Key Events This Week: Core PCE, GDP, Durables And Fed Speakers Gallore

After a fast and furious week which saw not just key economic data but also central banks galore, fedspeak will dominate the week until we reach the core PCE number on Friday with Bostic (voter - dovish) opening up proceedings today, followed by Goolsbee (non-voter - dovish) who may give indications that he is looking for a continuation of large rate reductions. Tomorrow and Thursday, Bowman will tell us why she was the first governor to dissent at an FOMC since 2005. Kugler (voter - neutral) speaks on Wednesday and then takes part in a fireside with Collins (non-voter - dovish) on Thursday. Also on Thursday we have the 10th annual US Treasury Market Conference. Powell opens it up with pre-recorded remarks with Williams (voter - dovish) and Barr (voter - dovish) also speaking. So a busy array of speakers and plenty of focus of all of them.

(Click on image to enlarge)

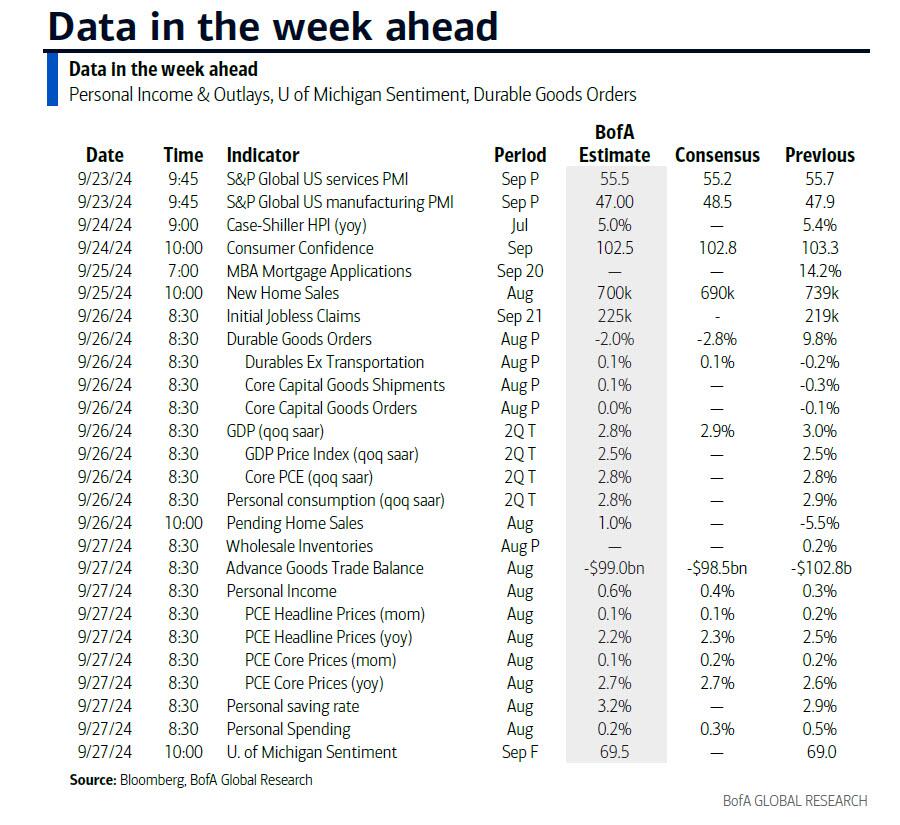

In terms of data, DB's Jim Reid notes that Thursday's final reading of US Q2 real GDP (expected to be unchanged at 3.0%), and the personal income and consumption report which contains the core PCE will be the main highlights. DB expect core PCE to post a +0.18% gain in August, helping the YoY rate tick up a tenth to 2.7%. The GDP report includes 5 years of revisions up to Q1 2024 so that will be an interesting curiosity that could slightly reshape how we think about this cycle. Elsewhere in the US, tomorrow's consumer confidence, Wednesday's new home sales, Thursday's durable goods orders and Friday's advance goods trade balance round out the week. The full day-by-day week ahead appears at the end as usual.

(Click on image to enlarge)

Over the weekend Olaf Scholz's SPD party has narrowly held onto first place in Brandenburg, pipping far right AfD with around 30.9% of the votes to the latter's 29.2%. This has been an SPD stronghold since unification in 1990 and the popular regional premier did distance himself from the federal government during the campaign so there is less of a read through to national politics than could be thought at first glance. There will also be some concern that this is the third regional election in a row where the AfD has come first or second with around 30% of the votes. Perhaps some tactical voting stopped them winning over the weekend? However no main party will power-share with them so at the moment there is limited implications of their current poll standings, but their rise continues to be on a broadly upward path.

Courtesy of DB, here is a day-by-day calendar of events

Monday September 23

- Data: US, UK, Germany, France and Eurozone September PMIs, US August Chicago Fed national activity index

- Central banks: Fed's Bostic, Goolsbee and Kashkari speak, ECB's Cipollone speaks

Tuesday September 24

- Data: US September Conference Board consumer confidence index, Richmond Fed manufacturing index, business conditions, Philadelphia Fed non-manufacturing activity, July FHFA house price index, Japan September PMIs, Germany September Ifo survey

- Central banks: ECB's Nagel speaks, RBA decision

- Auctions : US 2-year Notes ($69bn)

Wednesday September 25

- Data: US August new home sales, China 1-yr MLF rate, Japan August PPI services, France September consumer confidence, Australia August CPI

- Central banks: Riksbank decision

- Earnings: Micron

- Auctions: US 2-year FRN (reopening, $28bn), 5-year Notes ($70bn)

Thursday September 26

- Data: US August durable goods orders, pending home sales, September Kansas City Fed manufacturing activity, initial jobless claims, Germany October GfK consumer confidence, Italy September consumer confidence index, manufacturing confidence, economic sentiment, Eurozone August M3

- Central banks: Fed's Powell, Collins, Kugler, Williams, Barr and Kashkari speak, ECB's Lagarde speaks, ECB's economic bulletin, BoJ minutes of the July meeting, SNB decision

- Earnings : Costco, H&M

- Auctions : US 7-year Notes ($44bn)

Friday September 27

- Data: US August PCE, personal income and spending, wholesale inventories, advance goods trade balance, September Kansas City Fed services activity, China August industrial profits, Japan September Tokyo CPI, Germany September unemployment claims rate, France September CPI, August consumer spending, PPI, Italy July industrial sales, August PPI, Eurozone September economic confidence, Canada July GDP

- Central banks: ECB consumer expectations survey, ECB's Rehn, Lane, Cipollone and Nagel speak

Finally, looking at just the US, the key economic data releases this week are the durable goods report on Thursday and the core PCE inflation report on Friday. There are many speaking engagements from Fed officials this week.

Monday, September 23

- 08:00 AM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will give a keynote speech on the economic outlook at an event convened by the European Economics and Financial Centre at the University of London. Speech text and Q&A are expected. On August 28, Bostic said, “Both [inflation and unemployment] would suggest that we’re closer to where we want to be than I had anticipated but suggest we should move our policy action closer.”

- 09:45 AM S&P Global US manufacturing PMI, September preliminary (consensus 48.6, last 47.9); S&P Global US services PMI, September preliminary (consensus 55.3, last 55.7)

- 10:15 AM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will participate in a fireside chat on monetary policy and the economy at the National Association of State Treasurers Annual Conference. A Q&A is expected. On August 14, Goolsbee said, “It feels like, on the margin, I’m getting more concerned about the employment side of the mandate.” And on August 23, he said, “We’re not just fighting inflation now—inflation is on a path to 2%.”

- 01:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a Q&A about the economic impact of early childhood education at an event hosted by the Greater Kansas City Chamber of Commerce at the Science Museum of Minnesota. A Q&A is expected. On August 19, Kashkari said, “The balance of risks has shifted.”

Tuesday, September 24

- 09:00 AM FHFA house price index, July (consensus +0.2%, last -0.1%)

- 09:00 AM S&P Case-Shiller 20-city home price index, July (GS +0.3%, consensus +0.40%, last +0.42%)

- 09:00 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will speak on the economic outlook and monetary policy at Kentucky Bankers Association Annual Convention. Speech text and a moderated Q&A are expected. On September 20, Bowman published an essay addressing her dissent to the 50bp cut at the FOMC’s September meeting. Bowman agreed that it was appropriate to begin the process of lowering the fed funds rate “toward a more neutral policy stance” at the meeting but stated that she would have preferred a 25bp cut. Bowman characterized the economy as “strong” and the labor market as “near full employment,” but highlighted that inflation remains above the Fed’s 2 percent target. Bowman said she was concerned that the 50bp cut might be interpreted as a “premature declaration of victory” on the price stability goal and that a 25bp cut would have posed less of a risk of “unnecessarily stoking demand.”

- 10:00 AM Conference Board consumer confidence, September (GS 103.5, consensus 103.0, last 103.3)

- 10:00 AM Richmond Fed manufacturing index, September (consensus -12, last -19)

Wednesday, September 25

- 10:00 AM New home sales, August (GS -6.0%, consensus -6.0%, last +10.6%)

- 04:00 PM Fed Governor Kugler speaks: Fed Governor Adriana Kugler will speak on the economic outlook at Harvard's Kennedy School of Government. A moderated Q&A is expected. Kugler has not recently commented on monetary policy.

Thursday, September 26

- 08:30 AM GDP, Q2 third release (GS +2.9%, consensus +2.9%, last +3.0%); Personal consumption, Q2 third release (GS +2.9%, consensus +2.9%, last +2.9%): The third release of Q2 GDP will coincide with the 2024 annual update to the National Economic Accounts, which incorporates source data that are more complete than those previously available and methodological changes.

- 08:30 AM Durable goods orders, August preliminary (GS -2.0%, consensus -2.7%, last +9.8%); Durable goods orders ex-transportation, August preliminary (GS +0.2%, consensus +0.1%, last -0.2%); Core capital goods orders, August preliminary (GS +0.2%, consensus +0.1%, last -0.1%); Core capital goods shipments, August preliminary (GS +0.2%, consensus +0.1%, last -0.3%): We estimate that durable goods orders declined 2.0% in the preliminary August report (month-over-month, seasonally adjusted), reflecting a decline in commercial aircraft orders. We forecast a 0.2% rebound in core capital goods orders and shipments—reflecting potential payback for outsized declines in the prior month.

- 08:30 AM Initial jobless claims, week ended September 21 (GS 220k, consensus 225k, last 219k); Continuing jobless claims, week ended September 14 (last 1,829k)

- 09:10 AM Boston Fed President Collins (FOMC non-voter) and Fed Governor Kugler speak: Boston Fed President Susan Collins and Fed Governor Adriana Kugler will participate in a fireside chat focusing on the intersections between bank supervision and financial inclusion. A Q&A with the audience or media is not expected. On August 22, Collins said, “I think a gradual, methodical pace once we’re in a different policy stance is likely to be appropriate.”

- 09:15 AM Fed Governor Bowman speaks: Fed Governor Bowman will speak on the economic outlook and monetary policy at the Mid-Size Bank Coalition of America Board of Directors Workshop. Remarks are expected to be similar to those delivered to the Kentucky Bankers Association. Speech text and a moderated Q&A are expected.

- 09:20 AM Federal Reserve Chair Powell speaks: Federal Reserve Chair Jerome Powell will give pre-recorded opening remarks at the 10th annual US Treasury Market Conference. The event is co-hosted by the US Department of the Treasury, the Board of Governors of the Federal Reserve System, the Federal Reserve Bank of New York, the US Securities and Exchange Commission, and the US Commodity Futures Trading Commission. After the September FOMC meeting, Powell argued that the logic for the larger cut was clear “both from an economic standpoint and also from a risk management standpoint.”

- 09:25 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give remarks at the 10th annual US Treasury Market Conference. Speech text is expected and a Q&A is not. On September 6, Williams said, “It is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the fed funds rate…Looking ahead, with inflation moving toward the target and the economy in balance, the stance of monetary policy can be moved to a more neutral setting over time.”

- 10:00 AM Pending home sales, August (GS -2.0%, consensus -0.8%, last -5.5%)

- 10:30 AM Fed Vice Chair for Supervision Barr speaks; Fed Vice Chair for Supervision Michael Barr will give remarks at the 10th annual US Treasury Market Conference.

- 10:30 AM Fed Governor Cook speaks: Fed Governor Cook will participate in a roundtable discussion hosted by the Cleveland Fed and Columbus State Community College on artificial intelligence and workforce development. A moderated Q&A is expected. Cook has not recently commented on monetary policy.

- 11:00 AM Kansas City Fed manufacturing index, September (last -3)

- 01:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) and Fed Vice Chair for Supervision Barr speak: Minneapolis Fed President Neel Kashkari will host a fireside chat with Federal Reserve Vice Chair for Supervision Michael Barr on exploring the relationship between banking supervision and inclusive lending practices, including the Community Reinvestment Act. A Q&A with the audience or media is not expected.

- 06:00 PM Fed Governor Cook speaks: Fed Governor Lisa Cook will deliver the Ohio State University President and Provost’s Diversity Lecture on artificial intelligence and the labor force. Speech text and a moderated Q&A are expected.

Friday, September 27

- 08:30 AM Personal spending, August (GS +0.1%, consensus +0.3%, last +0.5%); Personal income, August (GS +0.5%, consensus +0.4%, last +0.3%); Core PCE price index, August (GS +0.16%, consensus +0.2%, last +0.2%); Core PCE price index (YoY), August (GS +2.69%, consensus +2.7%, last +2.6%); PCE price index, August (GS +0.12%, consensus +0.1%, last +0.2%); PCE price index (YoY), August (GS +2.25%, consensus +2.3%, last +2.5%): We estimate personal income increased 0.5% and personal spending increased 0.1% in August. We estimate that the core PCE price index rose +0.16%, corresponding to a year-over-year rate of 2.69%. Additionally, we expect that the headline PCE price index increased by 0.12% from the prior month, corresponding to a year-over-year rate of 2.25%. Our forecast is consistent with a 0.17% increase in our trimmed core PCE measure (vs. +0.14% in July and +0.13% in June).

- 08:30 AM Wholesale inventories, August preliminary (consensus +0.2%, last +0.2%)

- 08:30 AM Advance goods trade balance, August (GS -$97.7bn, consensus -$99.7bn, last -$102.8bn)

- 09:30 AM Boston Fed President Collins (FOMC non-voter) and Fed Governor Kugler speak: Boston Fed President Susan Collins and Fed Governor Adriana Kugler will meet with small business and community leaders in a series of meetings. Highlights from these engagements will be shared online. Speech text and Q&A are not expected.

- 10:00 AM University of Michigan consumer sentiment, September final (GS 69.4, consensus 69.3, last 69.0); University of Michigan 5-10-year inflation expectations, September final (GS 3.1%, last 3.1%)

- 01:15 PM Fed Governor Bowman speaks; Fed Governor Michelle Bowman will speak in a moderated conversation at the Alabama Bankers Association Bank CEO Meeting. A moderated Q&A is expected.

Source: DB, Goldman, BofA

More By This Author:

Gold, Oil, & Crypto Soar As Fed Slashes Rates With Stocks At Record HighsBank Deposits And Money-Market Funds See Sizable Outflows As Stocks Surge

Intel Shares Soar On Report Of Qualcomm Takeover Interest

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more