Market Psychology & Fundamentals Mismatched

“Davidson submits:

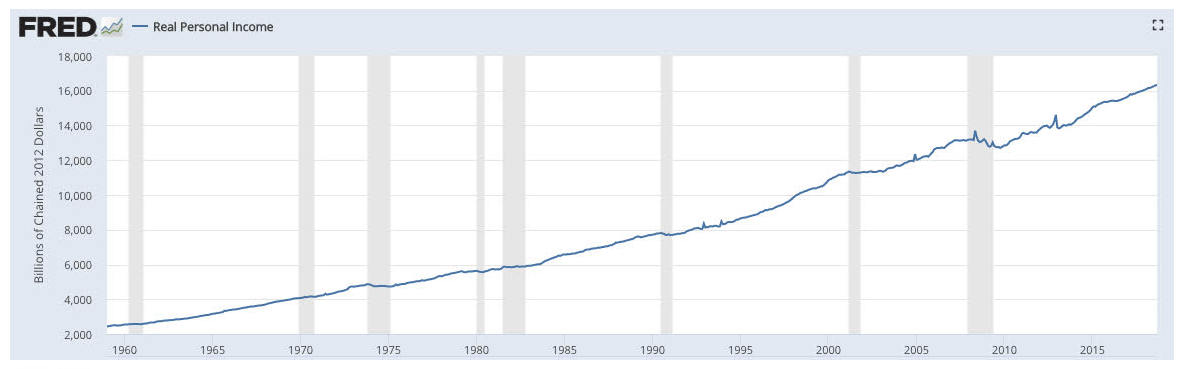

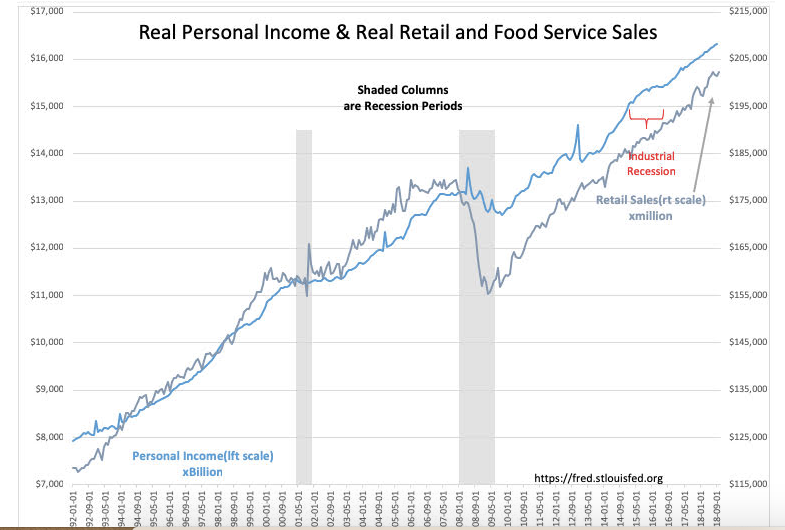

Real Personal Income data begins in 1959(see the FRED chart)and Real Retail and Food Svc Sales begins in 1992(see the correlated data charted from 1992). Both have long enough history to prove themselves decent recession forecast tools. Real Personal Income flattens perhaps 18mos-24mos prior to a recession while Real Retail Sales flattens roughly 12mos. prior.

(Click on image to enlarge)

(Click on image to enlarge)

It makes sense that when consumer incomes slow that they will spend less and this should eventually lead to a recession when companies suddenly realize they have over-staffed for business which did not materialize.

Inspire of the loud, very loud shouting of a pending economic collapse by CNBC anchors and well-known billionaire investors (actually they are Momentum Traders), the economic data indicates all will be surprised to the upside.

Very good time to buy stocks!!

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more