Wednesday, April 24, 2024 4:16 AM EST

It’s all well and good to announce positive economic news. Yet, consumers of such news may not be getting the full story.

In other words, there’s plenty of less-than-positive economic developments, and I’ll point out just three which portend a possible economic contraction.

The first one has been well-advertised: the developing commercial real estate crisis. In a nutshell, office building owners face higher interest rates as their loans mature. This could set off a wave of defaults. Indeed, there’s already been a dramatic rise in the number of U.S. commercial property foreclosures in the past four years.

Another sign of a developing economic slowdown has to do with consumers. If you live in the U.S., quite a few of your neighbors — or at least residents of your community — are tapped out.

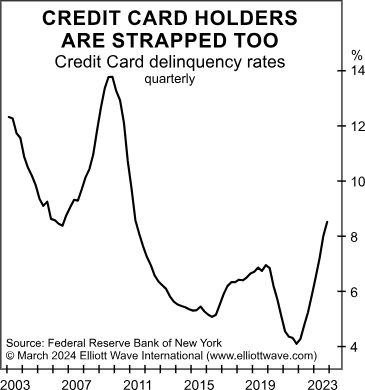

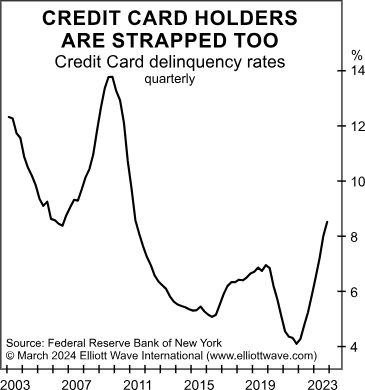

Here’s a chart from the March Elliott Wave Financial Forecast, a monthly publication which covers major U.S. financial markets:

As you can see, credit card delinquencies have been rising since 2022. Indeed, credit card arrears are higher than they’ve been since the wake of the Great Recession in 2007-2009.

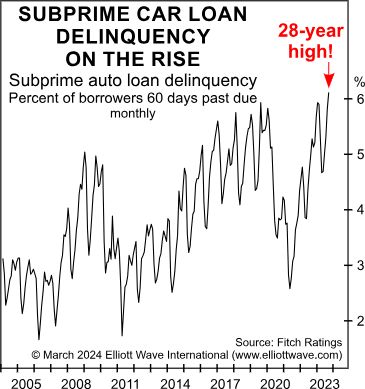

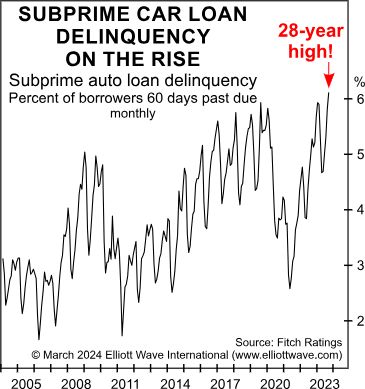

And speaking of the Great Recession, sub-prime car loan delinquencies are even higher than they were then.

The March Elliott Wave Financial Forecast elaborates with this chart and commentary:

Car loan delinquencies are higher than at any time in the data’s history, which goes back to 1996. … Credit standards are tightening, thereby freezing out borrowers. … Access to auto credit is the lowest in nearly four years.

Also keep in mind that the economy follows the stock market.

If the stock market goes into a correction — or worse — expect the economy to weaken. History shows that there’s usually a few months lag time between the action of the stock market and economy.

Elliott wave analysis can help you get a handle on the stock market’s trend.

If you’re unfamiliar with the Elliott wave method, read Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

All waves are of a specific degree. Yet it may be impossible to identify precisely the degree of developing waves, particularly subwaves at the start of a new wave. Degree is not based upon specific price or time lengths but upon form, which is a function of both price and time. Fortunately, the precise degree is usually irrelevant to successful forecasting since it is relative degree that matters most. To know a major advance is due is more important than its precise name. Later events always clarify degree.

More By This Author:

What To Make Of Record Bullish Market BetsBYD China Races By Tesla In Electric Vehicle SalesInvest In The Electrical Grid For Smart Energy Exposure

Disclosure: Financial Markets Risk Warning

U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large ...

more

Disclosure: Financial Markets Risk Warning

U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. Hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading.

All information on this website is for educational purposes. Any statements about profits or income, expressed or implied, does not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibility for your actions, trades, profit or loss, and agree to hold Invest2Success and any authorized distributors of this information harmless in any and all ways.

All rights reserved. The use of this website constitutes acceptance of our user agreement.

Financial Products Services Disclosure

Invest2Success is partnered with and advertises promotes other companies finanical products and services, as well as our own. As such, Invest2Success receives advertising promotion compensation from these other companies in doing so. Invest2Success believes the products services of our own and other compaines listed on our site and blog are very unique and can be beneficial to investors traders because they meet our quality guidelines for good investing trading methods which investors traders can use to help improve their financial education knowledge and investing trading results. We do not warrant and are not liable for any claims or testimonies made by these other compaines products and services. Review each product and service carefully before purchasing and using. The purchase, use, and results of any of the products services on our website and blog is sole responsibilty of the user.

less

How did you like this article? Let us know so we can better customize your reading experience.