How UK Inflation Can Fall To 1.5% By May

Lower natural gas prices are catching the headlines, but UK inflation is actually set for a fairly broad-based decline over the coming months. But the market risks getting ahead of itself by pricing a May rate cut, especially if tax cuts are announced in March.

2% inflation is coming very soon

Financial markets are fully pricing the first Bank of England rate cut in May. While that reflects a global shift in thinking among investors, it also shows mounting confidence that the UK inflation story is set to improve further.

This Wednesday’s CPI release for December might be too early to see that, and we’re only expecting a fractional tick lower in the headline measure to 3.8%. It’s a similar story for core, which strips out food and energy. But by April, headline inflation is set to fall below 2% and drop to 1.5% in May. We expect it to stay below 2% until November.

Why is UK inflation set to fall?

The most obvious explanation for that projected downtrend is lower natural gas prices. Futures prices for wholesale gas for delivery later this year and into 2025 have roughly halved since the Bank of England's November Monetary Policy Report. These futures contracts form the basis of the energy regulator Ofgem’s price cap methodology, and it looks like households can expect another sizeable drop in their bills when the cap is next updated in April. This alone will shave 0.6ppts off headline CPI between November and May.

But natural gas is only part of the story, and the disinflation we’re projecting should be fairly broad-based. Except for petrol/diesel, we think most components should contribute a fair amount less to overall inflation by the spring.

We expect a broad-based fall in UK inflation by May

(Click on image to enlarge)

Macrobond, ING calculations/forecasts

Take food prices. On a year-on-year basis, food inflation is still at 9%, which at face value is still painfully high. But if we look at the change in prices over just the past three months and account for the usual seasonality, food inflation is actually running at an annualised pace of just 2-3%. That suggests the contribution of food to headline inflation will continue to fall sharply over the coming months, not least because producer food prices have actually been falling in level terms recently.

Elsewhere, consumer goods inflation has already slowed a lot since the pandemic-induced supply shortages/demand surge, but there’s further to go here too. Back at the start of 2023, we were still seeing the last vestiges of that pandemic inflation coming through for things like household goods and vehicles. With prices set to increase less aggressively at the start of 2024 relative to the same period last year (or in some cases, like used cars, continue to see price falls), consumer goods inflation as a whole still has a bit further to come down. We think 'core goods' will be contributing close to a percentage point less in May than they were in November.

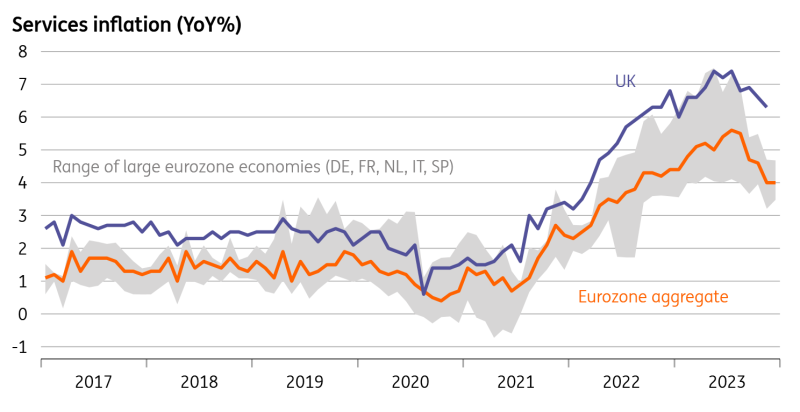

Does the UK have a more significant inflation problem than the eurozone?

As ever though, the bit the Bank of England cares most about is services inflation. Throughout much of 2023, there was a fashionable narrative among investors that the UK’s inflation problem was more worrisome than elsewhere, partly because services inflation appeared stickier. That was and still is, true, though we’d note that not all of this divergence between UK and eurozone services inflation can be explained by inherent economic tightness.

Some of the gap in services inflation can be explained by apparent differences in price collection/measurement, even if, in theory, UK and European inflation metrics are harmonised. Communication prices (eg internet/phone packages) are the most stark example of this. And rental inflation is more rampant in Britain too, a symptom perhaps of less aggressive rent controls.

UK services inflation is lagging the rest of Europe

(Click on image to enlarge)

Macrobond, ING calculations

But in areas that are more closely tied to cyclical economic developments, like hospitality, the differences between the UK and Europe are more minimal. In fact, the UK seems just to be lagging the disinflation seen elsewhere. Services inflation, at 6.3%, is also now well below the Bank of England’s most recent forecast and by some distance.

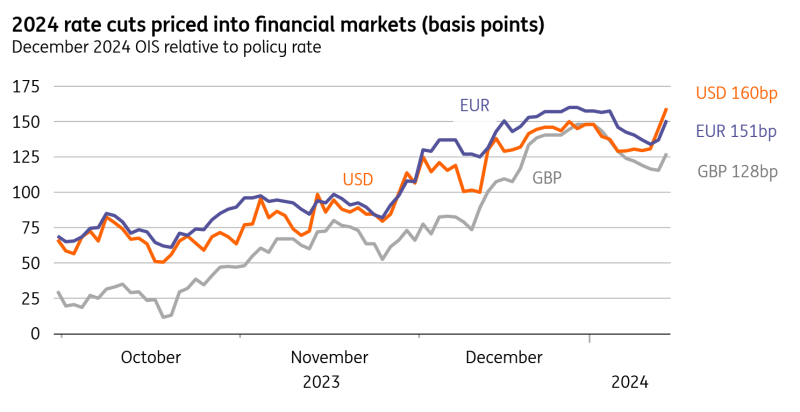

That might help explain why markets are now pricing a similar amount of policy easing this year at the Bank of England as the Fed or ECB. Investors expect 130bp of cuts in the UK, starting in May.

How quickly can the Bank of England cut rates?

So, how realistic is that May rate cut? We think for it to happen, three things might need to happen.

The first is that services inflation needs to show more progress, and in the near term, we think it will remain stuck between 6-7%. The March figure, which will be the last reading available before the May meeting, will probably be only slightly below that. Wage growth, which is the other key metric the BoE has its eye on, should show a little more progress, but surveys suggest this is also likely to be pretty gradual in the near term. Better news should follow on both services inflation and wage growth in the second quarter. But we think it would take a string of additional downward surprises here to convince the Bank to cut imminently, something it currently appears highly reticent to do.

The second thing to watch is the government’s Spring Budget in March. We wrote last week that we think the recent fall in market rates will give the government roughly £12bn extra to spend while still meeting its major fiscal rules. That comes in addition to the £13bn “headroom” left over from November’s Autumn Statement and, in total, gifts the government with as much as 1% of GDP in fiscal stimulus to play with if it so wishes.

A large fiscal boost in March may well be cited as a reason for the BoE to wait until the summer before cutting rates

The government is widely expected to spend at least some of that in the March budget, and press reports suggest an income tax cut is a likely candidate for that stimulus. The question is how large the fiscal injection is at this point and whether the government intends to split it in two with another budget closer to the widely-anticipated autumn election. The Sunday Times recently reported that the government was considering having a second budget event just before campaigning begins.

This detail potentially matters for the Bank of England, which bases its interest rate decisions on whatever government policy officially is at the time. A large fiscal boost in March may well be cited as a reason for the BoE to wait until the summer before cutting rates. This is a key factor in our call for rate cuts to start in August. But a more muted fiscal package could keep a May cut in play.

Rate cuts priced into financial markets

(Click on image to enlarge)

Macrobond, ING calculations

The final factor is, of course, the wider economic backdrop. We discussed a few days ago why this is looking brighter, but more tangible signs of a cooling in the jobs market, though not our base case, would help build the case for more immediate cuts.

For now, we’re sticking with our call for the first cut to come in August. To some extent, that’s splitting hairs with investors, and the bigger story here is that markets are right to be pricing a series of cuts this year. We’re forecasting 100bp of easing in the second half of 2024.

More By This Author:

FX Talking January: Waiting On The Dollar DepartureFX Daily: Waiting On Central Bankers To Shake Data-Resistant Markets

Asia Morning Bites - Monday, January 15

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more