Key Events This Week: Payrolls, Powell, JOLTS And Fed Speakers Galore

Welcome to the last day of the month ahead of what is another very busy week ahead bookended with a Powell speech today and payrolls on Friday. Also key will be the flash CPIs from Germany and Italy (today), and the Eurozone (tomorrow), especially after weak numbers from France and Spain on Friday. This could tip the balance for an October ECB cut. Elsewhere the global reaction to the China stimulus blitz last week will stay ever present even if their golden week holiday starts tomorrow and we won't see domestic markets open over the period. And, as one can see in the ridiculous chart below, investors are in a full-blown panic to put on China risk this morning ahead of the holiday.

(Click on image to enlarge)

Let's now go into closer detail on the main events ahead before summarizing the rest of the week's highlights.

For payrolls, economists expect headline (146k forecast vs. 142k previously) and private (125k vs. 118k) payrolls to be slightly ahead of the 3-month averages of 116k and 96k, respectively. Consensus also expects the unemployment rate to be unchanged at 4.2% even with a slight pick-up in participation (to 62.72%). There are plenty of other employment signals this week with the ISM surveys, ADP, claims and JOLTS tomorrow. The JOLTS report has historically had one of the most reliable longer-term correlations to the prevailing employment trends but is always lagging by a month. Last month the private sector hiring rate continued near 2014 lows (outside the pandemic) but lay-offs were also lower than any period prior to the pandemic. The private sector quits rate (2.3%), is also back close to 2018 levels and more consistent with an unemployment rate of 4.5% using historical correlations as your guide. In short, according to DB's Jim Reid, the US labor market can be characterised by currently having relatively low hirings and very low firings. So this is why there is no current drama but why it's wise to be on high alert. One small shock could move things very quickly. Equally a recovery in hiring could increase the gap between the two quite sharply. Interestingly the following month's payrolls figures could be influenced by the Boeing strike in mid-September (that probably won't influence Friday's figures), and a potential dockworkers' strike starting tomorrow.

The risk of lay-offs increasing and tipping the balance in the current labor market is why the FOMC recently opened up their account with a 50bps cut. Powell's speech today (just after 1pm ET) will likely stick to his FOMC script but it's fair to say that Fedspeak since the meeting has been more amenable to additional 50bps cuts than we'd thought they would be. We have another round of Fedspeak this week as you'll see in the day-by-day calendar at the end so plenty of opportunity for that debate to move along even if the payrolls at the end of the week could have a bigger impact.

In Europe, today's German and Italian CPI will take on added significance given how weak Friday's French (1.5% YoY vs. 1.9% expected) and Spanish (1.7% YoY vs. 1.9% expected) numbers were. The Eurozone numbers come tomorrow. If these misses are repeated it probably forces the ECB to either lean towards 25bps next month or 50bps in December instead of 25bps. So important releases.

In terms of the rest of the week across the globe, the main highlights outside those already discussed are the Chicago PMI and Lagarde speech today, various global manufacturing PMIs and US ISM alongside the US Vice President debate and the Japanese tankan survey tomorrow, US ADP and Eurozone unemployment on Wednesday, and various global services PMIs and ISM and Eurozone PPI on Thursday. Outside of data a policy speech by French PM Barnier tomorrow will give clues to how the budget will materialize.

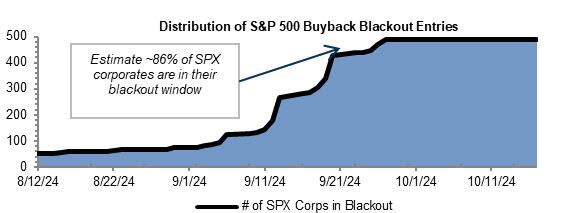

As a reminder, ahead of the start of earnings season in October, most companies are now in a buyback blackout period.

Courtesy of DB, here is a day-by-day calendar of events:

Monday September 30

- Data: US September MNI Chicago PMI, Dallas Fed manufacturing activity, China September official and Caixin PMIs, UK September Lloyds Business Barometer, Q2 current account balance, August net consumer credit, M4, Japan August industrial production, retail sales, housing starts, Germany September CPI, August import price index, Italy September CPI

- Central banks: Fed's Powell speaks, ECB's Lagarde speaks, BoE's Greene speaks

Tuesday October 1

- Data: US August JOLTS report, construction spending, September ISM index, Dallas Fed services activity, total vehicle sales, Japan Q3 Tankan survey, August jobless rate, job-to-applicant ratio, Italy September manufacturing PMI, new car registrations, budget balance, Eurozone September CPI, Canada September manufacturing PMI

- Central banks: Fed's Bostic, Cook, Barkin and Collins speak, ECB's Guindos, Schnabel, Nagel and Rehn speak, BoE's Pill speaks, BoJ's summary of opinions from the September meeting

- Earnings : Nike

- Other: US VP debate

Wednesday October 2

- Data: US September ADP report, Japan September monetary base, consumer confidence index, France August budget balance YTD, Italy August unemployment rate, Eurozone August unemployment rate

- Central banks: Fed's Hammack, Musalem, Bowman and Barkin speak, ECB's Guindos, Kazaks, Lane, Simkus, Elderson, Holzmann and Schnabel speak

Thursday October 3

- Data: US August factory orders, September ISM services, initial jobless claims, UK September official reserves changes, Italy September services PMI, Eurozone August PPI, Canada September services PMI, Switzerland September CPI

- Central banks: Fed's Kashkari and Bostic speak, BoJ's Noguchi speaks, BoE DMP survey

- Earnings : Tesco, Constellation Brands

Friday October 4

- Data: US September jobs report, UK September new car registrations, construction PMI, Germany September construction PMI, France August industrial production, Italy August retail sales, Q2 deficit to GDP YTD

- Central banks: ECB's Villeroy, Simkus, Kazaks, Muller, Centeno and Escriva speak, BoE's Pill speaks

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the JOLTS job openings report and ISM manufacturing index on Tuesday, and the employment report on Friday. There are several speaking engagements from Fed officials this week including Chair Powell on Monday. The U.S. vice presidential debate is scheduled to take place at 9pm on Tuesday.

Monday, September 30

- 08:50 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will speak on the economic outlook and monetary policy to the Georgia Bankers Association in Charleston. Speech text and Q&A are expected. On September 24, Bowman said, “I continue to view inflation as a concern. Should the data evolve in a way that points to a material weakening in the labor market, I would support taking action and adjust monetary policy as needed while taking into account our inflation mandate.”

- 09:45 AM Chicago PMI, September (GS 45.0, consensus 46.0, last 46.1)

- 01:55 PM Federal Reserve Chair Powell speaks: Federal Reserve Chair Jerome Powell will give the luncheon address at the National Association for Business Economics conference in Nashville. Speech text and Q&A are expected. During the press conference for the September FOMC meeting, Powell argued that the logic for the larger cut was clear “both from an economic standpoint and also from a risk management standpoint.” Powell pointed to the SEP—where the median dot implies 25bp cuts in November and December—as “a good place to start” and said that 50bp should not be assumed to be the new pace, but he emphasized that the FOMC will be “making decisions meeting by meeting based on the incoming data.”

Tuesday, October 1

- 09:45 AM S&P US Manufacturing PMI, September final (consensus 47.0, last 47.0)

- 10:00 AM Construction spending, August (GS +0.1%, consensus +0.2%, last -0.3%)

- 10:00 AM JOLTS job openings, August (GS 7,600k, consensus 7,660k, last 7,673k): We estimate that JOLTS job openings edged slightly lower in August (-0.1mn to 7.6mn), reflecting moderation in online job postings.

- 10:00 AM ISM manufacturing index, September (GS 47.0, consensus 47.6, last 47.2): We estimate the ISM manufacturing index edged lower in September (-0.2pt to 47.0), reflecting sequential softening in other manufacturing surveys (GS manufacturing survey tracker -0.8pt to 47.1) and neutral seasonality.

- 11:00 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will give opening remarks at the Technology-Enabled Disruption conference, organized by the Federal Reserve Banks of Atlanta, Boston, and Richmond. On September 23, Bostic said, “My residual concern about inflation might have led me to settle on a relatively small first move last week — say, 25 basis points. But such a move would belie growing uncertainty about the trajectory of the labor market.” Bostic also noted, “Policy remains in the restrictive range, so if my optimism about inflation is unsatisfied, then the Committee can slow or even halt the pace of further reductions. Should labor markets prove substantially less healthy than they appear at the moment, the ½ percentage point reduction puts us in a better position to adjust than a more modest cut would have.”

- 11:10 AM Atlanta Fed President Bostic (FOMC voter) and Fed Governor Cook speak: Atalanta Fed President Raphael Bostic will moderate a conversation with Fed Governor Lisa Cook at the Technology-Enabled Disruption conference. Speech text and Q&A are expected.

- 05:00 PM Lightweight motor vehicle sales, September (GS 15.8mn, consensus 15.6mn, last 15.1mn)

- 06:15 PM Atlanta Fed President Botic (FOMC voter), Richmond Fed President Barkin (FOMC voter), and Boston Fed President Collins (FOMC non-voter) speak: Atlanta Fed President Raphael Bostic, Richmond Fed President Tom Barkin, and Boston Fed President Susan Collins will participate in a panel discussion at the Technology-Enabled Disruption conference. Speech text and Q&A are expected.

- 09:00 PM U.S. Vice Presidential Debate: The U.S. vice presidential debate will take place on CBS.

Wednesday, October 2

- 08:15 AM ADP employment change, September (GS +115k, consensus +125k, last +99k)

- 09:00 AM Cleveland President Hammack (FOMC voter) speaks: Cleveland Fed President Beth Hammack will give welcoming remarks at the Fed’s 2024 Minorities in Banking Forum.

- 10:05 AM St. Louis Fed President Musalem (FOMC non-voter) speaks: St. Louis Fed President Alberto Musalem will give welcoming remarks at the Community Banking Research conference. Speech text and Q&A are expected. On September 27, Musalem said, “I’m attuned to the fact that the economy could weaken more than I currently expect [and] the labor market could weaken more than I currently expect. If that were the case, then a faster pace of rate reductions might be appropriate.”

- 11:00 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will give a keynote speech at the Community Banking Research conference. Speech text is expected.

- 12:15 PM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Tom Barkin will give a speech named “Why Not Declare Victory?” Speech text and Q&A are expected.

Thursday, October 3

- 08:30 AM Initial jobless claims, week ended September 28 (GS 215k, consensus 221k, last 218k); Continuing jobless claims, week ended September 21 (consensus 1,830k, last 1,834k)

- 09:45 AM S&P Global US Services PMI, September final (consensus 55.4, last 55.4)

- 10:00 AM Factory orders, August (GS flat, consensus +0.1%, last +5.0%); Durable goods orders, August final (last flat); Durable goods orders ex-transportation, August final (last+0.5%); Core capital goods orders, August final (last +0.2%); Core capital goods shipments, August final (last +0.1%)

- 10:00 AM ISM services index, September (GS 51.9, consensus 51.6, last 51.5): We estimate that the ISM services index increased 0.4pt to 51.9 in September, reflecting sequential improvement in our non-manufacturing survey tracker (+0.5pt to 52.9 in September) but a potential headwind from seasonality.

- 10:40 AM Minneapolis Fed President Kashkari (FOMC non-voter) and Atlanta Fed President Bostic (FOMC voter) speak: Minneapolis Fed President Neel Kashkari will moderate a discussion with Atlanta Fed President Raphael Bostic on an inclusive economy at an event organized by the Minneapolis Fed. A Q&A is expected. On September 23, Kashkari said, “In my judgment, cutting the policy rate by 50 basis points last week was the right decision—one that reflects both the substantial progress we’ve made in lowering inflation and also the softening of the labor market. Even after that cut, the overall stance of policy remains tight. Our path forward will depend on the totality of the incoming data for economic activity, the labor market and inflation. Ultimately this will guide us to where the policy rate eventually settles.”

Friday, October 4

- 08:30 AM Nonfarm payroll employment, September (GS +165k, consensus +146k, last +142k); Private payroll employment, September (GS +145k, consensus +125k, last +118k); Average hourly earnings (MoM), September (GS +0.2%, consensus +0.3%, last +0.4%); Average hourly earnings (YoY), September (GS +3.7%, consensus +3.8%, last +3.8%); Unemployment rate, September (GS 4.2%, consensus 4.2%, last 4.3%); Labor force participation rate, September (GS 62.7%, consensus 62.7%, last 62.7%): We estimate nonfarm payrolls rose 165k in September. On net, Big Data indicators indicate a pace of job creation above the recent payrolls trend. We assume above-trend (albeit moderating) contributions from the recent surge in immigration and catch-up hiring. We suspect August payroll growth will be revised higher, as has been typical over the last decade, though revisions so far this year have been disproportionately downward. We estimate that the unemployment rate was unchanged on a rounded basis at 4.2%, reflecting a flat labor force participation rate and firmer household employment growth. We estimate average hourly earnings rose 0.2% (month-over-month, seasonally adjusted), which would lower the year-over-year rate by 0.1pp to 3.7%, reflecting waning wage pressures and modestly negative calendar effects.

- 09:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give opening remarks at an event at the New York Fed called “The Future of New York City: Focus on Jobs.” Speech text is expected.

Source: DB, Goldman

More By This Author:

Boeing Union Says "Talks Broke Off" Amid Stalemate Over Pensions & Pay

Starlink Hits 4 Million Users As Elon Musk Leads Space Race

Volkswagen Cuts Profit Forecast Again Amid Sliding Car Demand

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more