One Of These Is Wrong - Will You Profit From What’s Coming?

Everything hinges on bonds today.

If longer duration Treasury yields continue to drop, then stocks will find a bottom of sorts. But if Treasury yields continue to rise, particularly on the all-important 10-Year U.S. Treasury, then stocks will be repriced to much lower levels.

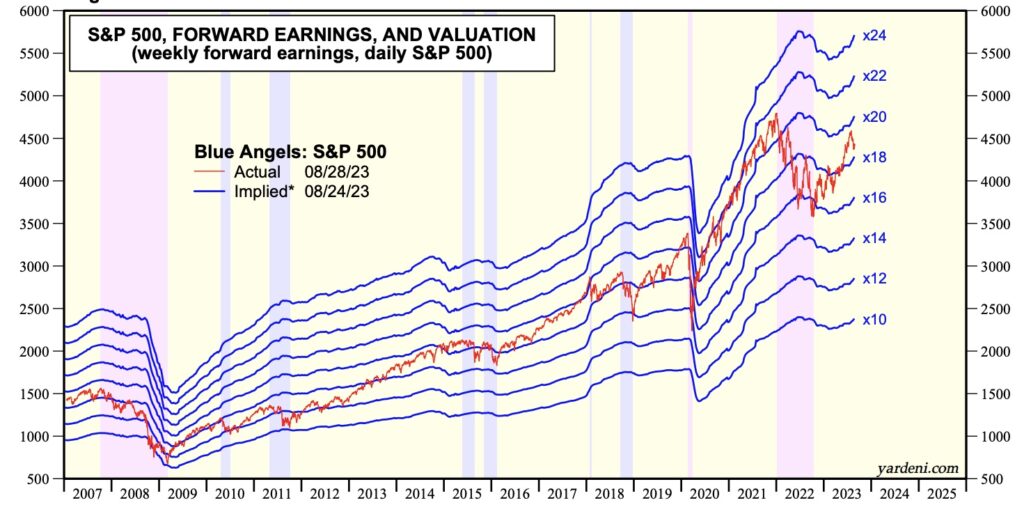

As the below chart from Dr Ed Yardeni illustrates, the S&P 500 is currently trading at around 19 times forward earnings. This is an extremely RICH valuation given that the yield on the 10-Year U.S. Treasury is around 4.25%.

(Click on image to enlarge)

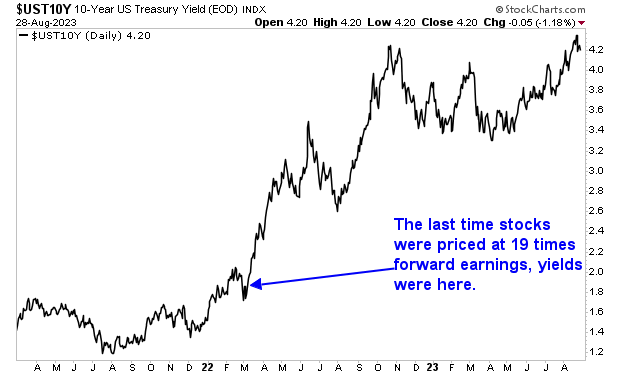

Consider that the last time stocks were this richly valued was early 2022 BEFORE the Fed started tightening monetary policy. At that time, the yield on the 10-Year U.S. Treasury was around ~2%. Obviously corporate earnings are now much higher, but the point is that the stock market is priced at a VERY high multiple given where the risk-free rate of return is trading right now.

(Click on image to enlarge)

Something has to give. Either Treasury yields are about to drop hard… or stocks will collapse. And smart investors who are properly positioned for this will see extraordinary returns.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

More By This Author:

This Is The Most Important Chart In The WorldThe Selling Might Be Done For Now

Ignore The Noise, This Is The Framework For The Markets Today