the Fed needs to look forward not backwards – and to also consider that monetary policy, both interest rate increases, and the shrinking of their balance sheets take time to work through the economy.

Unfortunately for gold and silver investors, the power central banks currently have over markets is sending the metal prices on a roller coaster – but when the Fed pushes ‘too far’ and crisis does happen metal prices are sure to rise.

Take a look at our latest chat with Chris Vermeulen to see when he expects gold to present a major buying opportunity, and when he thinks we may experience shortages:

Why Chris Vermeulen is Bullish About Gold and Silver Long-Term

For the remainder of 2023 physical metals investors should have an odd affinity for Elizabeth Warren. She is the person most likely to cow Jerome Powell into declaring victory over inflation prematurely.

Should this come to pass then physical gold and silver will run higher once the entire world recognizes the FED can only party and has zero stomach for the pain it professes to preach. From here on out until the 2024 elections end, money is politics.

More By This Author:

After The Euphoria And Profit Taking Comes The Panic

Apparently Central Banks Are “Safeguarding The Value Of Money” – Seriously?

U.S. Federal Reserve Sticks To The Script But For How Long?

Disclosure: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation ...

more