“How Did This Happen?” Stock Market (And Sentiment Results)

The bad news is, we have a Federal Reserve with no feel for the market or explicit understanding of “lagged effect” of tightening on the economy. To this point, the Chairman was quoted (in yesterday’s conference) as follows, “I mean the question we were all asking ourselves that first weekend was, ‘How did this happen?‘” (referring to the collapse of Silicon Valley Bank). Save the taxpayers some money and call off the “investigation.” Everyone already knows how this happened…

I can already hear the Shaggy (It Wasn’t Me) background music at the next Fed press conference…

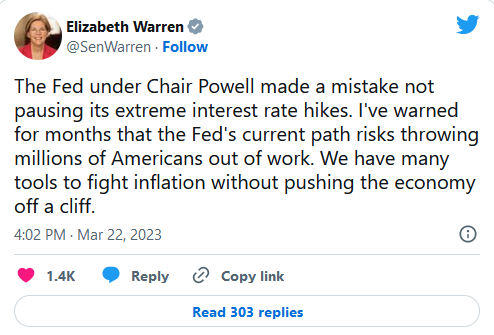

As we anticipated in January and have reiterated in our weekly podcast|videocast‘s, the political pressure is just beginning:

I covered the Fed’s role in SVB on Making Money with Charles Payne on Fox Business last Thursday (along with some new picks). Thanks to Charles and Kayla Arestivo for having me on:

This continues to be a “shoot first, ask questions later” market for regional banks. The Bank Term Lending Facility was an important measure, but until we get movement on an explicit deposit insurance increase or full coverage, you will continue to see these cracks in the market. Pandora’s box was opened by the Fed’s unyielding rate hike campaign until something broke.

As it stands, the only banks that are “fully insured” are the SIBs (systemically important banks) and until the government steps in to change that, we will continue to see flows away from regionals and into SIBs that are too big to fail.

The genie is out of the bottle and the only way to put it back in is further explicit guarantees/deposit insurance for ALL banks. This is not a protection/bailout for investors (as they got wiped out with SVB, SBNY and mostly CS), it is a way to keep regionals in business by keeping their deposit bases steady.

As for banks out trying to raise capital, private or public fundraising, the problem still remains. How do you raise capital when you don’t know what your deposit base will be in 2 weeks?

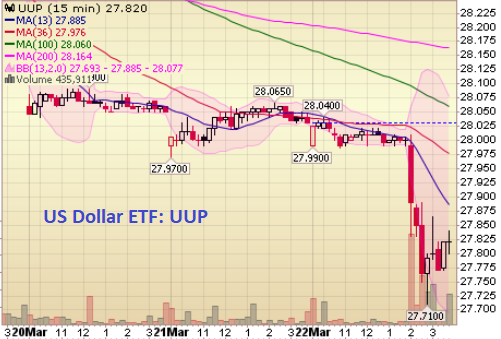

If you were wondering why the market sold off so aggressively into the close when it was holding up relatively well following the 25bps hike (expected by the Fed Funds Futures market) here you go:

![]()

The above headline hit at 3:30 (the second to last bar on this 15-minute chart):

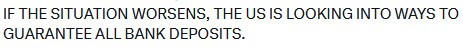

It was a potent surprise hit to the market as just 24 hours before, this was what came across the tape:

For those saying they can’t change the deposit guarantee limits without Congress, that is correct. However, in times of emergency or crisis the Executive Branch has the unilateral authority to act. So far crickets…

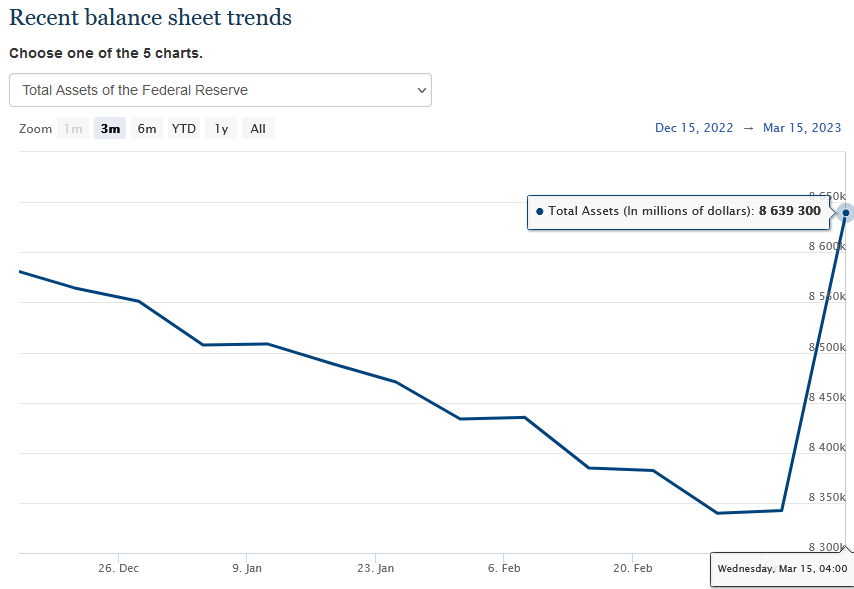

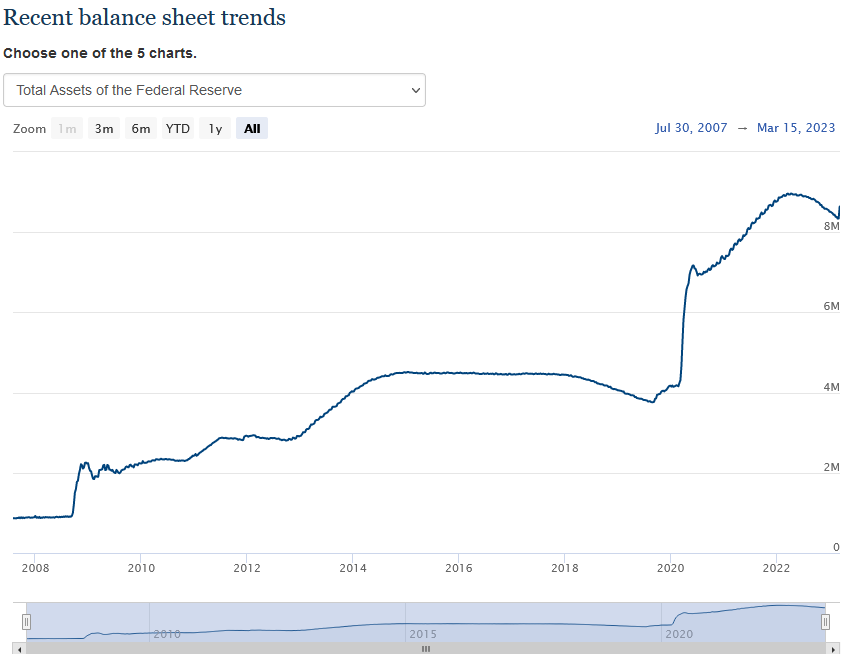

The good news is, they have unlocked liquidity tools to clean up the messes they have made and are likely to continue to make moving forward. The balance sheet is up $300B in the first week. I would expect the additional 25bps will require another 300B-600B+ by the end of the year. So is 25bps worth another $1T. I guess it is to them…

This is bearish for the US Dollar and Bullish for Emerging Markets Equities/China (after the short-term dust settles).

You are also seeing Gold get a bid of late. It has sniffed out the fact that the more they tighten now, the more they will have to print later. We’ve been saying it for months on our podcast|videocast. Now we are seeing it in real time. The only folks who have not gotten the memo are the ones sitting around asking themselves “how did this happen?” When the balance sheet makes a new record high during their “tightening cycle” perhaps they will revisit the question…

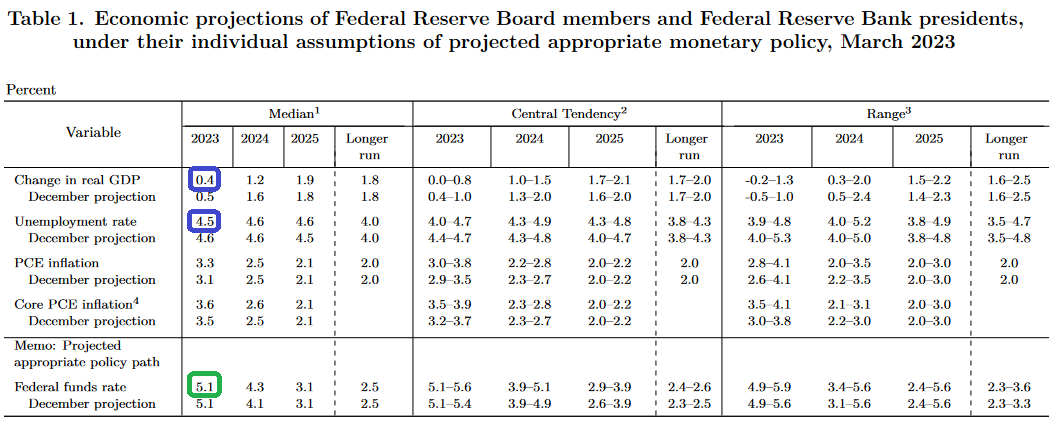

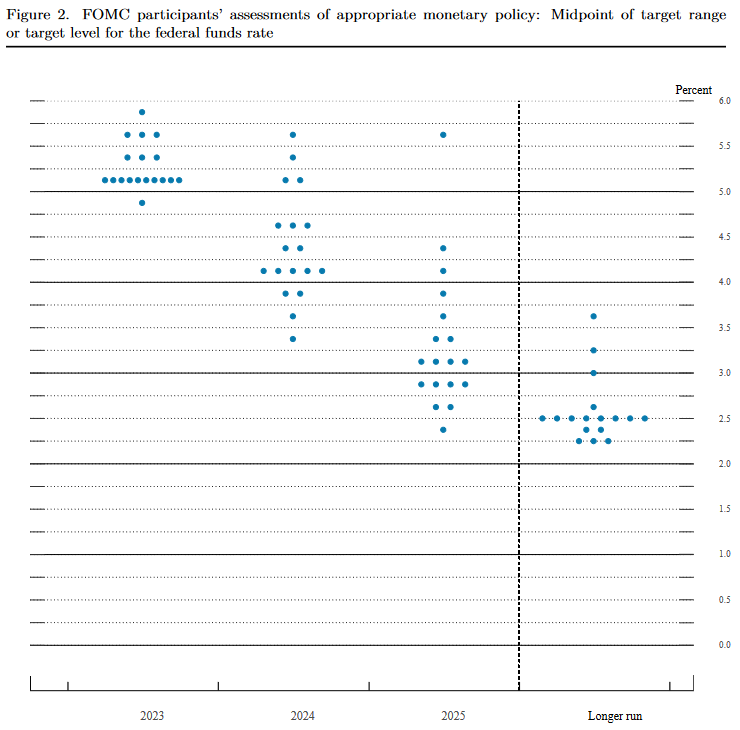

Here are the Fed’s new “projections” and dot plot. They anticipate another possible hike. Two weeks ago the market was convinced the terminal rate was >6%, now it’s ~5.1%. My guess is one more mid-sized bank closure and we’ll be done at 5% (here).

(Click on image to enlarge)

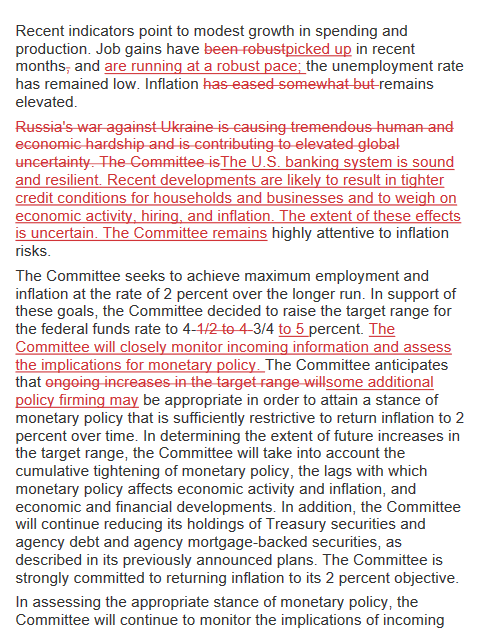

Fed Statement Changes:

CNBC, ‘The notable changes include a shift away from “ongoing increases” to the policy rate to “some additional firming,” as well as saying that the “U.S. banking system is sound and resilient.”’

On Tuesday, I posted a summary of Bank of America’s Global Fund Manager Survey. You can find it here:

March 2023 Bank of America Global Fund Manager Survey Results (Summary) #StockMarkethttps://t.co/H8Xp282OfE pic.twitter.com/fOmUdwgKco

— Thomas J. Hayes (@HedgeFundTips) March 21, 2023

The five key points were:

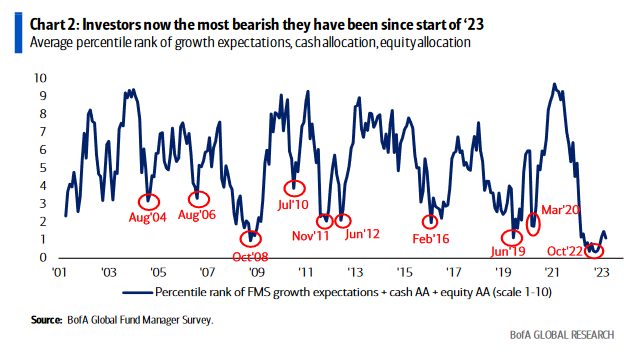

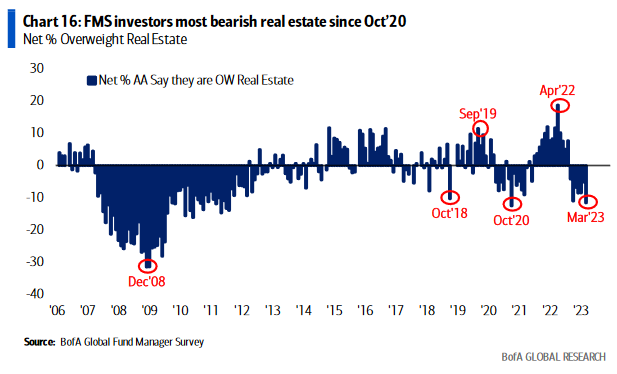

1. Investor Sentiment as bearish as GHC lows in 2008-2009

:

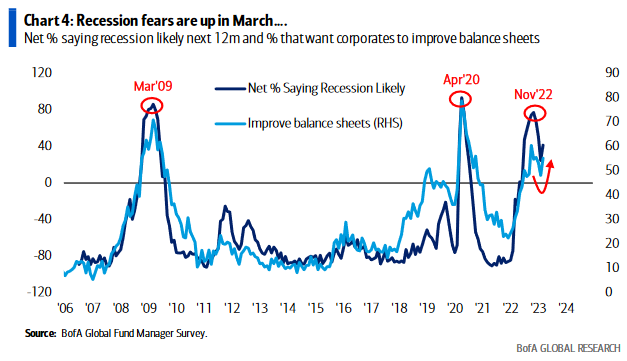

2. Recession Fears near previous major lows levels:

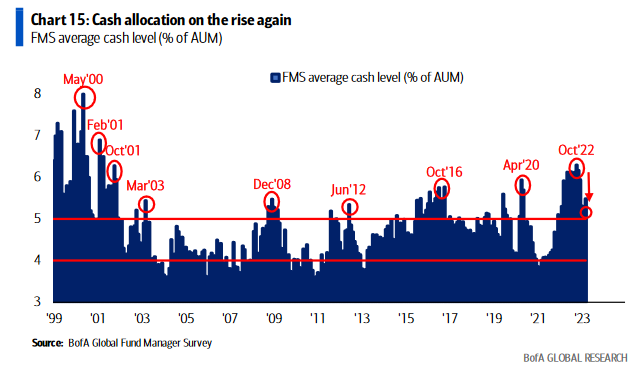

3. Cash levels still high:

4. Excessive bearishness in Real Estate:

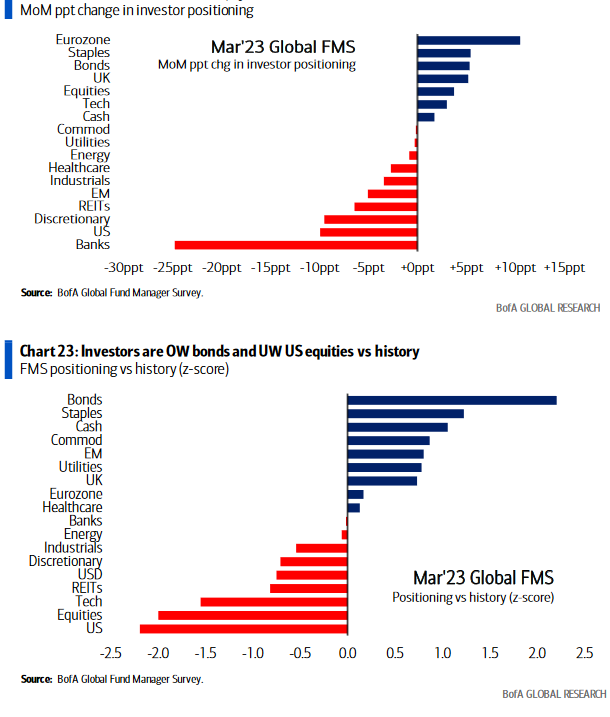

5. Managers running to safety:

Take the road less traveled…

Now onto the shorter term view for the General Market:

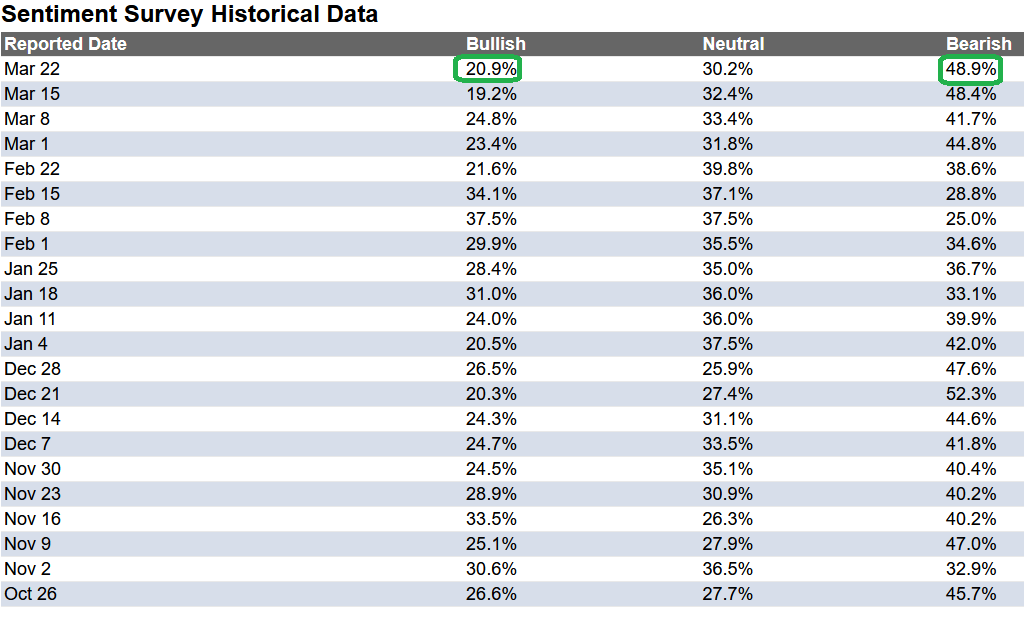

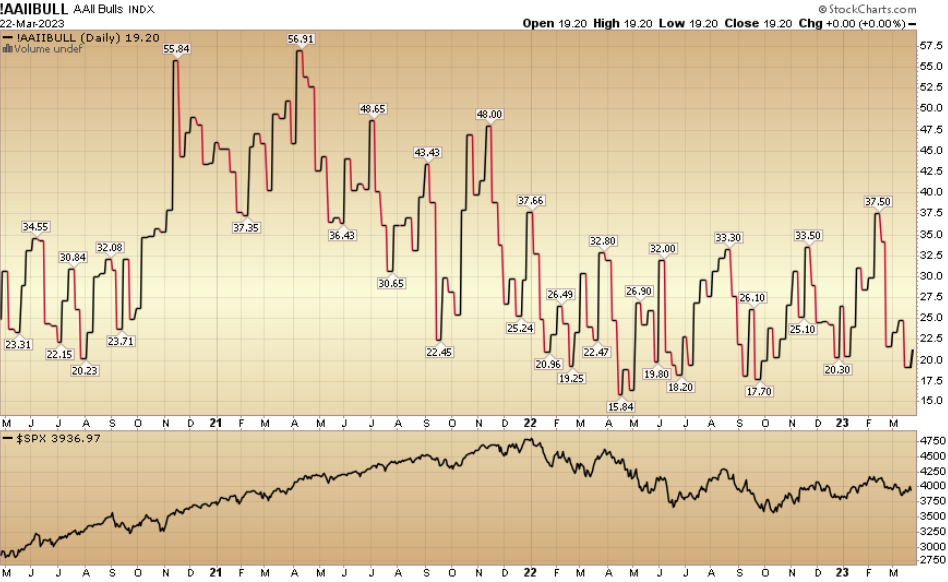

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 20.9% from 19.2% the previous week. Bearish Percent ticked up to 48.9% from 48.4%. Retail traders/investors are shaking in their boots…

(Click on image to enlarge)

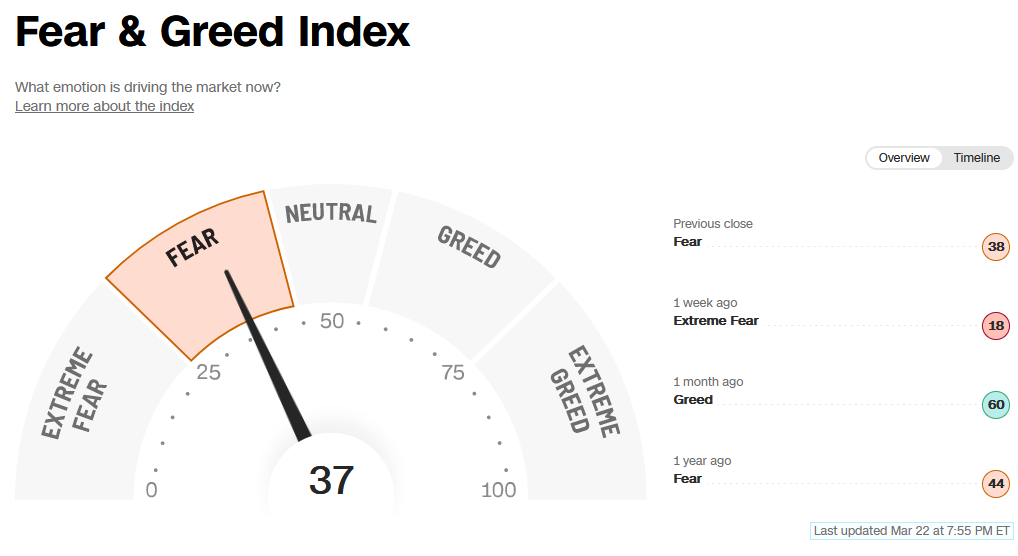

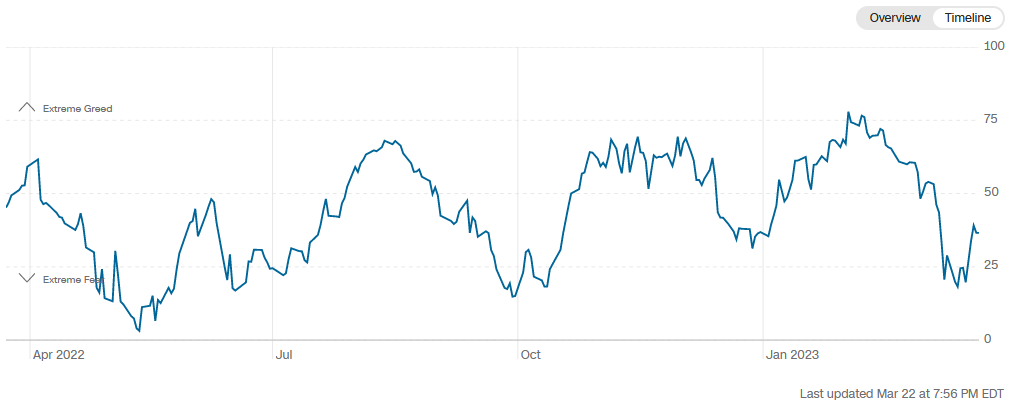

The CNN “Fear and Greed” rose from 20 last week to 37 this week. Sentiment is still fearful. You can learn how this indicator is calculated and how it works here: (Video Explanation)

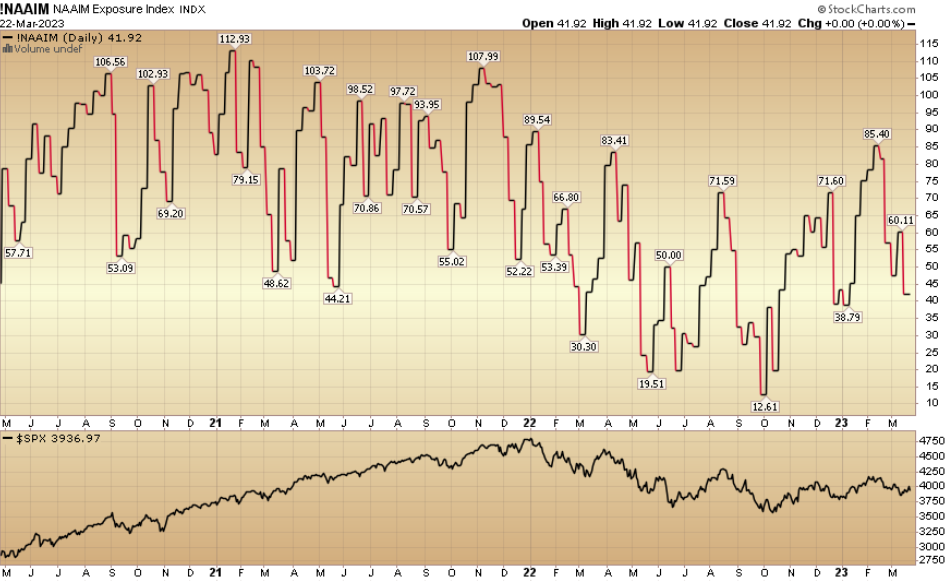

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 41.92% this week from 60.11% equity exposure last week.

More By This Author:

Deja Vu Not All Over Again – Stock Market (And Sentiment Results)

“Barbarians At The Gate” Stock Market (And Sentiment Results)

The Ferruccio Lamborghini Stock Market (And Sentiment Results)

Disclosure: Not investment advice. Visit Terms at HedgeFundTips.com