Sunday, February 26, 2023 5:35 PM EST

Federal Reserve Bank of Cleveland leader Loretta Mester said it will take more tightening for the Fed to get inflation back to 2%.

Key comments

''Data shows inflation not yet on trend to get back sustainably to 2% target.''

''Strong inflation pressures are ‘still with us’.''

''Focus on 25bps versus 50bps misses bigger picture.''

''Will need to go above 5% funds rate, stay there for a while.''

''Needs to keep at rate hikes until inflation trend breaks lower.''

''Declines to say what size rate rises needed at March FOMC.''

''View on inflation and economy remain unchanged by latest data.''

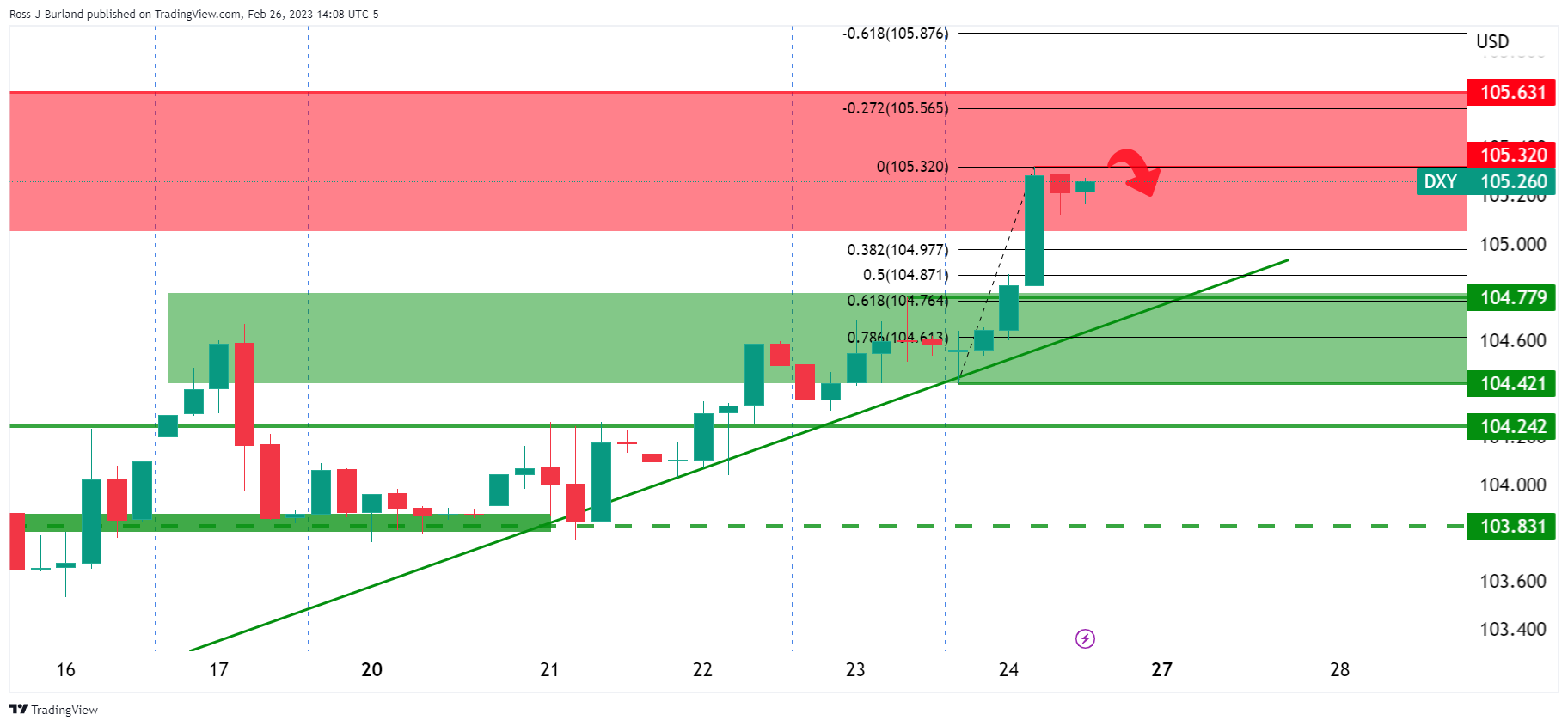

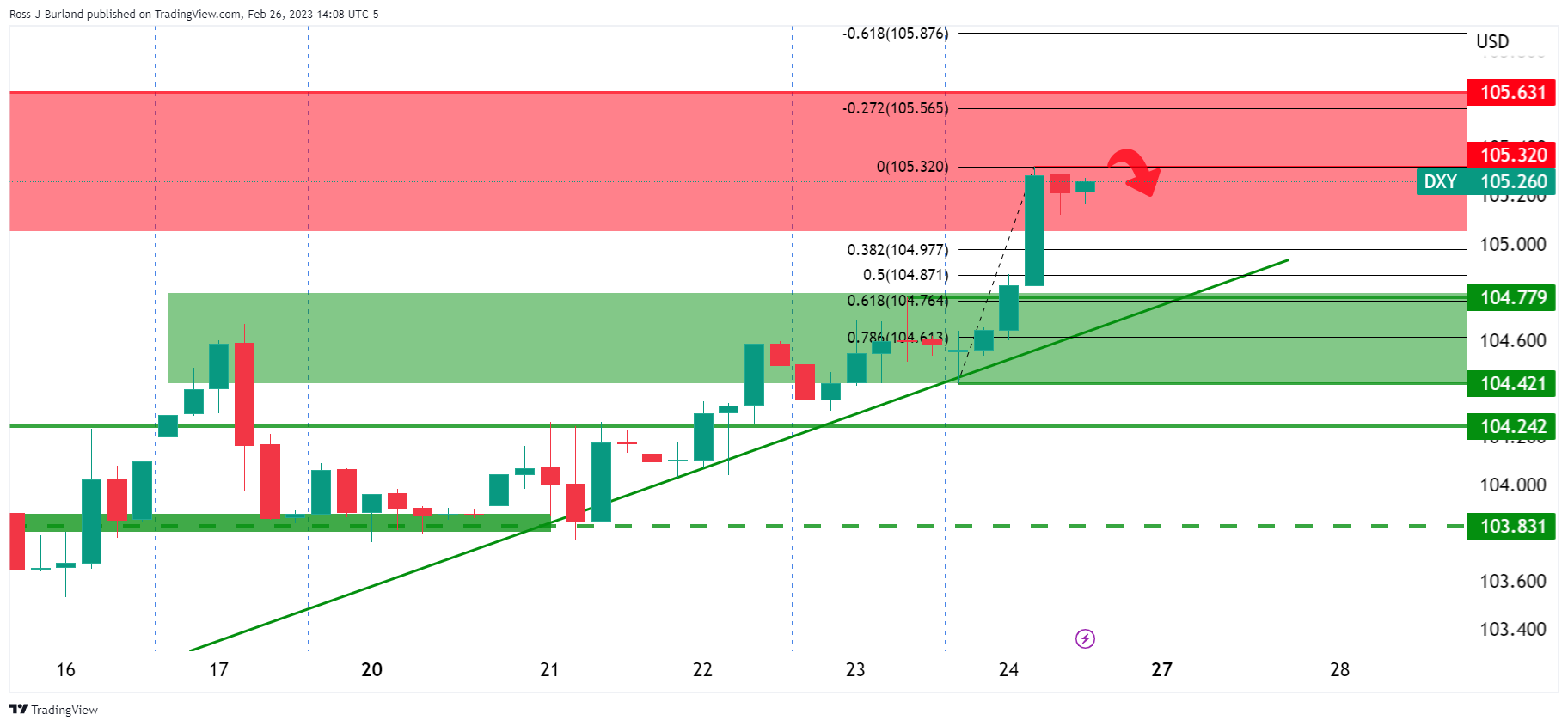

US Dollar update

The US Dollar climbed to seven-week peaks on Friday after data showed US inflation accelerated while consumer spending rebounded last month.

(Click on image to enlarge)

A correction could be on the cards for the days ahead.

More By This Author:

USD/JPY Climbs To Fresh 2023-High Above 136.00 USD/JPY Jumps Back Closer To YTD Top, Sits Above 135.00 Ahead Of US PCE Price Index USD/JPY Bears Are In Town And A Break Of 134.50 Is Eyed

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

less

How did you like this article? Let us know so we can better customize your reading experience.