Powell’s Real Choice: His Reputation Or Esteem

Image by Gerd Altmann sourced from pixabay

Banking’s History Reveals An Impossible Decision

Market participants ascribed a lot of importance to the December meeting of the Federal Open Market Committee (FOMC). Many expected (and even pleaded) the committee to take a dovish stance. When the Federal Reserve (Fed) disappointed, markets continued to liquidate. Did the FOMC commit a policy error? Well, they faced a catch-22. In my view, Chairman Jerome Powell’s choice was not between making the correct or incorrect policy decision; it was between maintaining some semblance of intellectual independence and being forever enslaved to the markets. Said differently, his choice was to either save his reputation or his self-esteem.

No single monetary policy decision should be that important in a dynamic economy. Conditions are ever-changing and markets still set the overwhelming majority of interest rates; the Fed controls just one—the Federal Funds Rate. In fact, it’s worth asking: Who needs the Fed?

If true, why did markets react so negatively? Did they overreact? I think they’re sniffing out an unavoidable risk created by the combination of central banking and fiat currency issuance: leverage—not just on balance sheets, but throughout the entire financial system.

To be sure, Powell is not to blame for this development; it’s been building for decades. Truth be told, central bankers face an impossible task. Their fundamental function—to effectively balance the supply of money to demand—is no job for a committee. It requires omniscience. Thus, the task is best left for the decentralized decision making process of markets. The result of successive and unavoidable missteps is higher leverage throughout the financial system.

Anyone following my What I’m Reading pages will see that I’m a bit of a history buff when it comes to banking. No, I’m not very popular at parties. But this historical perspective is quite useful for analyzing the esoteric workings of our modern monetary and financial system. The history of banks is the history of the financial system. Tracking their evolution illustrates why this increase in leverage was unavoidable once control over the money supply was centralized and currencies went fiat.

Here in Part 1, I run through the progression of banking and money issuance up to the era of central banking. In a forthcoming Part 2 I will show how the combination of fiat currency and central banking led to increases in leverage.

So how did we get here?

The Origins Of Fractional Reserve Banking

We currently have a fractional reserve banking system. Banks originate loans using their customers’ deposits. Thus, there is less cash “in the vaults” than what banks owe to depositors (hence the “fractional reserve” moniker). This creates the potential for devastating bank runs to occur, a common critique of the system. While a risk, fractional reserve banking was nonetheless a revolutionary leap forward for human progress and is the foundation for modern economies.

For most of existence money took the form of some asset. Over time, precious metals—and eventually gold—won the evolutionary race. Since money is merely past production transformed into a tradeable form, growing economies require a growing money supply; more importantly, dynamic economies require a dynamic money supply. Unfortunately, the production of gold is not very dynamic (though it is steady and responsive to market conditions). At any given time there’s only so much of it in circulation. Luckily, markets created a fix.

At first, “banks” were warehouses. They simply stored customers’ gold for a fee. Depositors were issued deposit receipts that represented claims to their gold held in storage. Considered as good as the metal itself, these deposit receipts eventually supplemented the usage of gold in commerce (especially for large transactions). It was far easier to carry a pocketbook of paper than crates of coins. Paper money was born.

Realizing that depositors didn’t come for their gold all at once, banks originated loans using their customers’ funds. This innovation not only eliminated storage fees for depositors, but inverted the relationship completely; banks paid customers for the use of their funds. Not only did banks and savers profit from this arrangement, but economic activity was catalyzed. A mechanism for mobilizing dormant capital was created. Investment and economic activity exploded (in the good way). Fractional reserve banking was born.

But something even more magical happened.

The Bank Note Is Born

Economic activity rapidly expanded. A proportional response in the supply of money was needed. Gold miners could not keep up with demand. How was the shortfall of required money bridged? By banks of course!

Remember those deposit receipts? Since banks were not fully reserved, deposit receipts no longer represented claims to specific assets held in storage. Rather, they were loans made to an issuing bank. Still, they were immediately redeemable for gold by the holder and, consequentially, still treated as gold substitutes. There was no reason to act otherwise so long as banks honored their commitments. The deposit receipt was gone. The bank note was born and became a dominant form of currency. (This is the origin of the “Federal Reserve Note” text found on any U.S. bill.)

Each bank issued its own currency. Since all were convertible into gold, bank notes were mostly treated as interchangeable. However, differences in banks’ credit qualities caused some to trade at a discount (including those from far away places). Hence, financial strength was a coveted competitive advantage.

Automatically Stabilizing Features

Fractional reserve banking and the issuance of bank notes created a dynamic money supply through the use of leverage. The amount of bank notes in circulation at any one time exceeded a bank’s gold reserves. The difference represented an expansion of credit. So long as borrowers used their loans to grow and repaid their debts, so did the money supply (remember, money is just productive output in a different form); the gold miners eventually caught up. The repayment of loans increased a bank’s capital and, as a result, the amount of additional credit it could extend. If loans defaulted, the bank’s capital and money supply shrank. It was plain and simple.

The secret was in the system’s design, an outcrop of market forces. There were built-in mechanisms to counteract a bank’s incentive to overextend credit. When a particular bank’s notes increased in circulation (either real or perceived), noteholders became fearful and redeemed. The issuing bank’s gold reserves dwindled. The institution then faced a choice. It could increase deposit rates in order to attract and build up more reserves, and/or it could curtail lending operations. Inaction increased its vulnerability to a bank run which competitors would happily facilitate.

This ecosystem of competing banks issuing private, yet fungible currencies that were immediately redeemable into specie kept leverage and (hence) the money supply tethered to the economy’s productive output. The “financial” economy was tied to the hip of the “real” economy—as it should be.

Thus, it was a marketplace that balanced the supply of money to demand, and credit extension to production. Banks had objective and clear signals. The consequences were dire, if not outright existential. Incentives were aligned. The process was decentralized. No single bank could materially impact the economy at large. It could only influence the money supply and amount of credit outstanding by so much.

To be sure, the decentralized banking regimes predating the 1900’s were far from perfect. Honestly though, they performed surprisingly well (notably in Scotland, Canada, and the antebellum period in the U.S.). The severity of the periods’ bank runs and panics are largely overstated by critics. In fact, they were often caused by some form of banking regulation: The prohibition against branching inhibited banks from diversifying risk; competition was restricted by chartering; government bond reserve requirements disrupted capital bases. Critics also conveniently forget that private markets resolved most issues themselves, including the Panic of 1907.

Swapping Markets For Models: The Rise Of Central Banking

All of that changed with the establishment of central banks. Granted monopolies over the issuance of currencies, they replaced private banks in providing and balancing the supply of money to demand. However, ties to gold were still in place. Thus, market forces remained influential.

While monetary policy became discretionary, one highly objective mechanism remained in place. Just like with private banks, a central bank that overextended itself saw its gold reserves dwindle. They also faced the same choices to remedy reserve deficiencies—raise interest rates to attract more foreign gold or reduce government debt. As you might imagine, neither are politically popular options.

Then in 1971 President Richard Nixon unilaterally took the U.S. off the gold standard. The U.S. Dollar became a fiat currency. Other countries followed. Money’s objective tether to the productive economy was severed. It was replaced by opinion.

No amount of my pining for those wondrous yesteryears can change the fact that we live in an era of fiat currency and central banking. Currency issuance is now solely a responsibility of Federal Reserve and its international brethren. Macro decisions that were once determined by millions upon millions of irrefutable, individual market decisions are now made by models, committees, and a handful of votes. Clear and objective signals were replaced by assumptions, hedonic quality adjustments, and subjective biases. Politics can also interfere. To be sure, the market still dominates the process of credit allocation, but the central bankers now have some influence.

Assessing The Fed’s Record

Central banking is often pitched as a remedy to the boom and bust cycles that occurred during the predating periods. They supposedly create lower “highs” and higher “lows”, and promote financial stability. So how have they done?

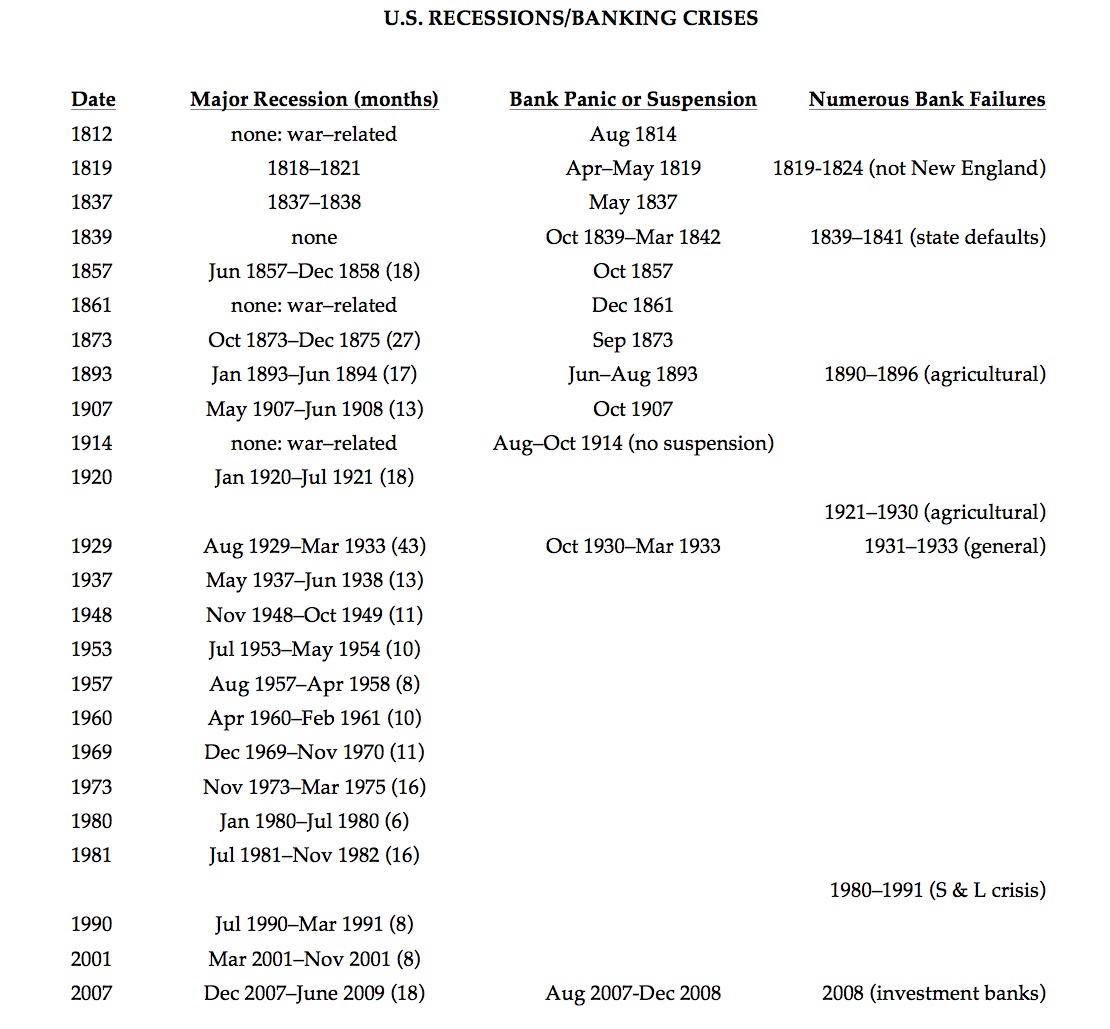

Unfortunately, the evidence is underwhelming at best, at least in the U.S. A tally of all recessions, bank panics, and bank failures reveals that the establishment of the Fed in 1914 did not reduce the frequency or severity of such events. In fact, the two worst financial crises in U.S. history—the Great Depression and the recent financial crisis—both occurred under its purview.

A tally of recessions, bank panics, and bank failures reveals that “[the] widespread belief among economists, historians, and journalists that the Federal Reserve [created in 1914] was an essential, major improvement appears to be no more than unreflective faith in government economic management, with little foundation in the historical evidence.”

Source: Alt-m.org

There are also claims that the U.S. Dollar has lost ~95% of its value since the Fed’s establishment. This is certainly true when comparing its purchasing power to the Consumer Price Index (CPI) or to gold. However, I think making CPI comparisons over long time periods is difficult (given all the adjustments). The comparison to gold is certainly more straightforward. The steep decline of the Dollar brings into question the Fed’s stewardship record (gold’s price was around $19 per oz at the Fed’s founding and is now close to $1,300 per oz at the time of this writing).

These findings should come as no surprise. Severed from the daily realities of the productive economy, central bankers are operating in an information void. Sure, they do their best to gather and act on data. Unfortunately though, they simply are not privy to the requisite information in amounts, locations, and speed. Worse, this centralized system lacks a self-reinforcing incentive scheme. Every decision is a matter of opinion.

Missteps Are Endemic

This article’s purpose is not to extol the wonders of free markets; nor is it to criticize central bankers. Rather, it’s to highlight the difficulty of maintaining a functioning banking and financial system. Balancing the money supply with demand is very complex. Market-based systems did this on the micro-level—one bank and one transaction at a time. Inputs and outputs were largely objective. The amount of data processed dwarfs the capabilities of the best econometric models and theories today (even when incorporating market-based data).

If decentralized systems were less than perfect how could one realistically expect a central banker to perform any better? It’s simply absurd to expect smooth sailing. Powell (and all central bankers, past, present, and future) will always get monetary policy wrong no matter how good their models or intentions may be. They lack the requisite information and tools . Economies are (thankfully) dynamic. Localized needs are in constant flux. Periodic meetings are too infrequent. Committees do not breed dynamism.

As an investor I find it helpful to recognize this. I no longer focus on what (I think) any central banker should do. Rather, I try to assess how they are mistaken. Expect policy errors as the norm, not the exception. Omniscience is not human quality.

Powell Went With His Gut … And Got Punched In It

Powell indicated numerous times that he is no fan of Quantitative Easing (QE). Perhaps he views its unwinding an imperative. This might explain the committee’s decision to stay the course with respect to reducing the Fed’s balance sheet.

“I’m concerned that the actions contemplated in this meeting are setting us on a path to a much larger balance sheet with likely benefits that are not commensurate to the risks that we’re bearing, … It will be very difficult to get off that path unless we begin to prepare the markets starting with this meeting.”

— Jerome Powell in 2012, cited by CNBC.com (source)

The investment markets, however, reacted quite negatively to this outcome. I (among many) believe QE inflated financial asset prices. Thus, Quantitative Tightening (QT, the unwinding of QE) should logically be deflationary and be a headwind for further market appreciation. Powell broke from his predecessors’ willingness to support asset prices at all cost. Markets threw a tantrum.

Powell’s hard-line stance did not hold though. He softened his position just two weeks later at the American Economic Association’s annual meeting. Markets rallied. Powell wanted the market’s approval after all.

The history of banking reveals the complexity of monetary policy decisions. Thus, it’s impossible to know if Powell (and the FOMC) was right or wrong in December, no matter how strongly you feel at the moment. There’s a long chain of events that created the current market conditions. Many mistakes were made. The compounded effect of all Fed decisions will play out over time. Markets will seek to discount the progression.

The FOMC cannot undo the past. Thus, the only choice Powell truly had was to give in to market participants’ dovish demands or do what he felt was right; to save his reputation with markets or maintain his self-esteem.

Please save your comments regarding the phenomena of the Great Moderation. I will tackle that in the forthcoming Part 2.

Additional Resources

Below is a list of resources for anyone interested in learning more about this historical perspective :

- Anything by George Selgin, Lawrence White, and Richard Salsman listed on my What I’ve Read page

- The History of Banks, by Richard Hildreth

- Alt-M website

- Free Banking and the Fed, a lecture by George Selgin

- The Federal Reserve, Markets & the Economy, episode of the Yaron Brook Show

- Anything by von Mises on the topic of money and banking

Interesting! Of course, Mises would say deflation is no big deal. But where credit is applied or taken away, deflation can be a very big deal.

Absolutely. There's nothing wrong with leverage. It just magnifies the pain when you get things wrong (and profits when done right).