Re-Steepening Of The Yield Curve Signals Rising Unemployment And Deepening Bear Markets

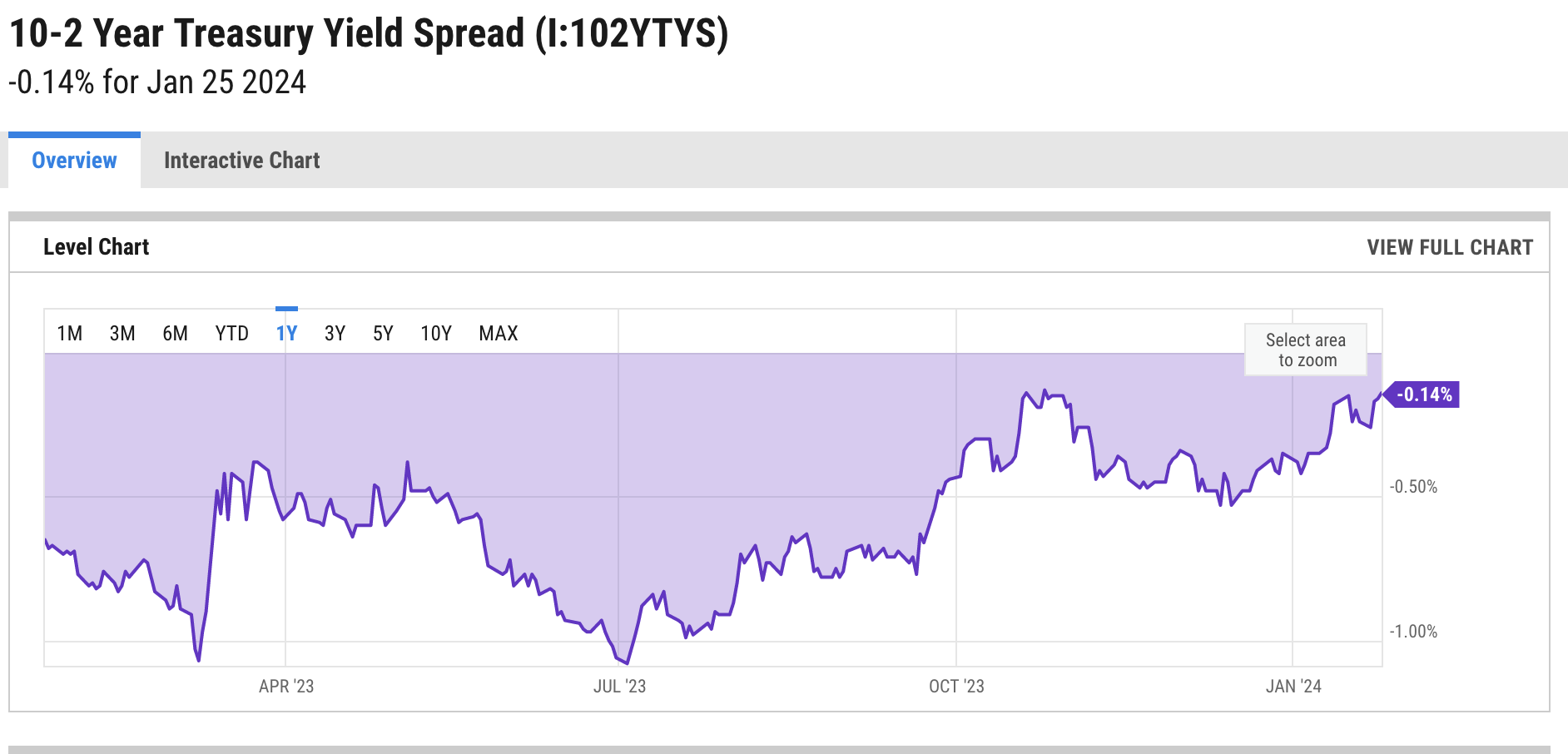

The US 10-2-year Treasury yield spread (via YCharts below) has moved from a deep inversion at 108 bps last July to -14 bps today. This process is known as re-steepening.

(Click on image to enlarge)

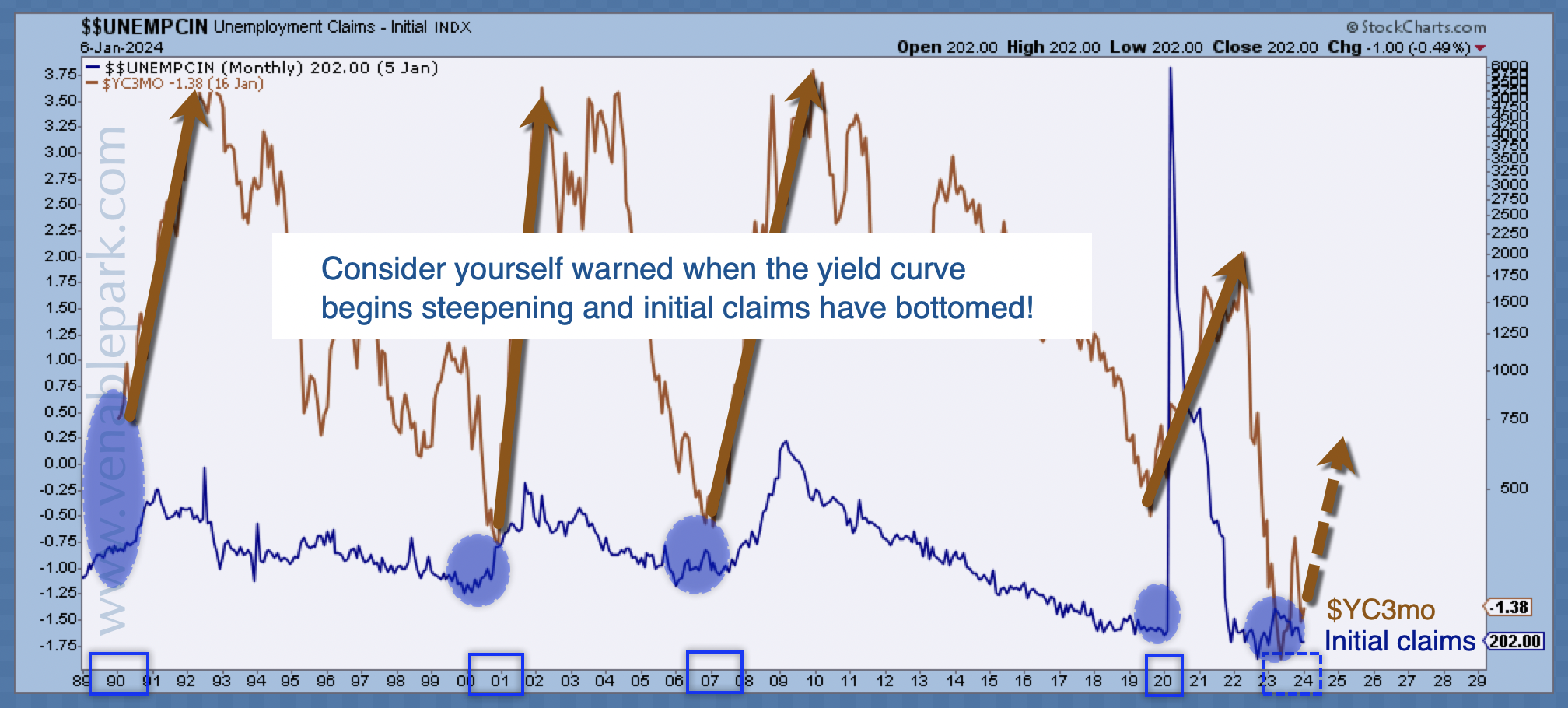

Re-steepening of the yield curve (10 minus 3-year spread in brown below since 1989, courtesy of my partner Cory Venable) has historically coincided with rising unemployment claims (in blue). So, it’s no surprise that layoff announcements are now picking up.

(Click on image to enlarge)

For stocks, corporate debt and commodities, re-steepening of the yield has historically signalled the worst part of bear-market losses, with the S&P 500 falling an average of 30% from the onset of the persistent 10-2-year inversion (which began in July 2022 this cycle).

Good overview of the present market cycle in this segment.

Video Link: 00:14:38

More By This Author:

Real Rates Rise After Central Banks Stop HikingChina Canary Warns About Global Economy And The Downside To Euphoria

Yield curve signals recession in 2024