Gulag Capitalism

Bill Bonner, reckoning today from Buenos Aires, Argentina...

What’s wrong with capitalism? What’s wrong with the US economy? Why isn’t it making people richer?

News flash from The Telegraph:

All Western economies are now facing the consequences of two decades of fundamental economic mistakes. Interest rates are the warning sign. They are far too low for a free market economy.

Capitalism, left alone, generally does make people better off. If it’s more money they want, they work for it…and get it. If it’s more leisure that they really care about…they can get that too. More hula hoops? More Bud Light? More diversity officers? Well…that’s where the story becomes more complicated.

In a capitalist system, people get ‘money’ by providing goods and services to other people. Then, they use their money to ‘vote’ for what they want. Naturally, if it is rocking chairs they want…capitalists deliver them. The whole ‘system,’ if you can call it that, intends to satisfy the wants and needs of “The People.”

Who Wants What?

This is not to say that everyone gets what he wants. People make mistakes. They make bad choices. They develop bad habits. So, what they actually get is not exactly what they want, but what they deserve.

But what about diversity officers? Who wants them? Why do we have them? Who votes for them?

It turns out that there are people who want you to spend money on what they want, rather than what you want.

Nobody wants a tax accountant. But the elite who run the government have made sure that you need one.

Who wanted to spend an estimated $100,000 per household so the Pentagon could lose a 20-year war in the Middle East? Who wants to pay for an anti-drug policy that doesn’t work? Who wants to send money to the Ukraine, where hundreds of millions are skimmed off by the corrupt elite? Who wants to pay for more regulators to tell them what to do?

And if you look at the entire federal budget – OMG, who wants that? This year, the feds will spend nearly $6 trillion. So far, half way into the year, which begins in October, the deficit has hit a record. Fox:

Federal budget deficit hits $1.1 trillion in first half of fiscal 2023, $430 billion higher than last year

Government spending was 13% higher so far this year compared to 2022, while revenues dropped 3%, the CBO said.

Incalculable Costs

In other words, the feds are spending about $5 for every $4 in revenue. The excess gets remembered as debt, now almost $32 trillion. That’s about $400,000 per household, which will most likely get ‘paid’ in the form of consumer price inflation.

And what half-wit would want to save money, and then lend it to a bank or the government at a lower rate than inflation? But that’s what everyone was forced to do for more than an entire decade. And even now, after more than a year of ‘going back to normal,’ the inflation-adjusted key rate is still almost 2% below the CPI.

This last point is an important one. Because the cost is incalculable. The price of money is the most important information in the whole system. And if it is distorted…and untrue…everything begins to warp and wobble.

The cost of money (interest rates) tells us where to invest…and where not to. If the interest rate is 5% a project must deliver 6% or 7% just to breakeven. Any less than that destroys capital.

But put the interest rate at NEGATIVE 2%...and where do you invest? You don’t know. Could you borrow money, buy gold, bury it in the ground and then just wait until you could repay your loan at pennies on the dollar? Maybe. Long term investing requires faithful numbers. And all the numbers are fishy. Better to take the money now – in dividends…or higher stock prices. Or speculate – it costs nothing to borrow…so why not take a chance?

Gulag Capitalism

The result is a fall-off in the kind of real investment that the economy needs. Production slumps. Productivity slides. Real growth and real prosperity disappear.

Adjusted for inflation, real wages just went down for the 24th month in a row.

Real GDP growth is only half the average of the 63 years from 1954 to 2017.

As we calculated last week, it now takes the average worker three times as much time on the job to buy the average house as it did in 1971.

And, oh yes…there’s a building boom going on. New houses are now being put up at the same rate as 1978. This is reported as good news, but now we have 100 million more people in the US than we did in the 70s.

What’s wrong with capitalism? The answer is very simple: nothing.

Capitalism does its best. Even in Soviet Gulags, capitalism continued, as prisoners exchanged food and clothing. Wherever they are, people try to produce things that other people want…and to trade with them for the things they want.

The Fed’s phony interest rates did not stop capitalism. Nor did $31 trillion federal debt – almost all of it squandered on wars, stimmies, and boondoggles. But they made it much harder for people to get what they really wanted.

Joel’s Note

Yesterday we mentioned the stagnation in real (that is, adjusted for inflation) wages. American workers have essentially gone nowhere in over a generation… and for the past couple of years, virtually the entire Biden administration, wages have actually gone backwards when measured against rising prices.

That alone would be bad enough. But as we know, the state never saw a wound it didn’t feel the sadistic urge to rub salt into. Have a look at the average “price of money” down the line and you’ll see what we mean.

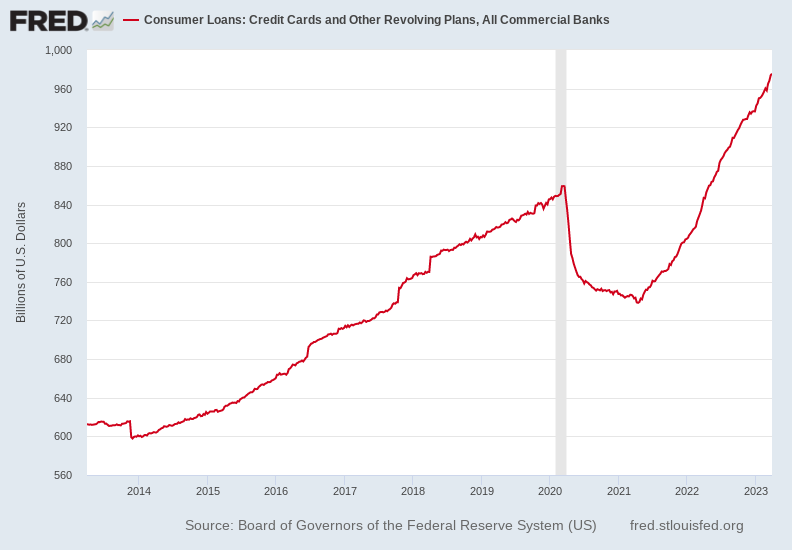

In an effort to keep their heads above water, working Americans have been smashing the plastic of late… to the tune of almost a trillion dollars. Our macro man up in Laramie, Dan Denning, sent over this rather fugly chart, courtesy of the Fed’s Board of Governors…

(Click on image to enlarge)

(Source: Board of Governors of the Federal Reserve System/FRED.stlouisfed.com)

As you can see, the chart shows the explosion in outstanding credit card loans (and other revolving plans) beginning in mid-2021… and then really taking off during the “recession-that-wasn’t-technically-a-recession,” in the back half of 2022.

Of particular note here is the fact that, according to the latest Forbes Advisor’s weekly credit card rates report, the average credit card interest rate in the US is… wait for it… a decidedly non-trivial 24.20%.

Unsurprisingly, after a significant uptick in Q4, 2022, credit card delinquencies are expected to see a sharp rise through 2023. TransUnion expects serious delinquencies – usually defined as being more than 30 to 90 days in arrears – to rise from 2.1 to 2.6%, the highest they’ve been since 2010. Delinquency rates on personal loans are also expected to track a similar path.

But unlike crony banksters, for whom money is cheap, plentiful and practically failure free, honest workers cannot simply declare insolvency and be “made whole” by their buddies/paymasters inside the beltway. As usual, it’s rule for thee… and not for the SOBs.

Call it what you will, Messrs. Sanders, Stewart, Edwards et al. Just don’t call it “capitalism.”

More By This Author:

Middle Class Blues

A Shock to the System

The 'Stealth Pivot'