Hold Off The Big Christmas Splurge, Bargains Will Be Better Later

Christmas season rates to be dismal according to shipping analysis. And the economy is iffier than most think. Hold off on early sales, or better yet, just say no to a Christmas splurge.

The Wall Street Journal has some interesting thoughts on holiday sales this year partially based on import and rail traffic.

Please consider Five Economic Signs You’re Smart to Procrastinate on Holiday Shopping This Year

Early signs—from the number of boxes loaded on railway cars to rising consumer debt—signal a weaker holiday season than the past three, when pent-up demand coming out of the worst of the pandemic sparked shoppers’ spending.

“This holiday will be late breaking and heavily deal reliant,” Chris Cocks, the chief executive of toy maker Hasbro, which makes such wish-list staples as My Little Pony, Nerf blasters and Transformers, told analysts recently.

The National Retail Federation expects overall sales increases could be in line with the slower pace we saw in the decade leading up to the pandemic, from 2010 to 2019, when the average annual increase over that period was 3.6%. It expects November-December spending, not including inflation, to rise 3% to 4%. By contrast, sales rose 5.4% in 2022, 12.7% in 2021 and 9.1% in 2020.

Others are even gloomier. Some economic and company forecasts call for almost no growth in holiday spending this year, particularly when inflation is stripped out. The consulting firm Bain expects inflation-adjusted retail sales in November and December for stores and e-commerce to rise 1%, the slowest pace since the financial-crisis holidays of 2008.

Shoppers can look forward to more discounts as Christmas approaches, predicts Jordan Voloshin, CEO of the upscale chain of cookwares stores Sur La Table. “October was very soft,” he said. He expects sales will be concentrated on a few big days of discounting like Black Friday and the Saturday before Christmas.

Many businesses are planning for a ho-hum holiday season by importing less stuff. U.S. imports of TVs and computer monitors, footwear and toys—including games and sports equipment—fell 20% or more in the nine months through September, compared with the same period a year earlier, according to the Census Bureau. Bicycle imports are down 41%, and smartphones declined 16%.

Railroad loads look light

Railroad operators said they are receiving fewer loads from ports to haul inland. United Parcel Service and FedEx have also reported lower revenues this year as consumers spend more on travel and services rather than on goods. FedEx executives said in a recent earnings call that they expect domestic parcel volumes this year to be down 25%, lower than what they had previously anticipated.

The decline in imports shows how business is reverting to prepandemic levels after the buying surges in 2021 and 2022.

Five Things

- Railroads and Imports Look Light

- Stockroom Cupboards Are Still Full

- Fewer Holiday Job Openings

- Consumers’ Cash Crunch

- Bargain Hunters Have Time

Christmas is on a Monday giving last minute shoppers a last minute weekend.

Fewer Holiday Job Openings

Point three by the WSJ caught my attention. I created the following chart to verify.

The three holiday related categories are Retail Trade, Professional and Business Services, and Trucking/Shipping

Unfortunately the BLS does not have either trucking or shipping as a category. It does have warehousing but for some reason it combines that with utilities so I ignored that as flawed.

Retail trade openings are now 674,000. That is 81,000 below the pre-pandemic total of 755,000.

Job Openings in Thousands

If you want a job at a restaurant, cleaning hotels, or taking care of the sick and elderly, you are in luck.

Cash Crunch

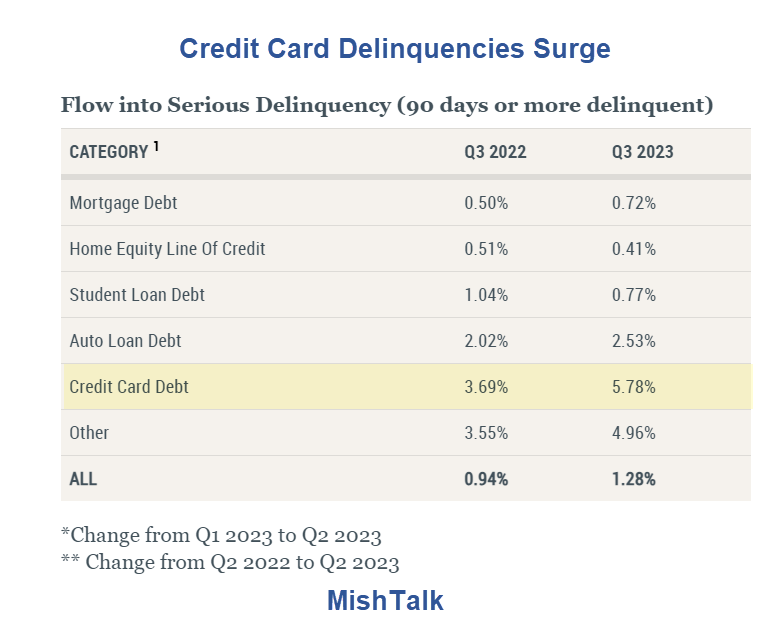

On November 8, I commented on the cash crunch in Credit Card Delinquencies Surge as Consumer Debt Tops $17 Trillion

“The continued rise in credit card delinquency rates is broad based across area income and region, but particularly pronounced among millennials and those with auto loans or student loans,” said Donghoon Lee, Economic Research Advisor at the New York Fed.

More By This Author:

Despite Subsidies, The Supply Chain For Electric Cars Is Still Mostly ChineseFormer ECB President Mario Draghi Discusses The Death Of The Eurozone

Credit Card Delinquencies Surge As Consumer Debt Tops $17 Trillion

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more