Gold, The Tried-and-True Inflation Hedge For What’s Coming!

Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the horizon as vaccine roll-out plans are being implemented. Many governments continue to aim for herd immunity by autumn of this year.

Massive fiscal and monetary stimulus has been pumped into economies around the world to help ease the economic devastation for both individuals and businesses. Building on hope for herd immunity being reached and restrictions being lifted towards yearend, the question arises: Is CPI inflation on the horizon?

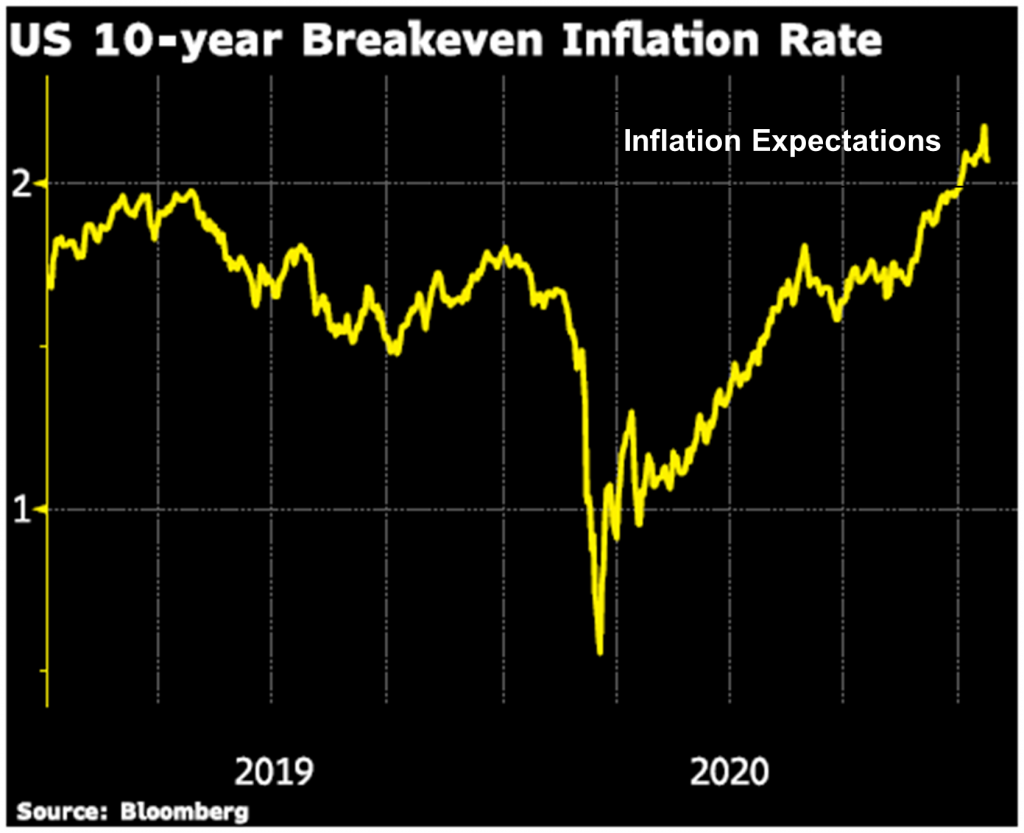

Central banks are generally forecasting inflation to be in the range of their 2% targets for the next several years, and although, inflation expectations have risen sharply since the March 2020 low, they are still not out of line to pre-coronavirus levels.

Below are four reasons that we expect higher inflation over the next several years.

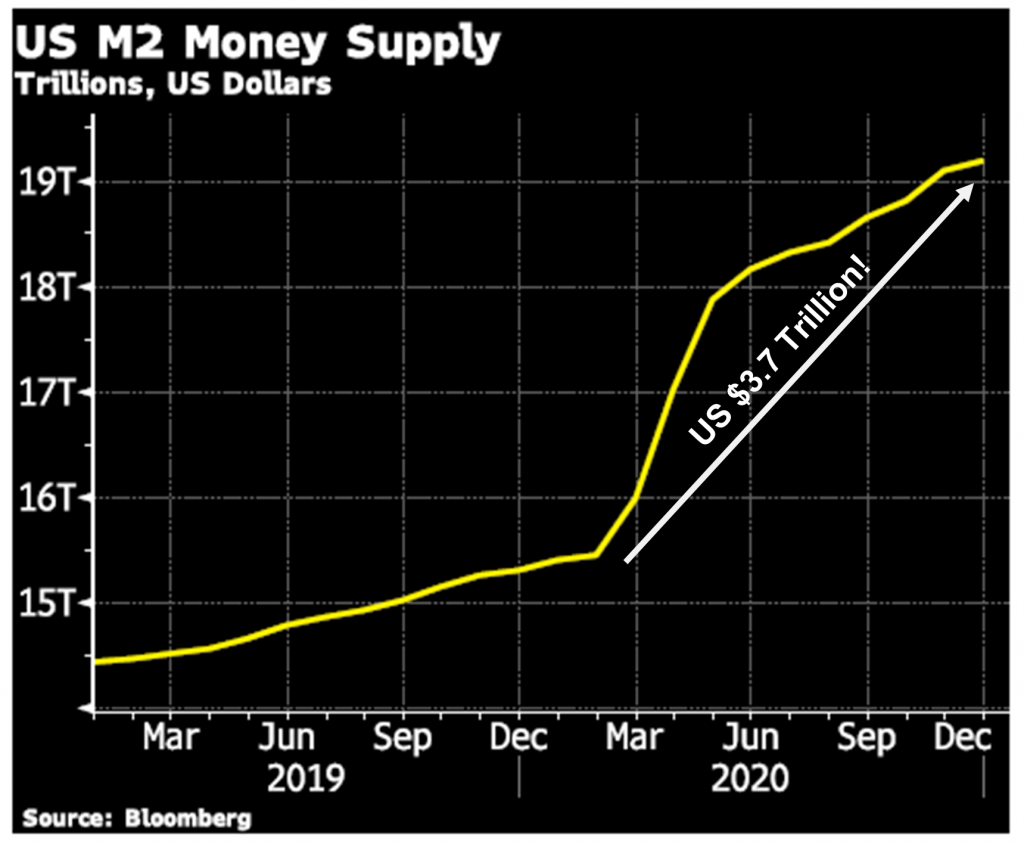

- Money Supplies have risen dramatically. Central bank asset purchase programs are rapidly increasing money supplies. For example, US M2 measure of money supply (includes currency in circulation, current accounts, savings deposits, small-denomination time deposits and retail money market funds) increased more than US$3.7 trillion (almost 25%) in 2020.In the Eurozone, this measure climbed by US$2.6 trillion and in the UK by almost US$600 billion – just those three equate to US$7 trillion in additional money sloshing around. To be sure, much of this money has been put into assets, i.e. equity markets and houses. Hence, record high equity markets, and soaring house prices, despite the coronavirus-induced economic downturn. This asset price inflation will be followed by general price inflation.

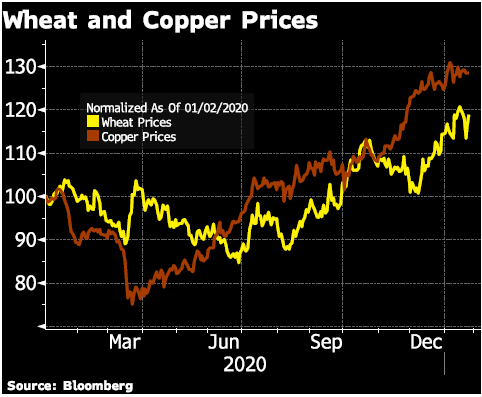

- Commodity prices are rising again. Rising commodity prices feed into higher inflation, especially key industrial commodities such as copper (+35% over the last year) and natural gas (+41%). Key construction commodity prices, such as lumber prices (+103%) have skyrocketed. Commodity food prices have also increased dramatically, wheat prices (+15%), and corn prices (+31%) for example. Although, some of this increase is transitory, part is due to ongoing supply constraints.

- Reduced Globalization as ‘Made at Home’ policies are proliferating. Cheaper foreign goods are being substituted with more expensive domestic goods. Many government procurement agencies have been instructed to use resources and products produced in their own countries and some governments are offering incentives for increased purchases of domestic goods and services by businesses. These ‘Made at Home’ policies are pro-domestic labor but are generally more expensive. Although, the Biden administration will go about his trade policy in a much more politically correct way, the Administration will still promote Made in America policies and fair-trade practices for its trading partners.

- Pent up demand. Price pressures will build in specific sectors of the economy after restrictions are lifted. A survey conducted by the New York Fed in October states that 36% of households surveyed saved their stimulus cheques and 45% said that they would save the second stimulus cheque. The US personal savings rate, although down from its massive peak in April, shows that households still had more than US$1 trillion in personal savings in November (latest date data is available) than at the beginning of 2020. This additional savings is on top of the US$1.2 trillion in reduced credit card debt. Oh, and don’t forget the increase in asset prices also increases household spending ability. There is also pent-up demand from businesses, both in re-opening shuttered operations due to restrictions, or expanding operations once supply chains re-open.

Some have compared the re-opening of the economy to the roaring 1920s – the new age of economic prosperity and spending. Three things are needed for consumer price inflation to take hold: too much money, chasing, to few goods. Currently, the only piece missing is the chasing – and once the vaccine reaches a significant majority of the population chasing of goods and services is likely to gain momentum – and demand will outstrip supply in key sectors of the economy. Part of it, will of course be temporary, but part of it is growth of a new economy with reduced global trade and increase emphasis on made at home products. In the coming new age of spending and inflation – gold is a tried-and-true inflation hedge!

Have You Seen this Must-See Inflation Episode of GoldCore TV – Watch it Now

We leave the reader with a quote from Milton Friedman to ponder…

“Central bankers always try to avoid their last big mistake. So, every time there’s the threat of a contraction in the economy, they’ll over stimulate the economy, by printing too much money. The result will be a rising roller coaster of inflation, with each high and low being higher than the preceding one”

Disclosure: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation ...

more

Copper will follow Lumber from 2020....Spot Copper IMO at some point(the months ahead 2021) as infrastructure ramps up to rebuild economies...will be here, then absolutely there will absolutely NONE and spot price of Copper will spike above $6.00USD/lb. that is a huge number....inflation will bust out, then then debt of World starts to break...$19 Trillion and counting thx to COVID, who is going repay any and/or all of this debt.

Gold will benefit....