From Slowdown To Crisis. Liquidity And Low Rates, Wrong Solutions For The Wrong Diagnosis

The recent macroeconomic data of the leading economies point to a widespread slowdown. What is more concerning is not just a logical moderation in the path of growth, but the acceleration in the weakening of economies that were supposed to be stronger and healthier. It is even more concerning that this aggressive worsening of key leading indicators in China, the EU, and most emerging economies happens at the peak of the largest monetary and fiscal stimulus in decades.

It is easy to blame this widespread weakening on political headlines, trade wars, and -of course-Trump, but it would be disingenuous to believe those are the real factors behind the negative economic surprise.

The pace of global recoveries since 1975 has been slower and weaker, consistently, according to the OECD. Recoveries take longer and happen slower. At the same time, periods of crisis are less aggressive albeit more frequent than prior to 1975. Another interesting evidence of the crises and recoveries since 1975 is that almost all economies end the recession period with more debt than before.

These factors are all concerning, but the evidence also shows that economic progress has continued regardless and that the main factors of wellbeing have improved dramatically. I had the opportunity of meeting Johan Norberg, author of “Progress” and we discussed all the positive elements we have seen in the past decades. In the same period, from 1975 to 2018, extreme poverty has been reduced to all-time lows. Hunger, poverty, illiteracy, child mortality… all those terrible problems have been dramatically reduced to the lowest levels in history. That is the positive.

However, recognizing the positive is important, but ignoring the risks is dangerous. Global debt has ballooned to all-time highs, more than three times the world GDP. For those elements of progress to continue improving, we must stop the race of perverse incentives created by the wrong analysis of the origin of crises and the solutions that are often proposed in mainstream economics and politics. I agree with Johan Norberg that the two main factors that have driven the phenomenal progress we have seen are free markets and openness. The freedom to innovate, experiment, create and share must come with the right incentives.

For decades, governments and central banks have always identified the problems of the economy as demand problems, even if it was not the case. If there was a crisis or a recession, governments immediately believed that it must be due to lack of demand, and subsequently decide that the private sector is not willing or able to fulfill the real demand needs of the economy, even if there was no real evidence that companies or citizens were investing or consuming less than what they needed. The entire premise was that companies were not investing “enough”. Compared to what and decide by whom?Obviously by central planners who benefit from bubbles and overcapacity but never suffer the consequences.

Governments and central banks never perceive risks of excess supply and even less predict a bubble. Why? Because most central planners see debt, oversupply, and bubbles as small collateral damages of a greater good: recover growth at any cost.

Behind the mistake in diagnosis is the obsession to maintain or grow Gross Domestic Product (GDP) at any cost. GDP is relatively easy to inflate. I always explain to my students that GDP is the only economic calculation in which you add what you spend with what you earn. GDP can be inflated through government spending and with higher debt-fueled expenditures. Debt is not a problem when it serves its purpose, which is to finance productive investment and allow the economy to grow, while efficiency, innovation, and technology allow us to be more productive and receive more and better goods and services at cheaper prices. It is a virtuous cycle.

The virtuous cycle of credit turns into a vicious cycle of unproductive debt when we incentivize malinvestment and prevent technology substitution by implementing massive government stimuli and liquidity injections.

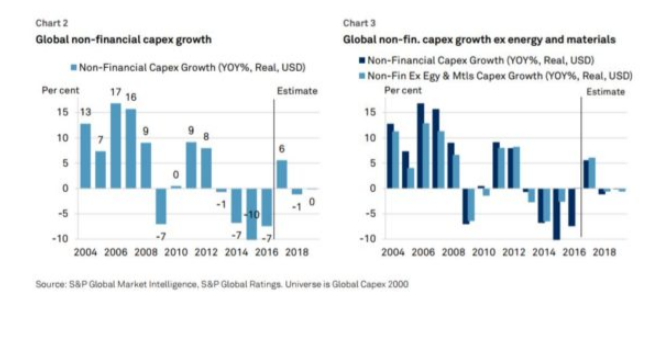

(Courtesy S&P)

Central banks justify their actions saying they do not cut rates, it is a market and private sector demand. Really? How and when did they survey that? What private sector? Crony or obsolescent companies? Highly indebted ones? Furthermore, if low rates and liquidity injections are a market demand, why not let the market set rates and liquidity instead of central banks?

Those same governments that feel the need to “increase inflation”, something that no consumer has demanded ever anywhere, do so because they benefit as the first recipients of newly created money and the only sector that truly benefits from inflation. Not even crony sectors fully benefit from inflation, the tax of the poor. Those suffer higher costs and import expenses.

By always making the same diagnosis, mistakes are repeated and accumulated. No wonder the pace of recoveries is slower, weaker and more indebted.

First, governments believe the problem is lack of demand and name themselves as the solution, using savers to finance it, via taxes and inflation. The best way to boost GDP? Massive white elephants, enormous infrastructure projects that generate a short-term boost to the spending side of GDP. Infrastructure is needed, of course, but the difference is when countries decide to use it as a subterfuge to disguise growth. Build anything at any cost. This leaves behind massive debt and a less dynamic, not stronger economy.

Second, demand-side policies perpetuate those sectors that are in process of obsolescence at the expense of savers, salaries and productive sectors. Governments will always subsidize and support the inefficient at the expense of the efficient because their objective is to maintain what they believe works and keeps jobs. It is not due to bad intentions or evil objectives, it is simply to perpetuate the past that they live off.

Third, massive liquidity injections and low rates are exactly the equivalents of indirect subsidies to the inefficient. The earliest recipients and most benefitted from “unconventional monetary policies” will, by definition, be the most indebted and least productive. This is why productivity growth and money velocity stall during periods of government-led monetary and fiscal excess.

Fourth, the benefits of the short and long-term credit cycle are broken. Creative destruction is all but eliminated, malinvestment is promoted via unsustainably low rates and liquidity is absorbed by financial assets and unproductive sectors.

Inflation does not rise as much as central planners want because technology and efficiency are unstoppable even if they try, and because overcapacity is perpetuated through constant re-financing. Massive liquidity and low rates make zombie companies soar. The percentage of companies that cannot pay interest expenses with operating profits balloons despite ultra-low rates and alleged “growth-boosting” plans.

For decades, demand-side policies showed diminishing but not lethal results, but now the world has repeated the same policies so many times that there is simply exhaustion. Rates are unsustainably low, liquidity is excessive and there is no real fiscal space in governments that have all but consumed their ability to extract wealth from savers.

The more we hear from governments that we need to spend more and save less, the weaker the response from economic agents.

Governments and central banks create a crisis from a moderate and completely healthy slowdown by denying economic cycles and, even worse, presenting themselves as the ones that will revert them.

The current global slowdown is not due to lack of stimuli, but the excess of them. When central planners decide to “correct” it, they create the seeds of the crisis. Malinvestment reaches unsustainable levels and bubbles burst, affecting all aspects of the real economy.

There is no evidence that companies or citizens are investing or consuming less than they need, it only happens in the mind of those that expect excel-spreadsheet-style results from demand-side policies in the real economy.

The global economy is close to recession, but a full-blown crisis is still unlikely. If central banks and governments present themselves, again, as the “solution”, they will create the next crisis.

Disclaimer: All opinions expressed in the books, interviews and articles by Daniel Lacalle are strictly personal and do not reflect the strategy or philosophy of any specific firm.

The Mises theory. Interesting. But without helicopter money creating demand, taking away stimulus is recessionary. Labor share of GDP does matter. Of course consumers in the USA are strapped, spending less than they need to spend. This is Mises' fatal flaw, not recognizing the weakness of the consumer across a broad section of the economy.