Macro Briefing - Tuesday, June 17

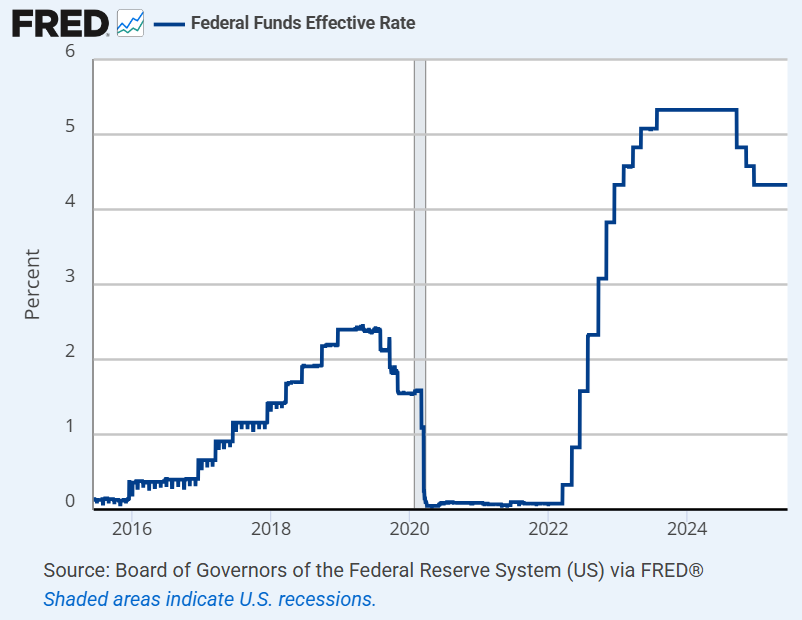

Fed funds futures are pricing in a near certainty that the Federal Reserve will leave its target rate unchanged today for the 2:00pm eastern policy announcement. The main focus will be on comments Fed Chair Jerome Powell in the press conference that starts at 2:30pm. Investors will be listening closely for hints of lingering concern over inflation, the path ahead for rate cuts and the outlook for economic activity. The Fed will also publish revised economic projections today.

President Trump on Tuesday hinted that his early departure from the Group of Seven summit in Canada was triggered by “much bigger” things than planning a ceasefire between Israel and Iran. He urged people to “immediately evacuate Tehran.”

Former Federal Reserve officials and staff are forecasting higher unemployment and higher inflation in the months ahead, according to a new surevy of former Federal Reserve officials and staff. “The survey found the vast majority of former officials and staff members believe the U.S. will avoid recession, with only one projecting the economy will take such a turn,” according to Duke University’s Department of Economics. “However, nearly all believe recession risks remain, as well as the possibility of higher inflation.”

The Federal Reserve’s model of the US economy estimates that a $10-a-barrel-increase in oil translates to an increase in inflation by 0.4% and lower GDP by 0.4%, wrote Torsten Sløk, chief economist at Apollo. “Tariffs also increase inflation and lower GDP growth. Restrictions on immigration also increase wage inflation and lower employment growth. In short, higher oil prices exacerbate the ongoing stagflation shock stemming from tariffs and immigration restrictions.”

The New York Fed Manufacturing Index unexpectedly fell in June. The slide marks the fourth straight month of manufacturing contraction for this benchmark.

Ahead of today’s Federal Reserve meeting, monetary policy remains tight, relative to the implied signals from the latest inflation data, advises a note from TMC Research, a unit of The Milwaukee Company. The year-over-year changes for the consumer price index (CPI), based on the headline and core readings, are still well below the Fed’s median 4.33% target rate.

More By This Author:

Industrials Take The Lead For US Equity Sectors This YearMacro Briefing - Monday, June 16

The Israel-Iran Conflict Complicates The Macro Outlook

Disclosure: None.