Friday, January 17, 2025 3:33 PM EST

December US manufacturing and industrial output data beat expectations and with upward revisions to November and lead surveys pointing to ongoing improvements there might finally be signs of a turn in the sector. Nonetheless, tariffs will present challenges for those with international supply chains and significant export exposure.

| 0.9% MoM |

December US industrial production

|

| Higher than expected |

Encouraging data point to an upward turn in US industry

US industrial production jumped 0.9% month-on-month in December versus the 0.3% consensus while November's growth rate has been revised up to +0.2% MoM from an initially reported -0.1%. The component breakdown shows manufacturing grew 0.6% after an upwardly revised 0.4% in November with utilities output up 2.1% and mining up 1.8%.

Hours worked in the goods producing sector had fallen 0.3% MoM according to last Friday's jobs report, which explains why economists had expected a weaker outcome, but the ISM report had suggested that new orders and production had finally returned to growth. The ending of the Boeing strike did help by boosting aerospace output by 6.3% MoM and there were also decent gains for apparel & leather (1.2%). Elsewhere the report was more mixed with machinery output, motor vehicle, furniture and miscellaneous production all falling.

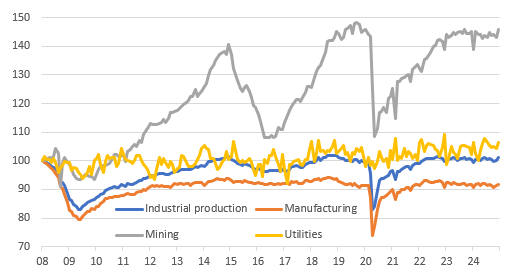

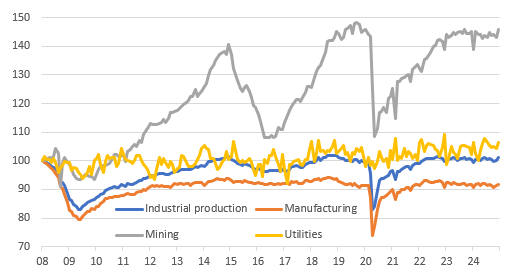

Industrial output component levels (2008=100)

(Click on image to enlarge)

Source: Macrobond, ING

Awaiting President Trump's trade plan

Nonetheless, for now, year-on-year industrial production is only up 0.5% and manufacturing still flat on the year so we are only in the very early stages of a potential shift in trajectory with trade policy a key determinant of what may happen next. President Trump's threat of tariffs should help make US manufacturing more price competitive on the domestic stage, but exporters will remain wary of reprisals from foreign governments and global supply chains for US producers will also be vulnerable to the threat of protectionism. Markets will be keenly awaiting for signals on how aggressive President Trump will be after Monday’s inauguration.

More By This Author:

Czech Producer Prices Rise As Agriculture Drives Food Costs Higher

FX Daily: All Eyes On Monday’s Inauguration

Asia Week Ahead: BoJ Decision And GDP From Korea And Taiwan

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.