Is US Recession Risk High, Low… Or Both?

There’s an old joke in the world of statistics that says if you torture the data long enough, it’ll say anything you want. But sometimes torturing is redundant. Consider the art/science of deciding how to read the state of the US business cycle at the moment. Is recession risk high, low, or somewhere in between? Yes, yes, and yes.

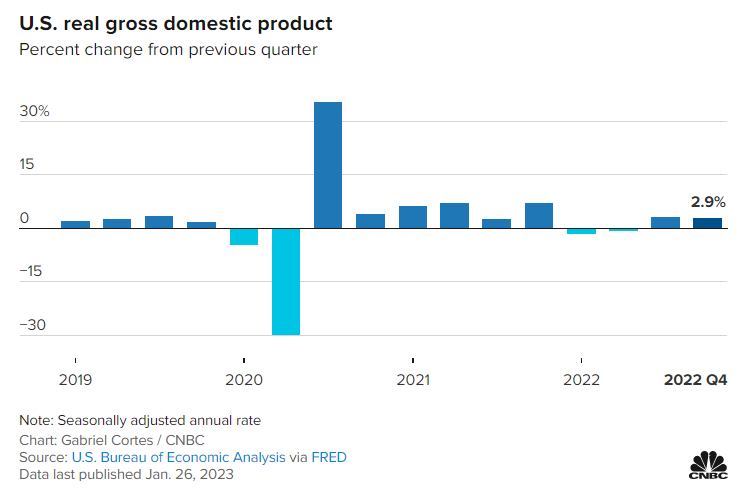

You can find any narrative you want at the moment in the US economic numbers. It’s rare to find so many varieties of indicators that, in aggregate, are effectively saying everything at once. Let’s start on the bright side with yesterday’s fourth-quarter GDP report.

US output rose again in the final quarter of 2022. Although GDP’s 2.9% increase was a bit slower vs. Q3, the gain beat expectations and gave the optimists a fresh set of talking points. As an ABC News headline crowed, “US economy grew at end of 2022, defying recession fears.”

But some analysts still see trouble lurking. “The mix of growth was discouraging, and the monthly data suggest the economy lost momentum as the fourth quarter went on,” advises Andrew Hunter, senior US economist for Capital Economics. “We still expect the lagged impact of the surge in interest rates to push the economy into a mild recession in the first half of this year.”

Luke Tilley, a chief economist at Wilmington Trust, also sees headwinds ahead but thinks a “soft landing” scenario is likely. “If we continue to get strong job growth and if we continue to get consumer spending on services, and companies don’t cut back on [capital expenditures], I think that adds fuel to the soft-landing story.”

On the plus side, yesterday’s weekly update on initial jobless claims suggests that the labor market will continue expanding. New filings for unemployment benefits slipped to a low seasonally adjusted 186,000 last week, near a record low. This leading indicator for the labor market is effectively predicting that payrolls will continue to post solid gains in the near term.

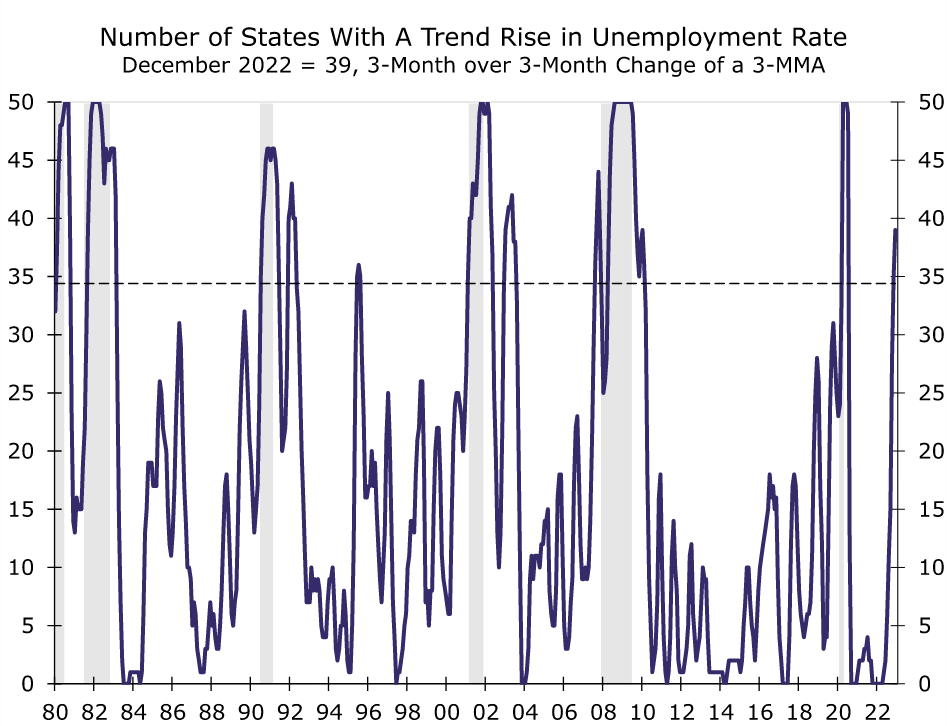

But the upbeat profile on the jobs front from the usual indicators is hard to square with an alternative measure based on aggregating individual state jobless numbers. Wells Fargo economists note that “rising state unemployment signals recession risk.”

Compiling jobless rates for all 50 US states shows a sharp rise recently. “Historically, the likelihood of a national recession increases when unemployment rates trend up in at least 34 states,” the Wells Fargo analysts report.

Specifically, in the first month of the past six recessions, 34 states on average experienced such an increase. We note that this threshold is an average, and that higher and lower counts have been experienced at the onset of each downturn. When the number of states rises above the 34 threshold, however, it can be interpreted that the likelihood of recession is increasing.

The threshold was crossed in November 2022, suggesting that near-term recession risks are currently elevated. Conditions deteriorated in December when the count rose from 35 to 39. It is worth noting that not every threshold breach has coincided with a downturn…

Although the threshold was crossed last November, we do not believe the United States is currently in recession. That said, deteriorating state labor market conditions in the last two months of 2022 are consistent with our current macroeconomic forecast of a mild recession starting in the second half of 2023.

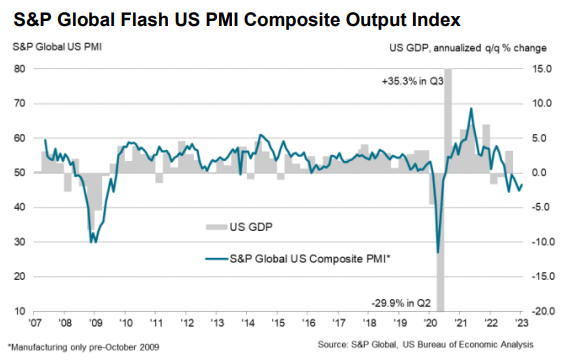

Earlier this week another report that uses a survey-based measure as a proxy for GDP indicated that a US contraction continues through January. “The US economy has started 2023 on a disappointingly soft note, with business activity contracting sharply again in January,” says Chris Williamson, a chief business economist at S&P Global Market Intelligence.

The Conference Board’s Leading Economic Index (LEI) paints a similarly negative profile. “The US LEI fell sharply again in December—continuing to signal recession for the US economy in the near term,” says the consultancy’s senior director for economics.

A pair of proprietary business-cycle indicators highlighted in the weekly updates of The US Business Cycle Research Report also shows a modest contraction in progress for the US.

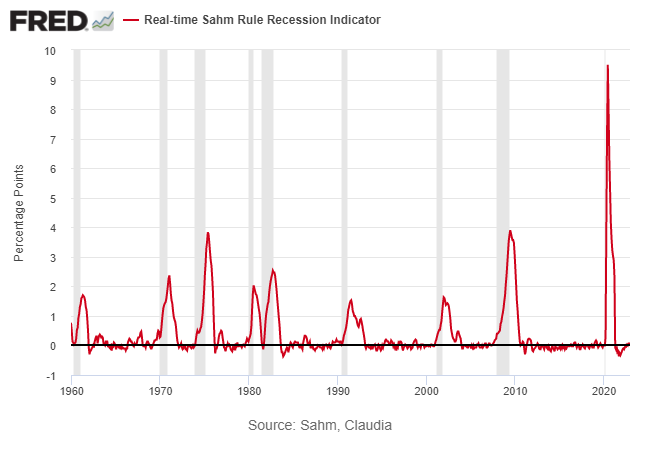

There are plenty of indicator-based counterpoints, however, including the Sahm Rule Recession Indicator, which uses the unemployment rate to evaluate the business-cycle bias. At the moment, this measure reflects virtually nil risk of contraction as of December.

How can we reconcile the starkly different profiles of US economic activity? Maybe we can’t, or at least not yet. Then again, perhaps we’re looking at a new type of recession that allows for sharply conflicting indicators to coincide in real time for some period of time. Other possibilities include a simple explanation that one side or the other is wrong, and that upcoming data revisions will wipe away the mismatch. Another scenario could be that the net effect of negative and positive business-cycle indicators reflects an economy that’s stagnating overall.

Once the full boat of January numbers is published the mystery may finally be resolved. Meantime, you can see anything you want for the US economic outlook. As Yogi Berra once observed: “You can observe a lot just by watching,” but that’s not especially helpful at the moment in the pursuit of clarity for business-cycle analysis.

More By This Author:

Is Rally In Communications Stocks A Sign Of New Sector Leadership?Fed Pivot Watch - Wednesday, Jan. 25

US Q4 GDP Nowcasts Project Solid Rise For Thursday’s Report

Disclosures: None.