It's Official: Tapering To Begin In November, End In July

It's official: Goldman - the bank that effectively runs the New York Fed - is now virtually convinced (70% odds as this moment vs 45% previously) that not only is tapering a done deal, but that we know when it is coming.

As the bank's chief economist Jan Hatzius writes following Friday's Wall Street Journal article authored by official Fed mouthpiece Nick Timiraos and which cites Federal Reserve officials preparing for a “November reduction,” Goldman is increasing its subjective odds of a November taper announcement:

We now see 70% odds of a November announcement (vs. 45% previously) and 10% odds of a December announcement (vs. 35% previously); we continue to see a 20% chance that growth risks related to the Delta variant delay the tapering announcement into 2022.

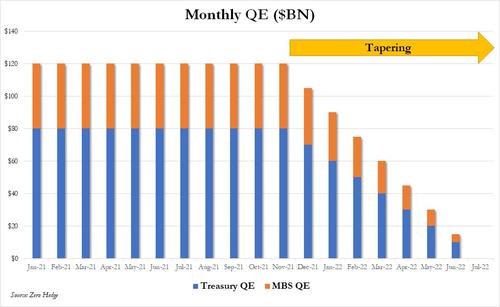

Furthermore, contrary to expectations that the Fed may bring forward an official announcement to September, the article notes that a September taper announcement is “unlikely.” The article also referenced “plans taking shape” that involve a taper that could end in mid-2022. Accordingly, Goldman now expects that a $15bn monthly pace of tapering that concludes next July is the most likely alternative to the bank's standing forecast of a $15bn per meeting pace that concludes next September, or visually:

From Goldman's late Friday note:

- Earlier today, the Wall Street Journal published an article titled “Fed Officials Prepare for November Reduction in Bond Buying.” The article went on to state that officials “will seek to forge agreement” on November as the beginning of “scaling back” accommodation, and it subsequently cited several public remarks about tapering from Chairman Powell and other members of the leadership. Reflecting this, we are increasing our subjective odds of a November taper announcement. We now see 70% odds of a November announcement (vs. 45% previously) and 10% odds of a December announcement (vs. 35% previously); we continue to see a 20% chance that growth risks related to the Delta variant delay the tapering announcement into 2022. The article also confirmed that a September taper announcement is “unlikely.”

- The article also referenced “plans taking shape” that involve a tapering pace that would conclude “by the middle of next year,” and it suggested one possible path involving a $15bn monthly pace of reduction—as compared to our standing forecast of $15bn per meeting ($10bn UST/ $5bn MBS). Coupled with public endorsements of a similar or “fast” taper timeline from FOMC members Bostic, Rosengren, Mester, Kaplan, Harker, George, Waller, and Bullard, we believe a $15bn monthly pace of tapering that concludes next July is the most likely alternative to our standing forecast. We view this as a close call, and the article notes that “officials still have to iron out the exact pace.”

Just two things to add here: with the Fed now set to taper in November and then shrink the balance sheet by $15BN per month, and it really has no choice with hyperinflation now taking hold in some sectors of the economy, it will have to make sure that covid delta, mu or whatever is not a factor in the immediate vicinity of the decision. Which means that in the coming month expect a dramatic reduction in the overblown media frenzy over the delta variant, lockdowns and so on, as continued covid panic will only lead to questions why the Fed is tapering at a time when the pandemic is still raging. Of course, that doesn't mean that we won't have a new resurgence in the future, which brings us to the second point namely that...

As Bank of America so impolitely put it back in June, everyone knows that the Fed will stop tapering as soon the S&P drops 10%. The only question is how long after the Fed tapering begins will the market tumble and force the Fed to reverse and/or start buying single stocks and ETFs.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

So if and when the feared "tapering" actually begins, we will see, possibly, if the effects are the same as what is feared that they will be. OR, will it all be the EFFECTS of the fears?

Will the difference be obvious? or even visible?