Macro Briefing - Tuesday, May 13

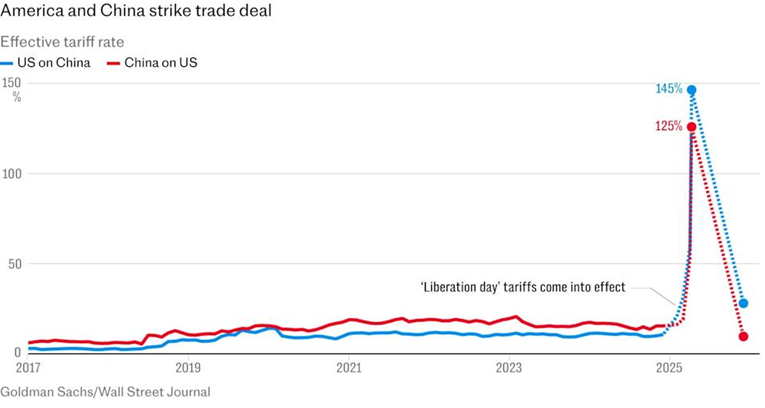

The tariff truce between the US and China dials down recession risk, or so it appears, based on the sharp rise in global equity markets on Monday. Economists also note that the 90-day pause announced on Sunday is a plus for sidestepping recession. “More de-escalation and progress on deals within the 90-day relief period are helping markets to buy time on the recession endgame,” analysts at Barclays wrote ahead of the US-China announcement. Mark Williams, at Capital Economics, advised: “The new status quo isn’t too far from our baseline assumption for tariffs [of] 10% for most countries [and] 60% for China, which underpins our view that the US economy will avoid recession.”

(Click on image to enlarge)

Amid a push to bring offshore manufacturing jobs to US, employers are struggling to fill manufacturing positions. There are currently nearly half a million open manufacturing jobs right now, according to data from the Bureau of Labor Statistics.

US small business sentiment fell for a second month in April below its 51-year average. “Uncertainty continues to be a major impediment for small business owners in operating their business in April, affecting everything from hiring plans to investment decisions,” said NFIB chief economist Bill Dunkelberg.

A Republican bill in the House aims to end most of the tax credits that support clean-energy investment. If the tax credits are cancelled, the change is expected to sharply reduce future demand for electric vehicles, batteries, solar panels and wind turbines, predicts the Rhodium Group, a consultancy.

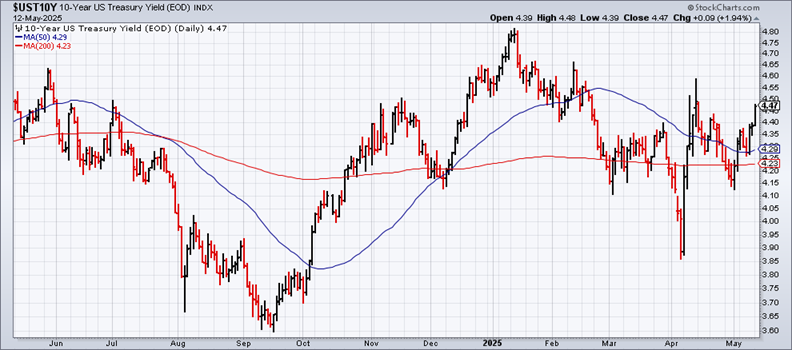

Traders are now betting that Fed won’t cut rates until September at the earliest, based on Fed funds futures. The news on Sunday that the US and China would cut tariffs persuaded to the market to reduce odds that the central bank further delay cuts.

US 10-year Treasury yield rises to highest level in a month:

(Click on image to enlarge)

More By This Author:

US-China Trade Deal Lifts Markets, But US Stocks Still TrailMacro Briefing - Friday, May 9

Defensive Sectors Continue To Lead US Stock Market This Year

Disclosure: None.