Mortgage Rates Are The Highest In 21 Years, What That Means In Pictures

According to Freddie Mac, the 30-year fixed mortgage rate is 7.09 percent. That’s the highest since April of 2002. Let’s discuss the practical implications and the inflationary mess the Fed made.

(Click on image to enlarge)

Mortgage rates from Freddie Mac via the St. Louis Fed

The Freddie Mac data is weekly, ending Thursday.

30-Year Fixed Mortgage Rates MND vs Freddie Mac

(Click on image to enlarge)

Mortgage rates courtesy of Mortgage News Daily

I believe the MND rate is more accurate and it is published daily.

Median Home Price

(Click on image to enlarge)

Median new home sales data from the Commerce Department, chart by Mish.

The median new home price is $415,400. The median price pre-pandemic, February of 2020 was $331,800.

Are you getting any more house now for the extra $83,600? I highly doubt it, and if not, it’s the result of Fed-sponsored inflation.

Assuming 20 percent down, let’s calculate the monthly payments from the Mortgage News Daily Widget then vs now, assuming a person was able to refinance at 3.00 percent or lower. That was easily doable with rates dipping all the way down to 2.65 percent.

Monthly Payment on a Median-Priced New Home Pre-Pandemic vs Now

(Click on image to enlarge)

Mortgage News Daily calculation based on median home prices in June of 2023 vs pre-pandemic, February 2000.

Anyone buying a new home today, putting 20 percent down has a monthly payment of $2,294 compared to $1,119 in 2020.

The math is much worse and more precise for existing homes.

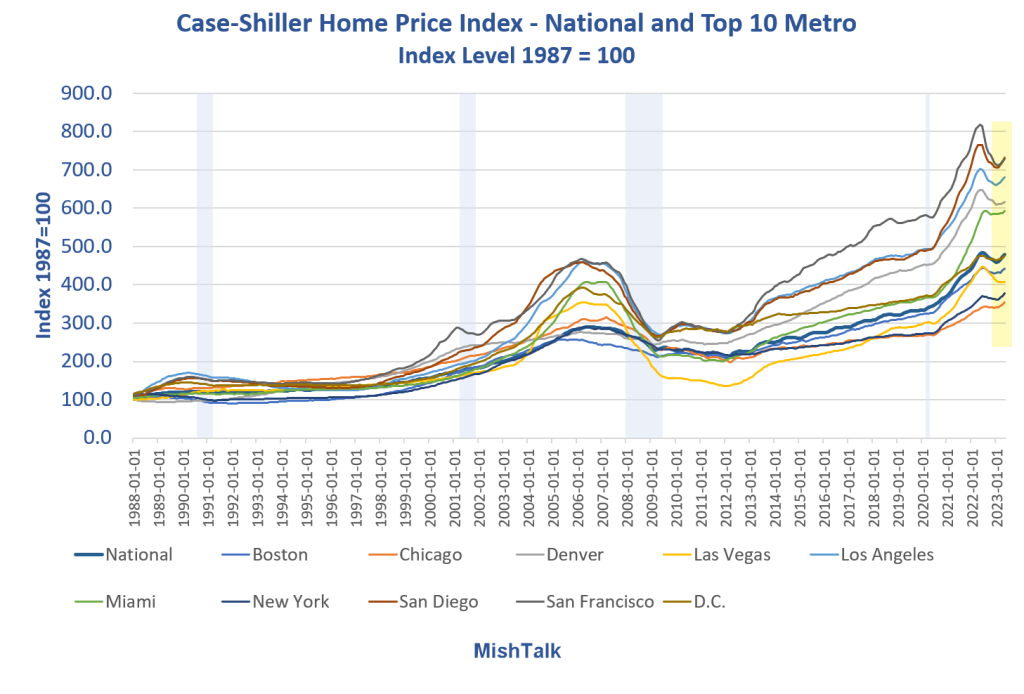

Case Shiller Home Price Indexes

(Click on image to enlarge)

The Case Shiller national home rice index was 334.6 in February of 2020. It is 478.8 as of May 2023. That’s an increase of 144.2 points, 43.1 percent.

A home that cost $400,000 in 2020 now costs $572,385. Bear in mind, this price is for the exact same house. Let’s crunch the numbers again.

Case-Shiller Mortgage Rate Example

(Click on image to enlarge)

Mortgage News Daily calculation based on a Case-Shiller house that sold for $400,000 in February 2000 vs now.

For the exact same house, pre-pandemic vs now, with 20 percent down, assuming a refinance at 3.0 percent, the mortgage payment has risen from $1,349 per month to $3,161 today.

The Fed does not count this as inflation. But what the heck is it? Chopped liver?

It’s no wonder existing home sales are in the gutter.

What a Mess the Fed Made

The Fed, hoping to increase inflation, forced down mortgage rates below below 3.0 percent. Existing home owners refinanced lowering their monthly payments. This put extra money in the hands of people for as long as they hold that mortgage.

This extra money fuels demand every month.

But millennials and Zoomers now looking to buy their first home have seen mortgage payments double or even triple for the very same house vs 2020. And home prices were not even cheap then as the Case-Shiller chart shows.

Inflationary forces are in full swing.

Yet Another Biden Regulation Will Increase Costs and Promote More Inflation

In addition to the extra money padding existing home owner’s wallets, the Biden administration is doing everything it can to stoke further inflation.

Inflation Promotion Everywhere

- The EV push is inflationary

- Clean energy tax credits are inflationary

- Cap and Trade is inflationary

- Deglobalization is inflationary

- Tariffs and sanctions are inflationary

- Push for more unions is inflationary

- Student loan forgiveness is inflationary

More By This Author:

Yet Another Biden Regulation Will Increase Costs And Promote More InflationIndustrial Production Jumps 1 Percent From Negative Revisions, Autos Lead The Way

Housing Starts Rise 3.9 Percent In July From Still More Negative Revisions

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more