Peak Inflation Watch - Thursday, July 28

The inflation battle continues. The Federal Reserve yesterday raised interest rates by a hefty 75 basis points, again, in a renewed effort to tame inflation’s recent surge. The key question: When will we start to see results?

There are increasing signs that the economy is slowing, with some indicators pointing to elevated recession risk. The 2yr/10yr Treasury yield spread, for example, is slightly inverted, which suggests a contraction is near. Using history as a guide leads to the easy conclusion that softer/negative growth will take the wind out of inflation’s sails.

Some analysts are already looking ahead on that front and read the tea leaves in yesterday’s press conference with Fed Chair Jerome Powell as a hint that the central bank might slow or even pause rate hikes in the near future. Maybe, but until there’s clear evidence that inflation has peaked the Fed will likely continue on its current path of tightening monetary policy.

Are there signs that inflation is peaking? The results remain mixed. Depending on the data set and macro expectations, you can see whatever you want to see. Deeper clarity and conviction are coming, but in real-time, the outlook remains fuzzy.

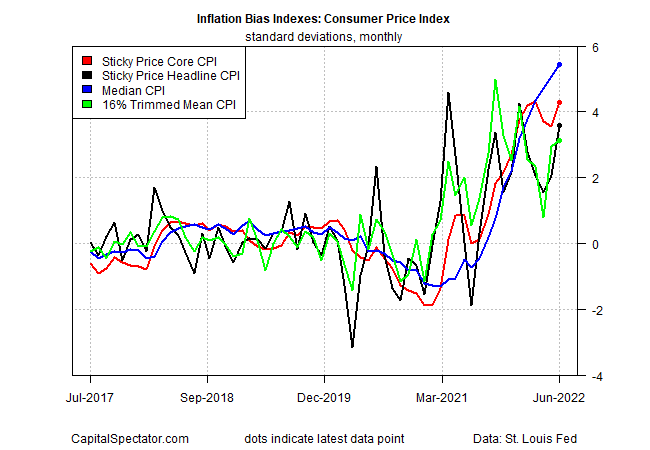

As a running profile for how a relatively objective set of metrics inform our thinking, here’s the monthly update on CapitalSpectator.com’s Inflation Bias Indexes. The methodology takes a standard inflation index, calculates the one-year change, and then computes the monthly difference and transforms the results into standard deviations around the mean. This bias offers one way to develop some quantitative insight for deciding which way the inflationary wind is blowing.

Running the analysis of the Consumer Price Index’s headline and core variations reveals a (slightly) mixed result through June. The bias for core CPI, which is considered a more reliable estimate of future inflation, continued to slide last month, offering fresh if not yet decisive support for thinking that inflation is peaking if it hasn’t already. There’s a bit of pushback in headline CPI, which ticked up slightly in June, although even here it remains well below its recent high. Overall, the slide in the core is steeper than the headline’s rise and so one can argue that the net result favors the view that inflation’s peaking.

Encouraging, but switching to a set of alternative (and arguably more robust) measures of consumer inflation calculated by regional Fed banks still suggests caution is in order. Indeed, in all four cases, the June data show these metrics turned up and remain at elevated levels. On this bias, it’s premature to say that inflation has peaked.

If you’re generous, the main takeaway is that the jury’s still out for confidently forecasting that inflation has created – a view that echoes last month’s update. As a result, we (like the Fed) remain data dependent and so all eyes turn to the upcoming CPI report for July in two weeks for a possible attitude adjustment.

More By This Author:

Energy Holds On To Hefty Lead For US Equity Sectors In 2022Is There A Case For A Return Of Disinflation/Deflation?

Across-The-Board Rebounds For Major Asset Classes Last Week

Disclosures: None.