Looming Trump Tariffs Spark Wave Of Freight Frontloading From China

Image Source: Unsplash

Anticipating that President-elect Donald Trump will fulfill his promise of a 25% tariff on all imports from Mexico and Canada and an additional 10% tariff on imports from China, importers are frontloading freight before the tariff wall takes effect in less than two months.

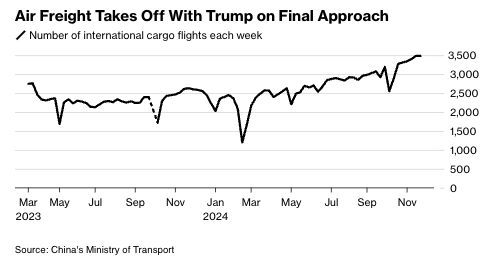

Bloomberg reports that international cargo flights out of the world's second-largest economy are ramping up to new records in the weeks after the presidential election.

According to the Ministry of Transport data, there were 3,485 international cargo flights in or out of China last week, the most since March 2023—or about the time when China reopened its economy after a few years of lockdowns. Last week was the third consecutive week with more than 3,400 flights.

"The threatened tariffs on Canada and Mexico will motivate US importers to frontload imports and accumulate inventories, regardless of whether the tariffs are implemented," Barclays analyst Pooja Sriram wrote in a note to clients earlier this week.

Sriram said, "The 25% tariffs could intensify this pull-forward effect, leading to an even stronger surge in imports in late 2024 and early 2025, thereby widening the trade deficit."

Several Chinese manufacturers, including Shenzhen Lingke Technology, a lighting products manufacturer, told Nikkei Asia that major US retailers have already increased orders.

"The thinking is that American clients want to lock in as many profits as possible before a new round of tariffs kick in," Wu Zhiqiang, CEO of Shenzhen Lingke, told the media outlet.

Nikkei reported, "Microsoft, HP and Dell are scrambling to obtain as many electronic parts as they can before January."

"We think shipment could be front-loaded, boosting exports in the first half of 2025 before dampening them in the second half," other Barclays analysts wrote in a note. Analysts at the bank expect a 30% tariff increase from the U.S. on Chinese goods next year, which would cap China's economic growth in 2025 to about 4%.

Mike Beckham, CEO of Simple Modern, which produces drinkware and other lifestyle production in Oklahoma, although it relies on components from China, warned there is a lot of tarrif "uncertainty right now."

"Some companies are attempting to ship as much as they can right now, but it has not been a major driver of strategy for the companies I am close with," Beckham said.

China's export boom bodes well for logistics firms, such as freight forwarders and carriers, in the short term, as the panic to pull forward as much product as possible before tariffs go into effect early next year.

A report from Judah Levine, head of research at Freightos, noted that air cargo prices out of China "have still not spiked and carriers report being busy but not overwhelmed even as December approaches," adding, "Capacity additions to these lanes and shippers who adjusted and planned ahead may prove to be enough to prevent extreme rate climbs and congestion through the end of the year."

Trump announced earlier this week he intends to levy a 25% tariff on all imports from Mexico and Canada and an additional 10% tariff on imports from China. Tariffs on Mexico and Canada would remain in place until the flow of "drugs, in particular fentanyl, and all illegal aliens stop," while tariffs on China would remain in place "until such time as [the drugs that are pouring into our country] stop."He also stated that on January 20, he would "sign all necessary documents" to implement the tariffs on Mexico and Canada as one of his "many first Executive Orders."

Overall, the tariff announcement is reminiscent of the first Trump administration, when such tariffs were announced as a negotiating tactic, rather than the more systematic tariff policies (e.g., the 10-20% "universal baseline tariff") Trump frequently discussed during the campaign.

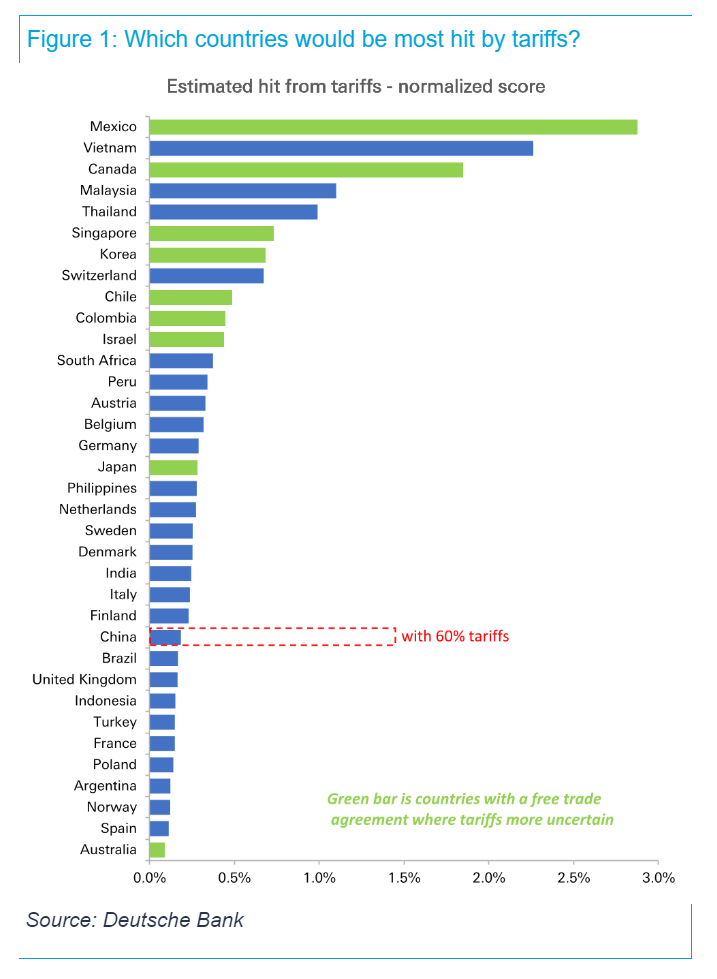

Deutsche Bank's chief FX strategist, George Saravelos, wrote a note late this week outlining the ten biggest takeaways his desk had about the incoming Trump tariffs.

Saravelos pointed out the countries that would be most affected by tariffs, including Mexico, Vietnam, and Canada.

The great pull-forward of freight to hedge against Trump tariffs is well underway—reminiscent of 2018. The only problem is that freight demand will likely slide once frontloading is over.

More By This Author:

Electric Revenge: Texas Sues BlackRock And Others For 'Conspiring' To Quash Coal, Sending Energy Prices SoaringContinuing Jobless Claims Top 1.9 Million Americans - Highest In 3 Years

US Home Prices Rose At Slowest Pace In A Year In September

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more