Hauser's Law & The Federal Budget Deficit

On a rolling 12-month basis, the federal budget deficit hit a peak of almost $1.5 trillion in February 2010. From that dizzying height of just over 10% of GDP it fell steadily for six years, hitting a low of $402 billion last February, a mere 2.3% of GDP. It's unlikely to get any lower than that, unfortunately, unless and until we see stronger economic growth and/or significant reform to entitlement programs. For the foreseeable future, the budget deficit is likely to get bigger; it's already jumped to just over $500 billion as of last month. There are several culprits: weaker economic growth, weaker tax collections, and a pickup in spending.

Written by Scott Grannis (scottgrannis.blogspot.ca)

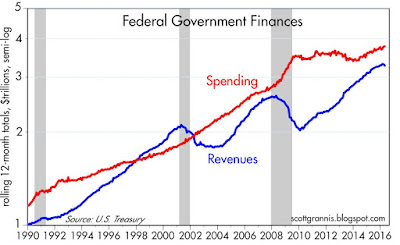

The chart below shows the nominal level of federal spending and revenues on a rolling 12-month basis. Note that spending was flat from mid-2009 through last year, but is now on a clear uptrend. At the same time, it appears that the strong uptrend in tax revenues, from early 2010 through early last year, is fizzling out. Two virtuous trends have reversed.

The chart below shows the level of federal spending and revenues as a percent of GDP. Note how both have been trendless over long periods.

It's time for policymakers to revisit Hauser's Law: there is a limit to how much tax revenue can be extracted from the private sector, and we are now approaching that limit. Tax rates have risen in the past year or so, but tax collections have weakened. Raising taxes—as both Clinton and Sanders are proposing—will almost surely fail to close our current and projected budget gap, because higher rates will discourage work and investment, while encouraging more tax evasion.

As the chart below shows, the weakness in tax collections is concentrated in individual and corporate income tax collections—both of which are driven by weaker profits—while payroll tax collections are rising at a 4% rate that is commensurate with the ongoing rise in payrolls and wages.

...There's nothing necessarily scary...[in the two charts] below, since it will be awhile before the deficit rises meaningfully relative to GDP, but the larger message is that the budget deficit is going to be returning to the headlines before too long.

The nominal level of federal budget surpluses and deficits

The level as a % of GDP

Summary

Politicians who fail to understand Hauser's Law will mistakenly call for a fix in the form of higher tax rates. The correct fix, of course, would be to reduce tax rates, simplify the tax code, and reform entitlement programs in order to keep spending under control.

This article may have been edited ([ ]), abridged (...) and/or reformatted (structure, title/subtitles, font) by the editorial team of munKNEE.com (Your Key to Making Money!) to provide a faster ...

moreComments

No Thumbs up yet!

No Thumbs up yet!