Key Events This Week: Payrolls, JOLTS, And ISM, But U.S. Govt Shutdown Is The Big One

Image Source: Pexels

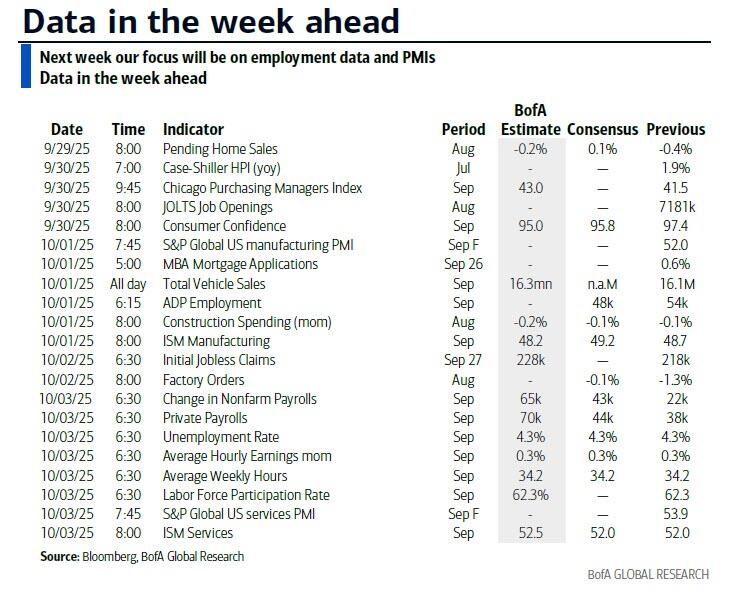

This week's big event might not actually happen, as payrolls Friday could be the first high profile victim of a potential government shutdown if Congress is unable to reach an agreement on a short-term funding resolution by midnight tomorrow night (see our preview here "Here's What Happens When The US Government Shuts Down On Oct 1 And How Markets Will React"). Indeed, as Deutsche Bank reminds us, back in October 2013, the shutdown meant we didn’t get the September jobs report until the 22nd of the month.

We'll preview both below, but the other main highlights this week are:

- Waller, Bostic and Hammock speaking today;

- US consumer confidence, JOLTS, China PMIs, German, French and Italian CPI, the RBA meeting and the Fed Jefferson and Goolsbee speaking tomorrow;

- US manufacturing ISM, the ADP, Eurozone CPI, and the Fed's Logan speaking on Wednesday;

- US jobless claims and the Fed’s Logan speaking again on Thursday;

- US services ISM and the Fed’s Williams and Jefferson speaking on Friday.

The full day-by-day calendar of events is at the end as usual.

(Click on image to enlarge)

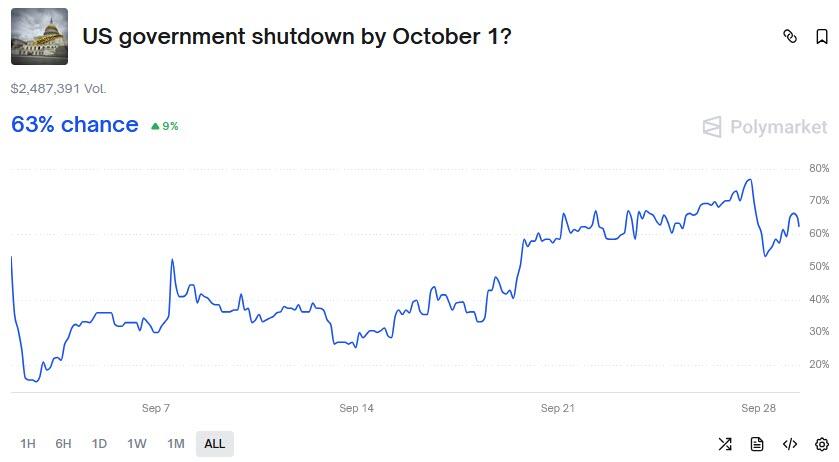

Turning to the week's main event, fears of a shutdown rose significantly last week, particularly after Trump cancelled a meeting planned with the Democratic leaders in the House and the Senate. But yesterday we heard that Trump will be meeting Democrat and Republican leaders today to try to broker a deal. So that helped the probability of a shutdown this year on Polymarket to fall from 84% yesterday to 63% this morning.

(Click on image to enlarge)

Such an event could still be later in the year if a stop-gap is put in place this week but overall the probability of one occurring is deemed to be more likely than not before the end of the year. Remember that even though the Republicans have a majority in both chambers, they still need Democratic votes in the Senate, as there’s a 60-vote threshold to avoid the filibuster.

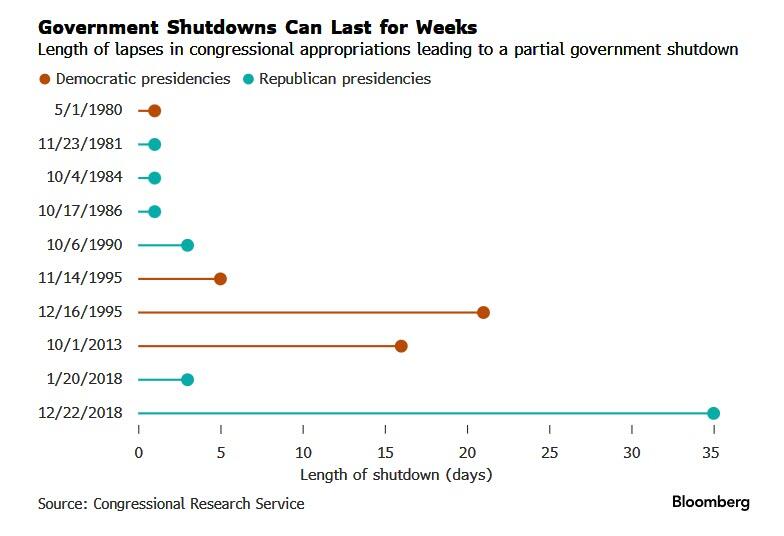

If there is a shutdown, all non-essential federal employees would be furloughed, which DB's economists estimate would cost the economy 0.2% per week on an annualized GDP basis. The longest shutdown was the 35 days straddling the end of 2018 and start of 2019. In 1996, we had one for 21 days and in 2013 one lasting 16 days. Others have lasted a few days or even only hours and before federal workers' alarm clocks went off.

(Click on image to enlarge)

If we don't see the shutdown and payrolls then get released, it’s a very important number given the recent negative revisions and real-time downtrend in new hiring, not to mention the Fed and market reaction function. We could be set for some notable volatility around these prints going forward as the breakeven payroll rate now seems to be around or under 50k per month. Given the naturally wide distribution of payroll numbers, this brings the prospect, and perhaps even the likelihood, of negative prints. These prints may not reflect the underlying trend but could lead to big moves. Given the breakeven rate has always been higher in our careers, we are not really conditioned to negative prints being within the margin of error, so reactions to such prints may be not be rational if and when they happen.

Having said that, for this month DB's economists expect a rebound on the headline to +75k (consensus +50k) against +22k last month. For private payrolls they also expect +75k (consensus +60k) against +38k last month. The unemployment rate is expected to remain unchanged at 4.3%. So, the point above is more of an ongoing one over the coming months and quarters.

Tomorrow's JOLTS report is also important but only refers to August. So it’s always behind but is perhaps the more reliable indicator of the labor market. So far it has been fairly stable and indicative of a low hiring and low firing labor market. So stable, but with low numbers on both sides, and therefore it wouldn't take a big change in the direction either way to make a big difference. We also have ADP on Wednesday and then we think jobless claims on Thursday would likely be released in a shutdown as it’s compiled by states. This happened in the 2013 shutdown but we can't be 100% sure. Elsewhere for employment trends, the jobs hard/plentiful measure in tomorrow's consumer confidence, as well as the employment subcomponents in the two ISM readings this week will also be important for the current state of play in the US labor market.

The one other thing to say is that the start of Q4 on Wednesday brings the start of the multi-year German stimulus package. Given most careers have been soundtracked by German fiscal discipline, then we will all have to get used to a changing narrative. It's fair to say that investors have become more pessimistic over the summer as to the extent of the difference it will make (just check out the DAX swoon after the early 2025 blast off) . However, some of this is just impatience and the momentum could kick into gear again soon. There is some disappointment that more will be directed to consumption than the initial infrastructure and defense bias suggested, but it shouldn't change the near-term multiplier much, just the long-term potential growth rate.

Staying in Europe, the focus will be on the flash CPIs for September starting with Spain and Belgium today. Prints for Germany, France and Italy will be released tomorrow and the Eurozone print will be out on Wednesday. Our European economists preview the releases here. They expect a 2.22% report for the Eurozone, with country-level forecasts including 2.34% for Germany, 1.12% for France and 1.67% for Italy. Finally, the September CPI report is also due for Switzerland on Thursday.

Courtesy of DB, here is a day-by-day calendar of events

Monday September 29

- Data: US September Dallas Fed manufacturing activity, August pending home sales, UK August net consumer credit, M4, Eurozone September economic, industrial, services confidence

- Central banks: Fed's Waller, Bostic and Hammack speak, ECB's Muller, Lane, Cipollone and Centeno speak, BoJ's Noguchi speaks, BoE's Ramsden speaks

- Earnings: Carnival

Tuesday September 30

- Data: US September Conference Board consumer confidence index, Dallas Fed services activity, MNI Chicago PMI, August JOLTS report, July FHFA house price index, China September PMIs, UK September Lloyds Business Barometer, Q2 current account balance, Japan August industrial production, retail sales, housing starts, Germany September CPI, unemployment claims rate, August retail sales, import price index, France September CPI, August consumer spending, PPI, Italy September CPI, August PPI, July industrial sales

- Central banks: RBA decision, Fed's Jefferson and Goolsbee speak, ECB's Lagarde, Rehn, Cipollone and Nagel speak, BoE's Lombardelli, Mann and Breeden speak, BoJ summary of opinions from the September meeting

- Earnings: Nike

Wednesday October 1

- Data: US September ISM index, ADP report, total vehicle sales, August construction spending, Japan 3Q Tankan survey, Italy September manufacturing PMI, new car registrations, budget balance, Eurozone September CPI, Canada September manufacturing PMI

- Central banks: Fed's Logan speaks, ECB's Guindos, Kazimir, Kocher, Nagel and Simkus speak, BoE's Mann speaks

Thursday October 2

- Data: US August factory orders, initial jobless claims, Japan September monetary base, consumer confidence index, France August budget balance, Italy August unemployment rate, Eurozone August unemployment rate, Switzerland September CPI

- Central banks: Fed's Logan speaks, ECB's Villeroy, Makhlouf and Guindos speak, BoJ's Uchida speaks, BoE's September DMP survey

- Earnings: Tesco

Friday October 3

- Data: US September jobs report, ISM services, UK September official reserves changes, Japan August jobless rate, job-to-applicant ratio, France August industrial production, Italy September services PMI, August retail sales, Q2 deficit to GDP, Eurozone August PPI

- Central banks: Fed's Williams and Jefferson speak, ECB's Lagarde, Sleijpen, Villeroy and Schnabel speak, BoJ's Ueda speaks, BoE's Bailey speaks

Finally, looking at just the US, key economic data releases this week are the JOLTS report on Tuesday, the ISM manufacturing index on Wednesday, and the employment report and the ISM services index on Friday. There are several speaking engagements by Fed officials this week, including events with Governor Jefferson on Tuesday and Friday. But again, if the federal government shuts down on October 1, most data releases from federal agencies will be postponed until after the government reopens.

Monday, September 29

- 07:30 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will deliver a speech on payments at the Sibos 2025 Conference in Frankfurt, Germany. Speech text is expected. On September 3rd, Governor Waller stressed that the FOMC needs “to get ahead of the labor market [weakening], because usually when the labor market turns bad, it turns bad fast.”

- 08:00 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will participate in a policy panel at the joint ECB-Cleveland Fed conference in Frankfurt, Germany. On September 22nd, President Hammack said that she has “a lot of concern about the level of inflation and [its] persistence,” adding that “if we remove [the current policy] restriction from the economy, things could start overheating again.”

- 10:00 AM Pending home sales, August (GS +1.0%, consensus flat, last -0.4%)

- 10:30 AM Dallas Fed manufacturing index, September (consensus -1.6, last -1.8)

- 01:30 PM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will participate in a panel at Washington University, St. Louis. Q&A is expected. On September 22nd, President Musalem said that while he “supported the 25bps reduction in the FOMC’s policy rate as a precautionary move intended to support the labor market at full employment and against further weakening,” he also believes that “there is limited room for easing further without policy becoming overly accommodative.”

- 06:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will moderate a conversation with Ed Bastian, CEO of Delta Air Lines, as part of the Atlanta Fed’s Leading Voices series. Audience Q&A is expected. On September 23rd, President Bostic said that with inflation “not having been at target for over four and a half years, we definitely need to be concerned about it,” and added that “it is incumbent upon us to continue to stay vigilant in the fight against inflation.”

Tuesday, September 30

- 06:00 AM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will deliver a keynote speech at the Bank of Finland’s International Monetary Policy Conference in Helsinki, Finland. Speech text and audience Q&A are expected.

- 09:00 AM FHFA house price index, July (consensus -0.1%, last -0.2%)

- 09:00 AM S&P Case-Shiller home price index, July (GS -0.2%, consensus -0.2%, last -0.3%)

- 09:00 AM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will deliver remarks at the Council on Foreign Relation’s Peter McColough Series on International Economics in New York City. Speech text and moderated Q&A with audience are expected. On September 22nd, President Collins noted that “an actively patient approach to monetary policy remains appropriate at this time.”

- 10:00 AM JOLTS job openings, August (GS 7,250k, consensus 7,170k, last 7,181k)

- 10:00 AM Conference Board consumer confidence, September (GS 96.0, consensus 96.0, last 97.4)

- 01:30 PM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will participate in a Q&A at the Chicago Fed’s 2025 Midwest Agriculture Conference in Chicago. Moderated Q&A is expected. On September 25th, President Goolsbee said that he is “somewhat uneasy with frontloading too many cuts based on just the payroll numbers coming down.” He added that “in the short term the most worrying thing is the possibility that after four and a half years of inflation above target, inflation now proves to be more persistent than we wanted it to be.”

- 07:10 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will speak in a moderated conversation at the Dallas Fed Survey Participants’ Appreciation Reception. Audience Q&A is expected. On September 25th, President Logan argued that the FOMC should consider targeting short-term interest rates other than the federal funds rate.

Wednesday, October 1

- 08:15 AM ADP employment change, September (GS +60k, consensus +50k, last +54k)

- 09:45 AM S&P Global US manufacturing PMI, September final (consensus 52.0, last 52.0)

- 10:00 AM ISM manufacturing index, September (GS 49.2, consensus 49.0, last 48.7): We estimate the ISM manufacturing index increased 0.5pt to 49.2 in September, reflecting improvement in our manufacturing survey tracker (+0.6pt to 51.7).

- 10:00 AM Construction spending, August (GS flat, consensus -0.1%, last -0.1%)

- 05:00 PM Lightweight motor vehicle sales, September (GS 16.2mn, consensus 16.2mn, last 16.1mn)

Thursday, October 2

- 8:30 AM Initial jobless claims, week ended September 27 (GS 220k, consensus 225k, last 218k); Continuing jobless claims, week ended September 20 (consensus 1,930k, last 1,926k)

- 10:00 AM Factory orders, August (GS +1.3%, consensus +1.4%, last -1.3%); Durable goods orders, August final (GS +2.9%, consensus +2.9%, last +2.9%); Durable goods orders ex-transportation, August final (last +0.4%); Core capital goods orders, August final (last +0.6%); Core capital goods shipments, August final (last -0.3%)

- 10:30 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will speak in a moderated conversation at the University of Texas Evolving Energy and Policy Landscape Conference in Austin.

Friday, October 3

- 06:05 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak at the farewell symposium for Klaas Knot, outgoing President of De Nederlandsche Bank, in Amsterdam, Netherlands. On September 4th, President Williams said that “if progress on our dual mandate goals continues as in my baseline forecast, I anticipate it will become appropriate to move interest rates toward a more neutral stance over time.”

- 08:30 AM Nonfarm payroll employment, September (GS +80k, consensus +50k, last +22k); Private payroll employment, September (GS +85k, consensus +60k, last +83k); Average hourly earnings (MoM), September (GS +0.2%, consensus +0.3%, last +0.3%); Unemployment rate, September (GS 4.3%, consensus 4.3%, last 4.3%): We estimate nonfarm payrolls rose 80k in September. On the positive side, big data indicators indicated a sequentially firmer pace of private sector job growth. On the negative side, we expect a 5k decline in government payrolls, reflecting a 10k decline in federal government payrolls and a 5k increase in state and local government payrolls. We suspect August payroll growth will be revised higher, as has been typical over the last decade, though revisions so far this year have been disproportionately downward. We estimate that the unemployment rate was unchanged at 4.3% on a rounded basis, reflecting the stabilization in continuing claims over the last month, though the bar for rounding up to 4.4% is not high from an unrounded 4.32% in August. We estimate average hourly earnings rose 0.2% (month-over-month, seasonally adjusted), reflecting negative calendar effects.

- 09:45 AM S&P Global US services PMI, September final (consensus 53.9, last 53.9)

- 10:00 AM ISM services index, September (GS 52.0, consensus 51.7, last 52.0): We estimate that the ISM services index was unchanged at 52.0 in September, reflecting sequential softening in our non-manufacturing survey tracker (-1.6pt to 52.4) but a tailwind from residual seasonality.

- 01:40 PM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will speak on the economic outlook and the monetary policy framework at Drexel University in Philadelphia. Speech text and audience Q&A are expected.

Source: DB, Goldman

More By This Author:

Marijuana Stocks Jump On Trump's "Revolutionize Senior Healthcare" Video

Help Wanted: These Are The Most In-Demand Jobs Of The Next Decade

Trump Imposes 25% Tariff On Imported Heavy Trucks Starting Oct. 1

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more