Is The US Labor Market As Strong As It Appears?

Friday’s payrolls data for February dispatched another upside surprise, reaffirming the now-consensus view that recession risk is low for the US economy. Hiring rose 275,000 last month, beating expectations — well above the consensus forecast for around 200,000.

A closer look at the numbers, however, paints a mixed picture. As The Wall Street Journal noted, “behind the headline number were signs of a gradual slowdown.”

Nonetheless, there’s still a strong case for expecting the labor market to expand at a healthy if slower pace. But there are also hints that as the year unfolds, hiring headwinds could increase, perhaps more than expected.

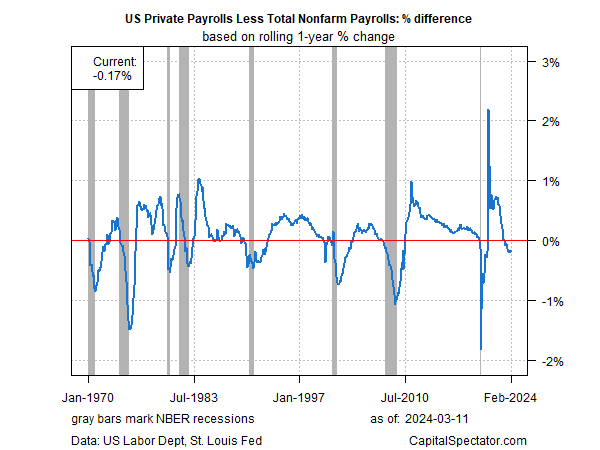

One possible early warning: the private-sector component continues to underperform relative to the aggregate level, which includes government jobs. The distinction is important because private firms are responsible for the overwhelming share of hiring (and firing). Companies are also sensitive to the business cycle vs. the relative immunity to staffing in government.

In short, measuring the difference in the year-over-year change in total payrolls vs. its private counterpart is revealing. Most of the time, the year-over-year change in private hiring exceeds hiring in total payrolls. That’s not surprising since companies expand their payrolls in line with a growing economy (which tends to prevail most of the time), and shift into reverse when economic headwinds increase.

Although several key indicators for payrolls continue to reflect strength, the recent slide in year-over-year private payrolls vs. the aggregate number is worrisome, as the chart below shows.

A net negative reading often coincides with recession. The fact that this metric has been negative for 11 straight months through February raises a possible warning flag for the labor market and the economy.

The good news: this indicator, to the extent it signals trouble, tends to be early. Another pushback is that several so-called reliable business-cycle indicators have faltered recently, and so it’s possible (likely?) that this caveat applies here too.

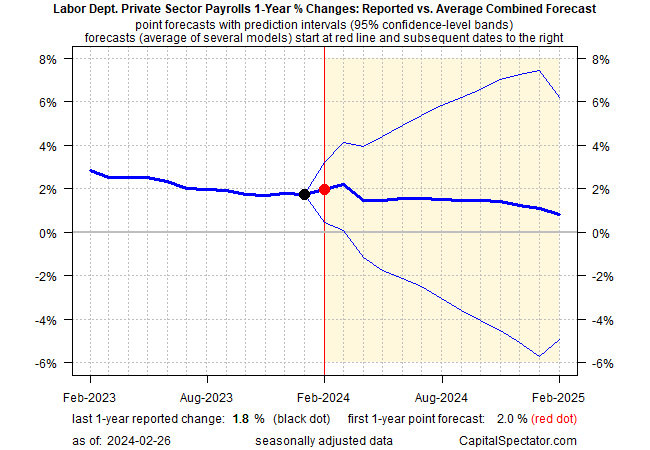

In fact, modeling the outlook for the year-over-year change in private payrolls with a different methodology suggests that the chart above is overstating the potential risk. Using CapitalSpectator.com’s ensemble model for projecting the 1-year trend private payrolls continues to anticipate low risk for the labor market in the near term.

That’s also the implied forecast in the low level of initial jobless claims, which continue to print near multi-decade lows. If and when this leading indicator starts to rise in a meaningful, sustained degree, that would confirm the warning sign in the first chart above.

For what it’s worth, the relative weakness in private payrolls vs. total payrolls is telling us that jobless claims will soon rise, although that seems like a low-probably event today.

More By This Author:

US Growth Expected To Slow In Next Month’s Q1 GDP ReportWill Powell’s House Testimony Today Shift Rate-Cut Expectations?

Bubble Watch: S&P 500 Edition

Disclosure: None.