How Did The FOMC Minutes Change The Market's Perception Of Fed Policy?

The Fed has posted minutes of the FOMC meeting on May 2-3. Let's take a look how the Fed Funds Futures reacted to the minutes.

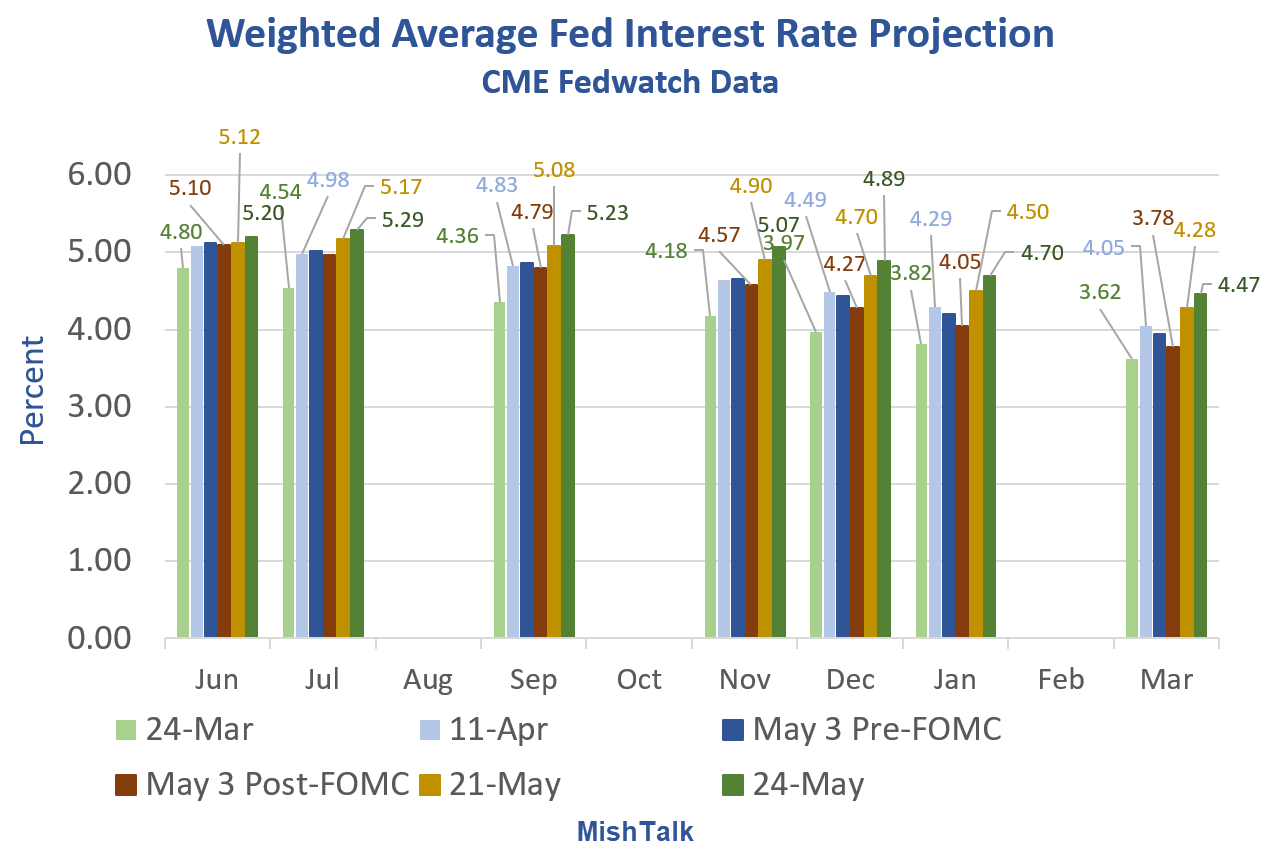

(Click on image to enlarge)

Data from CME Fedwatch, calculations by Mish.

I had one data error in my previous chart. I had a weighted average of 5.38 percent for July on May 31. The correct number is 5.17 percent.

Following the Minutes of the Federal Open Market Committee May 2–3, 2023, the market got some of the Fed's message of higher for longer.

Here is the key sentence from the minutes: "Respondents expected the peak rate to be maintained through the January 2024 FOMC meeting."

The reaction is very noticeable from December on into next year.

The overall net change from the May 3 post-FOMC Q&A meeting with the press to the release of the May 3 minutes is even more dramatic.

For example, looking ahead to March of 2024, the weighted average expectation rose from 3.78 percent to 4.47 percent. That's nearly three, quarter-point cuts that have been priced out.

The terminal rate changed by less than a quarter-point. It now fluctuates very little through November.

But the market still sees rate cuts starting in December and roughly a quarter-point cut at three consecutive meeting.

For discussion of six key takeaways from the minutes, please see Fed Minutes Include Expectation of No Rate Cuts Through January 2024

More By This Author:

Fed Minutes Include Expectation Of No Rate Cuts Through January 2024

A Groundhog Day New Home Sales Report With More Massive Revisions

Home Prices Drop The Most In Eleven Years, New Listings Plunge