Forecast Traders Expect An Oct. 21 Reopening, But The Fed’s Weekly Economic Index Isn’t Suspended Tomorrow

Image Source: Pexels

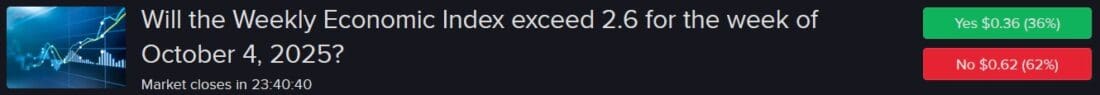

Tomorrow’s Weekly Economic Index from the Dallas Fed isn’t suspended due to the government shutdown because central banking activities aren’t subject to congressional funding. Meanwhile, the contract related to the week ended Oct. 4 included four days of the closure and my hunch is that conditions decelerated during that time span. In consideration of my 2.3 estimate, I like the risk-reward profile of the “No” answer at 2.6, priced at $0.62. Despite the previous figure of 2.4, 2.6 hasn’t been exceeded for nine consecutive weeks and I don’t envision that in this print. Additionally, I find the “Nos” from 2.8% up to 3.2%, which range from $0.87 to $0.96, undervalued.

Claims Were Due Tomorrow, But Are Suspended

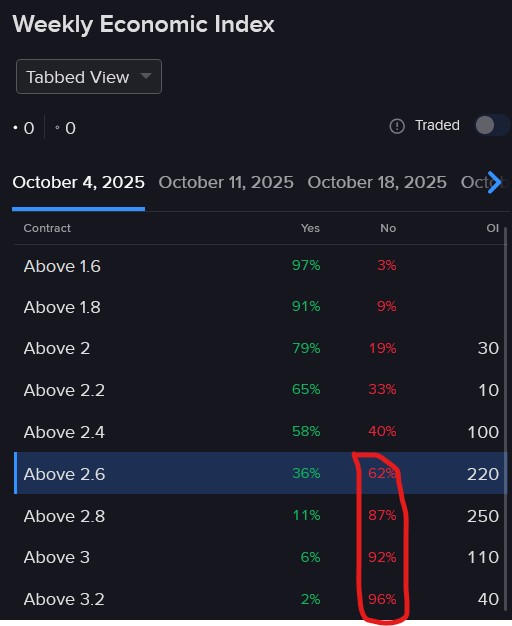

Initial unemployment claims won’t be released tomorrow due to the shutdown but I find the “Yes” at 220k undervalued at $0.65. In the past eight weeks of data, it’s only failed to exceed that level once. Meanwhile, signs of labor marker deceleration are evident, pointing to an increasing likelihood of “Team Yes” being correct here when the figure is published.

Forecast Traders Expect Shutdown to End Around October 21st

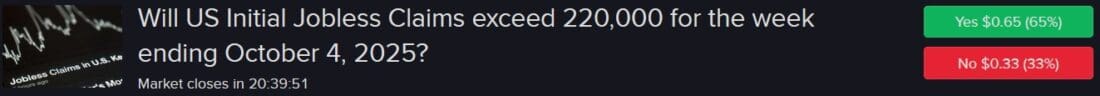

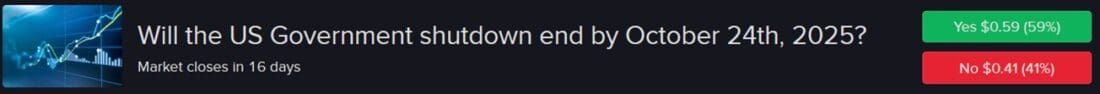

Current probabilities for the end of the government shutdown contracts on Oct. 17 and Oct. 24 are 37% and 59%, pointing to forecast traders expecting a reopening date around Oct. 21.

Source for images: ForecastEx

Note: Prices are highest bids as of the morning of October 8, 2025. Red circle around the thresholds was inserted by J. Torres to highlight his preferred “No” answers throughout different levels.

More By This Author:

Forecast Traders Expect A Miss In September Payrolls, Price In Continued Shutdown RiskTomorrow’s Forecast Trades For EU Unemployment, Fed’s Weekly Index

Should We Care About Another Shutdown?

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more