Let’s Discuss Excess Pandemic Savings, How Much Is Still Unspent?

Economists debate excess savings, but in reality is there any such thing?

(Click on image to enlarge)

Aggregate Excess Savings chart from San Francisco Fed

Excess No More? Dwindling Pandemic Savings

On August 16, San Francisco Fed writers commented Excess No More? Dwindling Pandemic Savings

In a study earlier this year (Abdelrahman and Oliveira 2023), we examined household saving patterns since the onset of the pandemic recession. Our study showed that households rapidly accumulated unprecedented levels of excess savings—defined as the difference between actual savings and the pre-recession trend—relative to previous recessions. Our analysis suggested that some $500 billion of the $2.1 trillion in total accumulated excess savings remained in the aggregate economy by March 2023.

Since then, data revisions show noticeable changes in household disposable income and consumption, while new data releases indicate that consumer spending picked up in the second quarter. Our updated estimates suggest that households held less than $190 billion of aggregate excess savings by June. There is considerable uncertainty in the outlook, but we estimate that these excess savings are likely to be depleted during the third quarter of 2023.

Excess Savings Cause

The excess savings are a result of three rounds of fiscal stimulus during and after the Covid pandemic.

The first two rounds of stimulus were by Trump. The third, and very excessive round of stimulus was sponsored by the Democrats.

Biden’s student debt cancellation and eviction moratoriums also fed savings. The result was the biggest outbreak in inflation since the 1970s.

The Fed, whose job it is to control inflation, not only failed to see it coming, but also kept QE going to the bitter end.

The debate now is how much excess savings remain that may fuel consumer spending.

Only the Richest 20% of Americans Still Have Excess Pandemic Savings

(Click on image to enlarge)

On September 25, Bloomberg commented Only Richest 20% of Americans Still Have Excess Pandemic Savings

Americans outside the wealthiest 20% of the country have run out of extra savings and now have less cash on hand than they did when the pandemic began, according to the latest Federal Reserve study of household finances.

For the bottom 80% of households by income, bank deposits and other liquid assets were lower in June this year than they were in March 2020, after adjustment for inflation.

All income groups have seen their balances decline in real terms from a peak in 2021, according to the Fed survey. But among the wealthiest one-fifth of households, cash savings are still about 8% above their level when Covid hit. By contrast, the poorest two-fifths of Americans have seen an 8% drop in that period. And the next 40% — a group that roughly corresponds with the US middle class — saw their cash savings drop below pre-pandemic levels in the last quarter.

Can You Have Excess Savings?

No, not really, unless you believe you can have too much money.

However, note the definition used for these charts: “Defined as the difference between actual savings and the pre-recession trend—relative to previous recessions.”

In that sense, the above discussion makes sense.

If excess savings are dwindling, one would expect to see consumer spending decline or credit card debt rise.

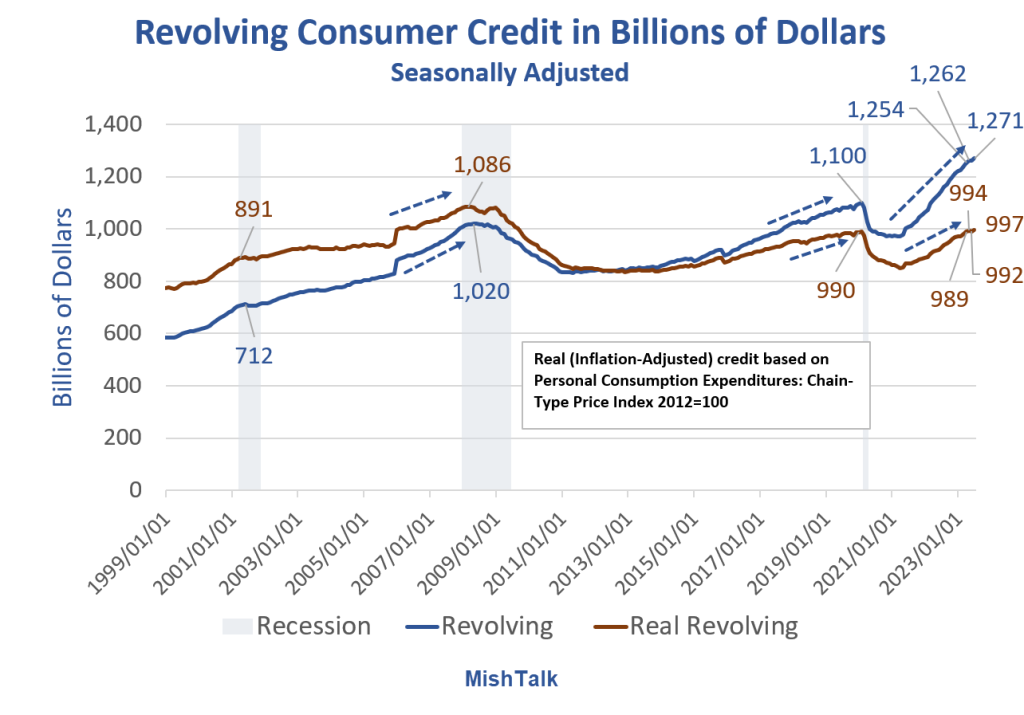

Revolving Consumer Credit in Billions of Dollars

(Click on image to enlarge)

Consumer Credit data from the Fed, Real (inflation-adjusted calculation), and chart by Mish

Stunning Steepness in Credit Card Debt Accruals

The speed at which consumers are going into credit card debt is stunning.

It’s hard to maintain lifestyles with rising inflation unless wages keep up.

The BLS and Fed believe the rate of increase in inflation is falling. Assuming the data is correct, consumers are struggling anyway.

For discussion, please see Consumer Credit Growth Plunges in July With Huge Negative Revisions

BEA Revises Spending Lower, Income Higher, With GDP Unchanged for 2023 Q2

As additional supporting evidence for the dwindling excess savings theory, the BEA revised real personal consumption expenditures (PCE) for the second quarter steeply negative from 1.7 percent to 0.8 percent.

The PCE spending downgrade happened despite upward revisions to income.

For discussion, please see BEA Revises Spending Lower, Income Higher, With GDP Unchanged for 2023 Q2

it’s reasonably safe to assume that excess savings, as defined, has been spent. What hasn’t by now been spent is in the hand of people who prefer not to spend.

More By This Author:

Manufacturing ISM Declines 11 Straight Months, New Orders Down 13 MonthsWhen Will Record Housing Units Under Construction Ease Rent Inflation?

Small Business Bankruptcies Surge In 2023, Five Reasons Why

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more