Ranked: The Biggest Buyers Of U.S. Debt

(Click on image to enlarge)

Key Takeaways

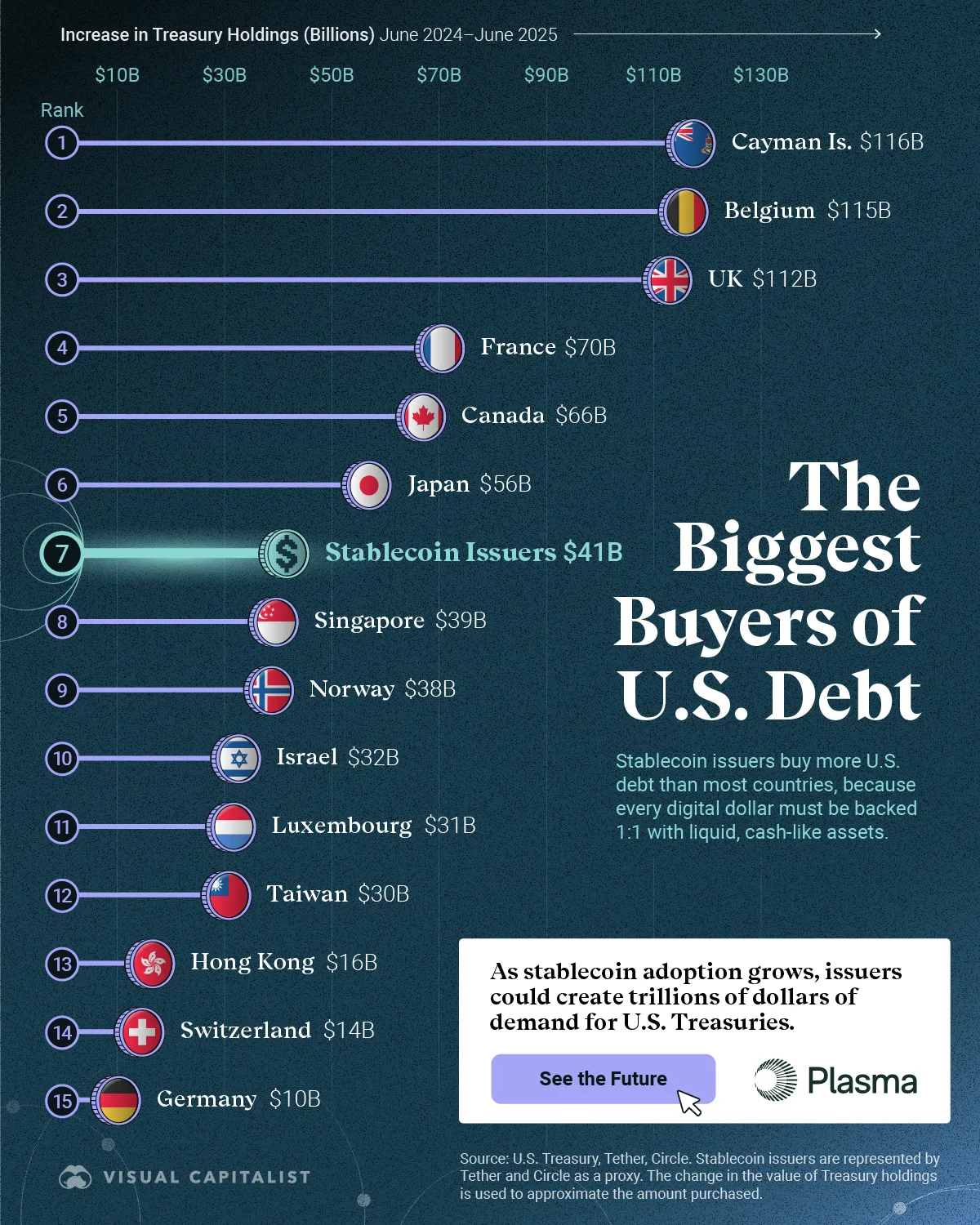

- The Cayman Islands bought the most U.S. debt in the year spanning June 2024–June 2025.

- When compared to foreign holders, stablecoin issuers rank as the seventh-largest buyer of American debt.

- Stablecoin issuers rank above countries like Singapore and Norway.

As stablecoins grow in popularity, their impact on global markets is becoming harder to ignore. This is especially true when it comes to who’s financing U.S. debt.

This visualization, created in partnership with Plasma for Stablecoin Week, compares the biggest foreign buyers of American government debt to the amount bought by stablecoin issuers.

The Role of Legal and Administrative Hubs

From June 2024–June 2025, the Cayman Islands was the biggest buyer of U.S. debt.

Why does a small Caribbean territory buy so many Treasurys? The Cayman Islands has no corporate income tax and is the legal home to many of the world’s hedge funds. When these funds buy Treasurys they count toward the Cayman Islands’ total, despite the fact that most funds are managed from elsewhere.

| Buyer | Increase in Treasury Holdings, June 2024–June 2025 |

|---|---|

| 🇰🇾 Cayman Islands | $116B |

| 🇧🇪 Belgium | $115B |

| 🇬🇧 United Kingdom | $112B |

| 🇫🇷 France | $70B |

| 🇨🇦 Canada | $66B |

| 🇯🇵 Japan | $56B |

| 💲 Stablecoin Issuers | $41B |

| 🇸🇬 Singapore | $39B |

| 🇳🇴 Norway | $38B |

| 🇮🇱 Israel | $32B |

| 🇱🇺 Luxembourg | $31B |

| 🇹🇼 Taiwan | $30B |

| 🇭🇰 Hong Kong | $16B |

| 🇨🇭 Switzerland | $14B |

| 🇩🇪 Germany | $10B |

Stablecoin issuers are represented by Tether and Circle as a proxy. The change in the value of Treasury holdings is used to approximate the amount purchased.

Belgium was the second-largest buyer of U.S. debt. This large total can be traced in part to the fact that Belgium is home to Euroclear, a custodian that holds securities on behalf of other parties.

But how do stablecoin issuers stack up against these major foreign holders?

U.S. Debt Bought by Stablecoin Issuers

When compared to these large foreign holdings, stablecoin issuers come in seventh place. Tether and Circle bought about $41 billion in U.S. Treasurys directly, more than countries like Singapore, Norway, and Israel.

The reason stablecoin issuers buy so much debt is because they must back every digital dollar 1:1 with liquid, cash-like assets. That pushes them toward ultra-safe instruments like U.S. Treasury bills, money market funds, and cash.

Both stablecoins and the U.S. Treasury market benefit from their close relationship. Stablecoin issuers rely on U.S. Treasurys to create consumer confidence and grow their user base. Treasurys also offer safe interest payments. On the other side, the U.S. Treasury market stands to gain from new, large-scale buyers to help expand demand.

However, this growing interdependence poses systemic risks. If stablecoin issuers face large redemption requests, rapid liquidations could disrupt the Treasury market.

More By This Author:

Visualized: What Are Stablecoins Backed By?Mapped: U.S. Oil Production By State

Mapped: The Massive Network Powering U.S. Data Centers