Food And Services Prices Drive Czech Inflation

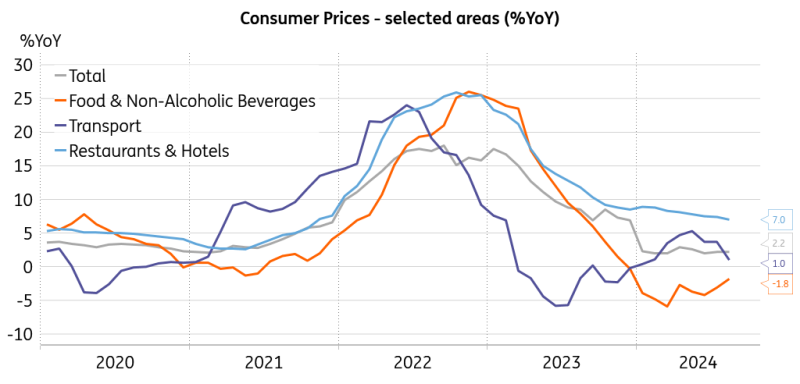

Annual consumer inflation in Czechia stalled at 2.2% in August, coming in stronger than markets expected. Price increases in the food and services segment were the main sources of the surprise. Still, the inflation print will likely not prevent a further reduction in policy rates later this month.

Headline inflation is close to the target, but service inflation flies high

Czech annual inflation remained unchanged at 2.2% in August, confounding market expectations for a return to the 2% target. Consumer prices rose by 0.3% month-on-month, mainly driven by higher prices in the alcoholic beverages, tobacco, and food sections. Considering the monthly dynamics in the food segment in August, price increases were mainly tangible for fish (4.1%), oils and fats (3.1%), and fruit (2.2%). Lower prices were recorded primarily in transport, where prices of fuel dropped by 2.2% and prices of cars by 0.7%. Prices of goods increased by 0.1%, while prices of services added 0.5% from a month earlier.

Prices in restaurants remained elevated

(Click on image to enlarge)

CZSO, Macrobond

Annual consumer inflation was considerably affected by food and fuel prices, with a softening decline in food prices and a renewed annual decline in fuel prices partially offsetting each other. Prices in the housing segment continued to significantly impact the overall annual price change in August, with a 6.6% increase in rents and a 10.9% increase in water charges. Prices of goods rose by 0.5% in aggregate, while prices of services added 5.0% from a year earlier.

Shortages of skilled labour can further feed into services prices

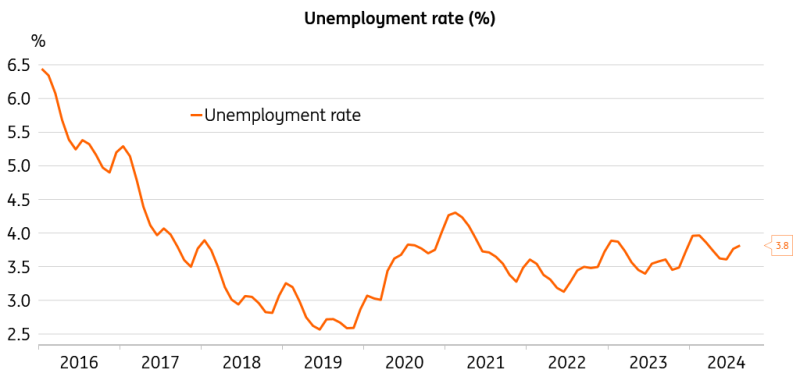

Annual core inflation has increased by 0.1 percentage points to 2.4%, as recorded in August, predominantly due to the items from the service segment. The persistence in the elevated price growth in services seems to be hard to break and could continue due to the impact of increasing wage costs. This linkage represents a recurring reason for the Czech National Bank's caution when it comes to rate cuts. Average nominal wage growth decelerated to 6.5% in the second quarter, sliding below the CNB estimate of a 7.2% annual wage increase. However, the labour market is still tight, as the unemployment rate remained unchanged at 3.8% in August, according to the Czech Ministry of Labour.

The unemployment rate is low, skilled labour is scarce resource

(Click on image to enlarge)

Ministry of Labor, Macrobond

Companies report a shortage of skilled employees and are ready to retain or hire an experienced workforce, accepting solid wage increases despite the uncertain growth outlook. This is confirmed by the lower median wage growth of 5.8%, with low-wage workers receiving a less buoyant wage rise. The average wage growth in the first half of this year was 6.9%, which is comparable to the 6.8% historical average recorded between 2016 and 2019 when the Czech economy was firing on all cylinders. That said, the CNB does not have to be afraid of an evolving wage-price spiral, though robust wages could keep services prices elevated for some time.

Uncertain growth prospects call for less restrictiveness

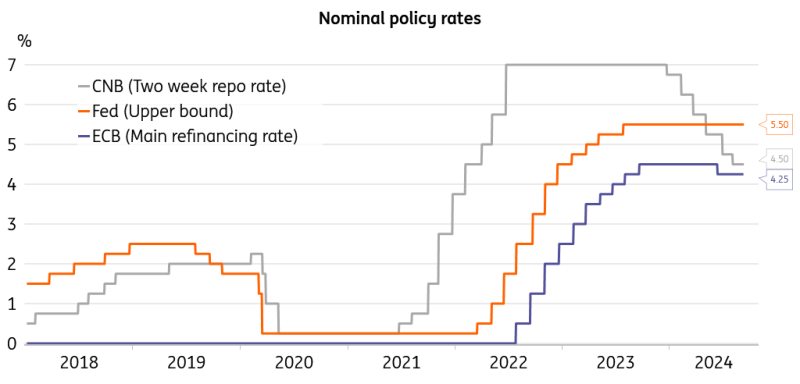

Steady consumer inflation supports the CNB’s hawkish tone and the Board’s call for caution. However, the monetary policy stance seems tight as measured by the elevated real interest rate of 2.3%, which seems to discourage the expansion of medium-sized firms along with the tepid foreign demand. Also, the lower Brent crude price, stronger koruna, and announced reductions of electricity and natural gas end-prices by major energy distributors will contribute to lower inflation pressures in the coming months. We see a 25bp cut at this month’s CNB meeting as the most likely outcome. A gentle cut would reduce the restrictiveness of monetary policy in light of weak foreign conditions and the performance of Czech industry, while still maintaining the leitmotiv of caution due to high retail sales and sustained price growth in the service sector.

Monetary easing fashion month

(Click on image to enlarge)

Macrobond

CNB policymakers will already know what the Federal Reserve and the European Central Bank have done with their main policy instruments and how these institutions think about the economic outlook and the adequate monetary policy setup. With only a gradual recovery in the eurozone and inflation close to the target, another rate reduction from the ECB side is highly likely. With the cooling US jobs market and inflation prints trending downwards, the Fed is also expected to cut rates at the September meeting. Dovish signals from the major players have to be taken into account by the CNB, as the interest rate differential is one of the crucial drivers for the domestic currency. Overall, the likely rate cuts by other major monetary institutions, the weaker data from abroad, the mediocre performance of Czech industry, and uncertainty about the recovery in the year ahead point toward reducing the current restrictiveness of the Czech monetary policy mix.

More By This Author:

Asia Morning Bites For Tuesday, September 10Improvement In Hungary’s Inflation Outlook

Asia Morning Bites For Tuesday, Sept 10

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more