Losing The Capacity To Shock

Edvard Munch's Iconic Artwork, "The Scream"

Investors have borne witness to a substantial valuation correction in equities and corporate credit over the past 12 months. During this valuation reset, the resilience of markets in general has been remarkable. There has been little evidence of panic, at least outside the more esoteric areas of the investing universe as risk premia in equities and credit returned to levels closer to long-termaverages. At the end of last year, abnormally high valuations were our primary reason for caution on global equities. We believed bullish sentiment was always at risk from normalising interest ratesat both the short and long ends of global yield curves, as ultimately proved to be the case.

Furthermore, the spurt in economic growth was necessarily time-limited as the global economy, supercharged by fiscal and monetary policy support, exited COVID-19 restrictions. As incoming data now amply demonstrate, rapidly declining output gaps combined with supply chain bottlenecks have resulted in one of the largest surges in global inflation rates in living memory. In terms of growth, recessions are on the horizon in many developed markets as purchasing managers’ indices continue to decline.

Given this backdrop, we find the recent recovery in investor risk appetite, as measured by the surge in global markets over the past six weeks, is notable for its exuberance. This recovery in sentiment has been achieved in the absence of any concrete ‘all clear’ on the key variables of monetary policy, inflation or growth – or Russia’s war in Ukraine, which is the primary driver of the current energy crisis.

In many respects, this year’s major investment themes have unfolded relatively predictably over the last six months, although not in a helpful manner. Inflation and interest rates have continued to surprise to the upside while growth forecasts have been revised lower. We wonder if financial markets are increasingly sanguine in respect of the outlook if only because of habituation to the still-outstanding risks, which give the appearance of having lost the capacity to shock.

Past ‘peak fear’ on interest rates – or just fear of missing out?

For some investors there may be strong temptation to chase performance following the relatively difficult period for equity markets during H122. For example, the S&P500 has gained close to 20% in just six weeks before falling back somewhat in recent days. During this period of improving market sentiment, growth stocks have clawed back a significant proportion of their year-to-date underperformance of value segments of the market, Exhibit 1.

The rally appears to have been driven by the sense that ‘peak inflation’ is just around the corner, which could be quickly followed by a doveish policy pivot by the US Federal Reserve (US Fed), as it attempts to avoid the US economy risking falling into a deeper recession. We admit it is a seductive argument; for many professional investors, the greatest fear is missing out on the first leg of a market recovery.

However, while we would certainly concur with the idea that at some point in the next six months the US Fed will slow the pace of rate increases, recent post-meeting comments from Fed policymakers suggest the focus for the immediate future remains wholly on bringing inflation under control.

The US Fed also appears to be giving only limited weight to the suggestion that supply side factors might be playing the dominant role in above-target inflation, leaving the US central bank targeting slower demand growth to ease pricing pressures. The policy implication is that it puts the Fed into the predicament of tightening monetary policy into a US recession, in common with the European Central Bank and the Bank of England.

US Fed forecasts for inflation are above the 2% target throughout 2023 and into 2024, according to the most recent public projections. Even if the policymakers stay alert to incoming data indicating moderating US economic growth, the probability of a return to accommodative monetary policy settings when inflation is above target seems rather low, in our view.

In these circumstances we believe the speculative potential for risk assets is reduced. The US Fed may even wish to keep a firm lid on equity valuations and credit market excess as easier financial conditions run counter to its policy objectives.

Therefore, investors hoping for a re-inflation of asset price bubbles whether in crypto, the technology sector, or even in relatively mundane assets such as real estate may be disappointed in the coming 12-month period, which we believe is more likely to be one of monetary austerity rather than largesse.

Europe pays dearly for its dependence on Russian energy

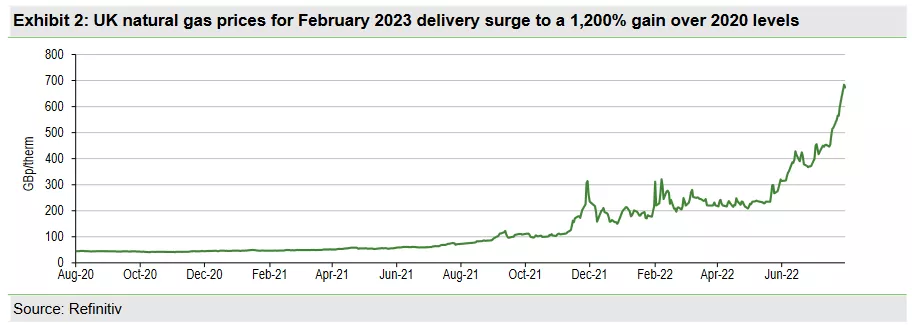

As financial markets relax over the summer, traders in European natural gas markets seem to be panicking. European gas for December delivery is up a further 30% over the past month, Exhibit 2. The price for this basic and essential commodity for eating, electrical power and fertiliser production is up 1,240% versus two years ago.

With Europe’s electricity prices closely linked to gas prices the pain is likely to be widespread. Electricity grid operators are preparing for industry shutdowns to prioritise household supplies during the winter. The cost of living is now a key political challenge for European governments as winter approaches.

Popular support for the tough stance against Russia’s war on Ukraine is likely to be severely tested over coming months. Significant fiscal support would be required to fully offset the coming surge in energy costs which, if sustained over a full year, amount to as much as 4% of European GDP.

In the UK, recent government discussions with the power industry have called for a plan for capping household bills at approximately double pre-war levels through a government-funded tariff deficit recovery scheme with a total cost of 4% of GDP over two years, which would be significantly more than the amount spent on the COVID-19 furlough scheme.

Extra support has not been ruled out for small- and medium-sized enterprises. If implemented, such a scheme would significantly dampen the surge in energy-related inflation expected over coming quarters. Government calculus appears to be shifting as it is increasingly acknowledged it is politically unsustainable for households to bear the full costs for the decision to impose sanctions on Russia following the invasion of Ukraine.

Russia has invested for decades in physical infrastructure and political influence campaigns to convince European nations that it is a reliable supplier of gas based on economic factors rather than any hidden geostrategic leverage. The claims appear hollow now that a war in Ukraine has directly caused the explosion in the price of natural gas. Germany’s economy minister Habeck recently stated the country’s Russia-dependent energy model has failed and is not coming back. Nevertheless, for the short-term Putin’s administration has played its economic hand well. Through controlling the supply of gas, Russia is exerting significant pressure on Europe’s democratically elected politicians, whose resolve will be tested by voter fatigue as energy consumption for domestic heating increases over the coming winter. Recent Financial Times reports based on Kremlin sources suggest this is precisely Putin’s strategy.

We believe Putin’s administration could surprise markets again and investors should be clear-eyed about the potential for diplomatic developments, which could quickly depress energy prices rather than support them. Ahead of the European winter, there will be the maximum negotiating leverage on democratically elected leaders in Europe to listen to Russia’s territorial demands in Ukraine in return for cheaper gas. While this would be odious to many in principle, a Russian initiative to reach out for a favourable compromise is, we believe, an increasingly probable scenario as Russia’s military advances stall. Western arms and Ukrainian military ingenuity for now seem to be changing the balance of military superiority in the contested regions.

For portfolio managers, one of the challenges at present is that potentially the entire sweep of the monetary policy, inflation and growth outlook could yet hinge on developments wrapped in the fog of war or closed-door international diplomacy. This represents a significant uncertainty for the outlook, rather than a quantifiable risk – and investors should have contingency plans in place.

The perfect storm will pass

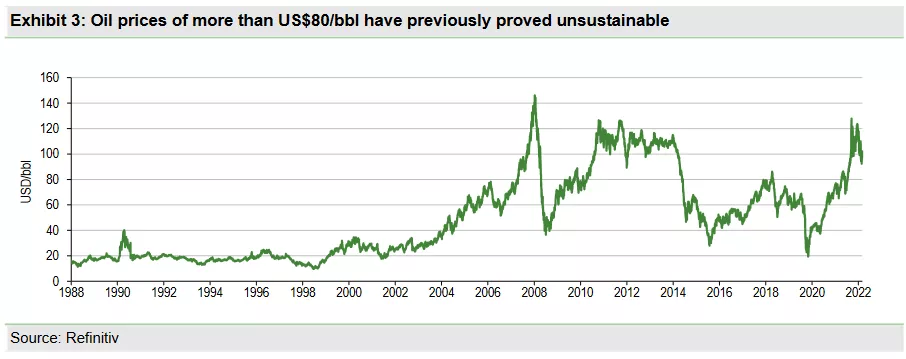

Nevertheless, this ‘perfect storm’ for rising energy prices is likely to prove a short-term phenomenon in the context of the typical investment time horizon. Historically, every surge in oil prices over US$100/bbl has proved unsustainable over the medium term as prices so far ahead of marginal costs attract production increases, demand destruction and supply substitution.

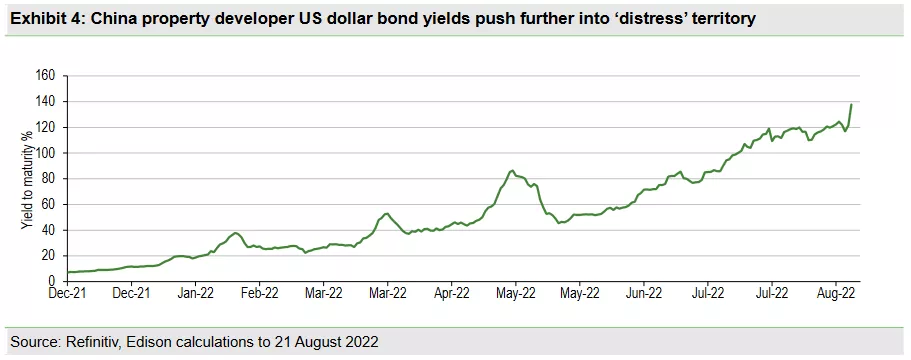

China’s economy is a further downside risk for commodities

There has been the low rumble of a gathering economic storm in the Chinese real estate sector for at least the last six months, but it appears so far to have had little knock-on effects on markets or investor sentiment outside China. We note the yield on around $150bn of US dollar-denominated bonds issued by China’s property developers, Exhibit 4, has continued to rise over the summer and the market has pushed further into ‘distress’ territory. Even specialist investors are shying away from the yields on offer given the suspicion that domestic entities will be given preferential treatment over international investors and no government bailout package of sufficient size and scope has been announced to date. There have also been a number of issuer defaults this year.

China’s real estate price indices only recently started to turn lower year-on-year and the developing crisis in one of the world’s largest asset markets may yet have the power to shock via the connections to the global economy in terms of resource demand and the idea that China’s growth is unstoppable. Anecdotal reports of ‘mortgage strikes’ by purchasers of yet-to-be-built apartment complexes highlight the policy challenges facing the Chinese authorities. In this regard we note the recent, if modest, loosening of monetary policy following disappointing Chinese consumer spending and industrial production figures, although a comprehensive bailout of the sector is yet to be forthcoming from the Chinese government.

Valuations: No longer offering a clear caution signal to investors

A close eye on equity valuations remains core to our strategy outlook. Valuation measures have provided important guidance on sector performance during 2022. Until mid-year when the ‘growth’ rotation took hold, there was an unusually strong correlation between sector overvaluation and the corresponding sector performance. The de-rating of the most overvalued sectors has been significant over the past 12 months and of a scale similar to that seen prior to the recession of 2008/09.

At this immediate point in time however, we believe the relative importance of valuation metrics has declined. Much of the obvious steam has seeped out of forward price/book premiums, if compared to the situation 12 months ago. Many country valuations have retreated and now lie within their normal range of fluctuations around their long-term mean.

In Europe, some national exchanges are now trading below their long-term average, potentially indicating higher than normal prospective expected returns, provided investors can carefully assess the extent and duration of the geopolitical risks in these markets. However, the US remains an important outlier from this trend, still trading at a significant premium of 40% to its long-term price/book average, benefiting from both a relatively strong corporate performance and the perception of being remote to, if not in a position to take advantage of, Europe’s recent geopolitical challenges. The relatively large weighting of the US technology sector also contributes to this premium rating.

Given the mixed signals, we believe a negative outlook on equities has insufficient support on a valuation basis, especially in the context of still-low government bond yields. Bearish outlooks are therefore reliant on a continuation of negative economic momentum and in this regard the risk of a recession is real, but also well-known to investors.

It is in our view too late to be overly bearish on equities and instead investors should be looking towards the turning point in this cycle, which is likely to be closely linked to the timing of the peak in inflationary pressure, shortly followed by the trough in economic activity. There is some evidence that inflationary pressure is waning (outside the special case of European natural gas supplies). Food, lumber and oil prices have all fallen from the peaks recorded earlier in 2022. However, it is still too early in our view to attempt to identify the trough in economic activity, especially given that purchasing managers’ surveys continue to contract in developed markets, suggesting that the slowdown is still gathering pace.

Conclusion

We would have hoped that nine months after the peak in the global equity index, the shape of at least a ‘muddle through’ scenario for the global economy, monetary policy and corporate profits might have been traced out. Yet the risks and uncertainties in respect of inflation, monetary policy, economic growth and the Russian war in Europe remain in place even if they have perhaps lost the power to shock. With the important exception of European natural gas, commodity prices are now falling while the peak of inflation is approaching in developed markets.

A rebound in growth segments of the equity market has been supported by a better-than-expected corporate earnings performance recently and a small uptick in economic surprise indices. Nevertheless, the sheer extent of the market rally suggests this modest improvement in the outlook is at best fully priced and potentially, investors have leapt several steps ahead of the fundamentals.

>With global equity valuations close to historic averages and no longer providing a clear ‘sell’ signal compared to this time last year, we believe it may be time for a modest course adjustment away from strongly overweight energy exposures, which have performed well and may struggle as growth slows.

At the margin, we would suggest taking profits in energy-related sectors and rotating towards defensive branded goods sectors such as personal care, which may benefit from declining input costs over the next 12 months. However, consumer cyclicals may continue to struggle while real wage growth remains negative, the peak in interest rates still lies some months ahead and the trough in the economic cycle is difficult to pinpoint with any conviction.

It remains an unfortunate fact that geopolitics remains unusually important. In the event of a diplomatic breakthrough between Russia and Ukraine, the ‘war premium’ currently embedded in energy markets and related equities would instantly evaporate. Such a scenario may look remote, but we would suggest it has a meaningful probability, with the potential to transform the current inflationary consensus. The Russian invasion appears to have stalled and risks Ukrainian counterattacks. Ahead of the European winter, Russia’s negotiating position is maximised. We cannot rule out that any attempts by Russia to sue for peace would find a positive reception in certain political quarters in Europe.

In an environment where a significant and synchronised slowdown in real economic activity is our base case, even as inflation is expected to remain well above target over the next 12 months, we believe investors should remain focused on building portfolios robust to a variety of economic outcomes. We are encouraged by the improving valuation picture but remain neutral on global equities pending evidence that the earnings downgrade cycle is complete.

We believe investors should however be alert to opportunities to trim overweight energy positions, which have performed strongly this year towards those defensive sectors that are set to benefit from declining inflationary pressure, especially where lower commodity prices are yet to be factored into currently depressed margin forecasts.

Branded consumer staples with resilient pricing models may offer the best sector opportunity, being relatively defensive equity investments. While airlines, leisure and entertainment should benefit from lower input costs in a disinflationary environment, there remains significant earnings risk from the lagged effect of financial pressure on the consumer in this cycle.

More By This Author:

Cultivated Meat – Engineering The Growth Of Alternative Meats

Deep Geothermal Energy

Enterprise Adoption Of AI - Cutting Through The Hype