Macro Briefing - Friday, Oct. 31

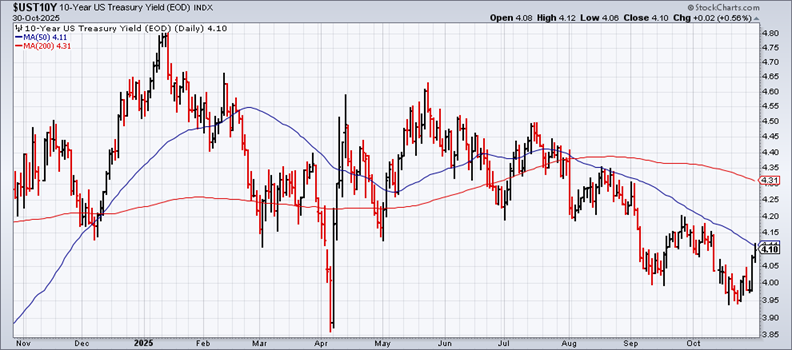

US 10-year Treasury yield continues to rise, trading at at 4.10% on Thursday, marking the highest close in more than three weeks. “The rise in Treasury yields is really the response to the generally hawkish message that I think Powell very intentionally portrayed,” said Matt Bush, US economist at Guggenheim Investmentsat, referencing the Federal Reserve chairman’s comments on Wednesday that raise doubts about another rate cut in December.

(Click on image to enlarge)

China factory activity slumps to six-month low in October, according to survey data. The latest reading reversed the recovery in recent months, after the PMI rose to a six-month high of 49.8 in September, compared to 49.4 in August and 49.3 in July.

Announced job cuts at several high-profile firms is stoking fears of a so-called white-collar recession. FT reports: “The recent cuts mark the end of nearly six years of high job security for high-earning human resources specialists, marketers, managers, software developers and other knowledge workers whose ranks have expanded rapidly since the start of Covid-19 pandemic.”

The European Central Bank has kept interest rates unchanged at its policy meeting on Thursday. “The economy has continued to grow despite the challenging global environment. The robust labour market, solid private sector balance sheets and the Governing Council’s past interest rate cuts remain important sources of resilience,” the central bank said in a statement.

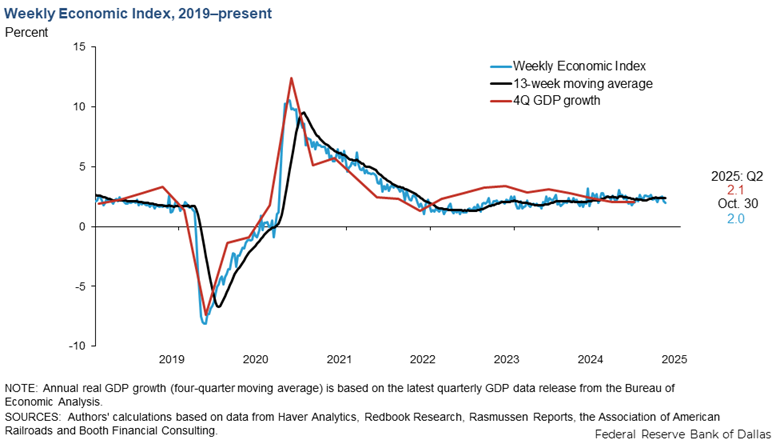

The Dallas Fed’s Weekly Economic Index edged down to 2.0% for Oct. 25. The estimate equates with a four-quarter GDP growth that’s slightly below the 2.1% pace reported for Q2, which suggests the economic trend remains mostly unchanged in Q3. The caveat is that the some of the inputs for the index aren’t being updated due to the government shutdown and so the latest numbers may be misleading.

(Click on image to enlarge)

More By This Author:

US Economy Probably Grew At Solid Pace In Q3Macro Briefing - Thursday, Oct. 30

Fed’s Powell Raises Doubts About Another Rate Cut