Fed Warns "Soon To Be Appropriate" To Raise Rates, QE Ends In March

Since the last FOMC meeting, on December 15th, Gold is the lone asset-class that is higher while bonds and stocks have been monkey-hammered and the dollar is weaker...

(Click on image to enlarge)

Source: Bloomberg

All US equity markets are lower since the last Fed meeting with Tech/hyper-growth hammered and all the bubble-markets blowing up.

Financial Conditions have tightened significantly since the last Fed meeting (after easing dramatically into the Santa Claus rally)...

(Click on image to enlarge)

Source: Bloomberg

Rate-hike expectations have soared since the last Fed meeting too with March now fully priced-in and more than 4 hikes priced in by year-end. The last few days of market weakness prompted a dovish drop in rate-hike odds, but the last two days have seen it shift hawkishly once again...

(Click on image to enlarge)

Source: Bloomberg

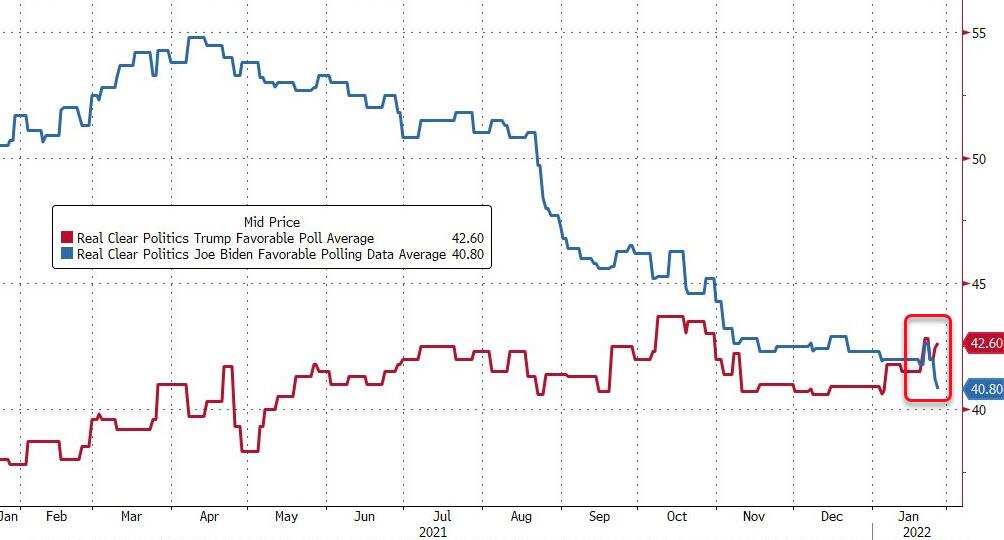

And before we get to The Fed's decision, there is also this chart to consider... President Biden's approval rating has crashed below that of Trump's...

Source: Bloomberg

We suspect the politicians will learn that lack of jobs is way worse for being reelected than inflation... and indirectly pressure The Fed (if they haven't already) to walk back the QT and rate-hike trajectory plans... at least until after November maybe.

So what did The Fed say/do...

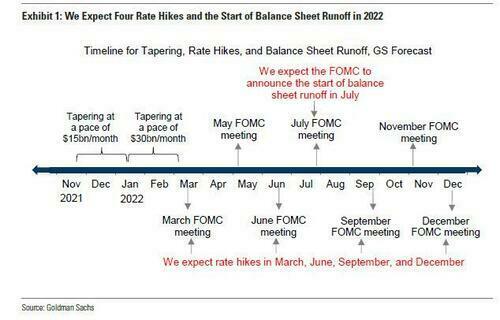

The market is pricing-in liftoff in March (followed immediately by QT) and four rate-hikes by year-end (just like The Fed's "Dots") - did Powell and his pals jawbone any of that hawkishly or dovishly today?

In a word: NO.

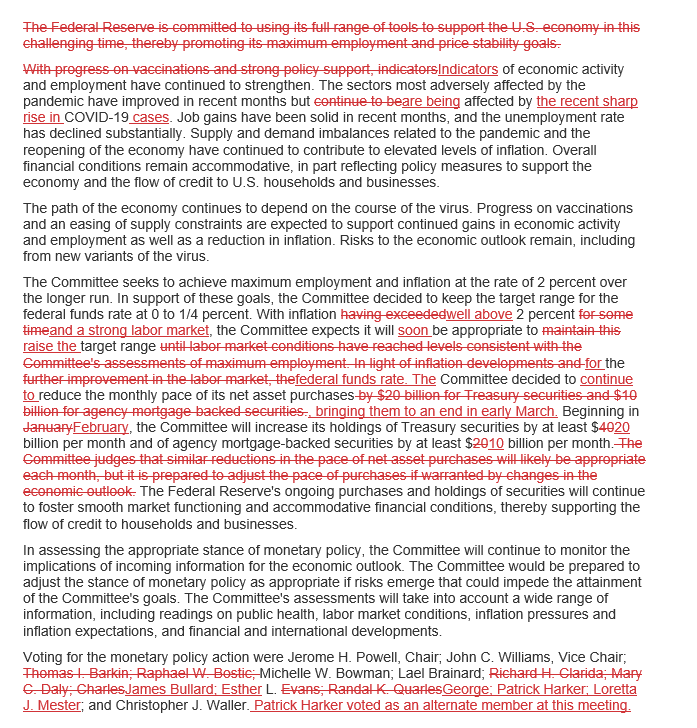

- The Fed says it "will soon be appropriate" to raise funds rate.

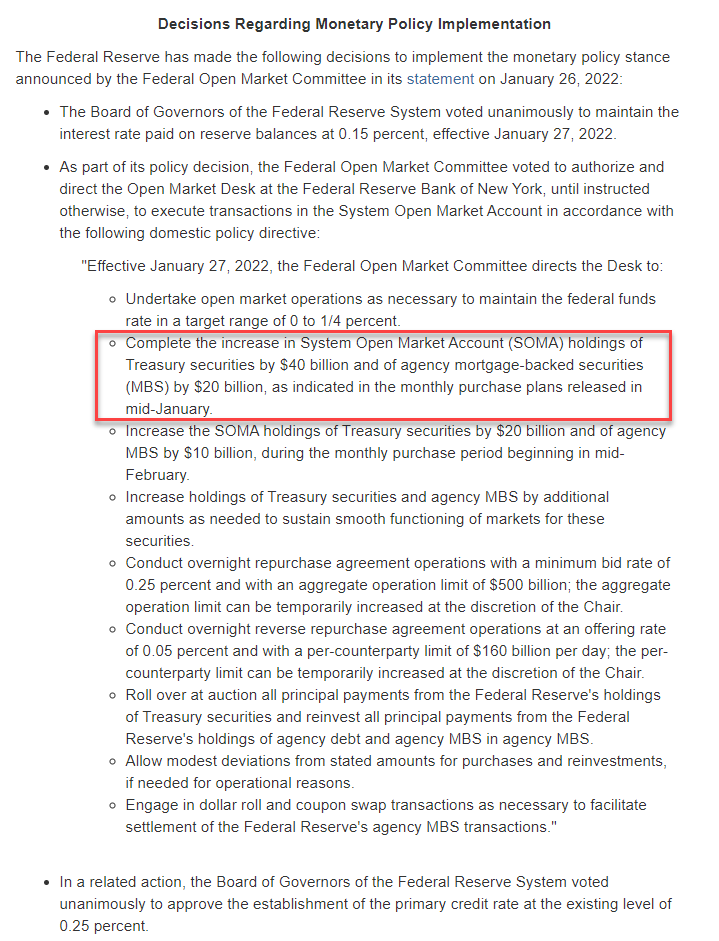

- The Fed says asset-purchases will end in March...

(Click on image to enlarge)

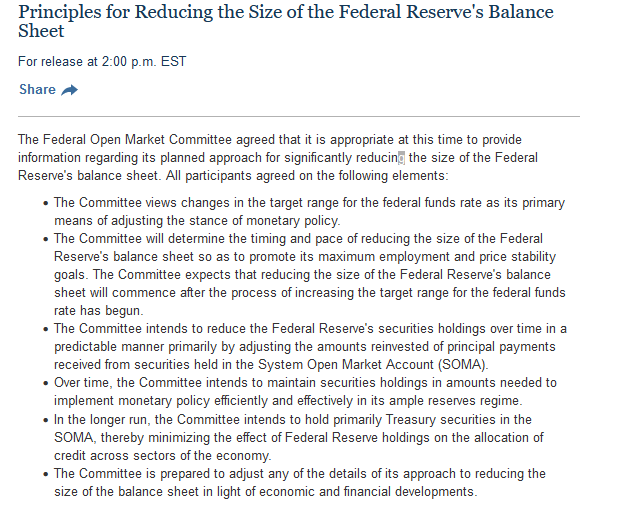

- And The Fed says that balance-sheet-shrinking (QT) will start after rate-hikes commence.

- The Fed intends primarily to hold Treasuries in the longer run.

-

Finally, The Fed believes, "overall financial conditions remain accommodative."

All of which means the timeline remains as follows:

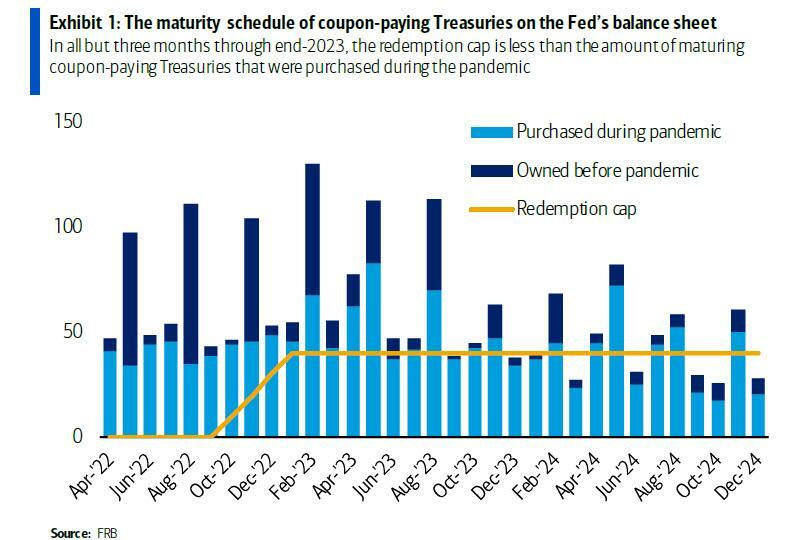

With the QT schematic forecast to be as follows (given the roll-off, roll-over plans):

(Click on image to enlarge)

Arguably the Fed was 'dovish' because it did not bring forward the end of QE or explicitly name a time for QT. Mohamed El-Erian is not happy that The Fed wasn't more hawkish...

.#Fed signals

— Mohamed A. El-Erian (@elerianm) January 26, 2022

Start of a hiking cycle "soon" (read March)

Asset purchases (QE) to end in early March

Nothing new on balance sheet reduction (QT)

Per my Monday @FT post:

It's what I expected but not what I think they should have done

Fed falls further behind economic developments

Danielle DiMartino Booth, CEO and chief strategist of Quill Intelligence and a former adviser to Richard Fisher, the former president of the Dallas Fed, says:

“The Fed’s biggest challenge is figuring out how to implement policy measures that are hawkish enough to lower inflation, but that also keep financial markets afloat, because volatility in financial markets may bleed into an economy that is already showing signs of slowing. The Fed is faced with choosing the lesser of two evils."

***

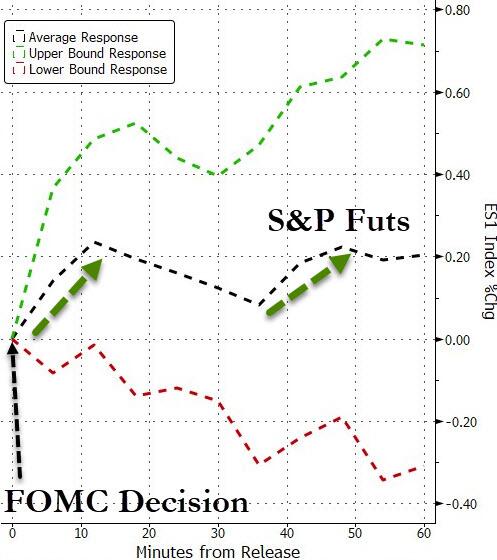

Of course, we know what the stock market will do... at least to start with anyway...

***

Read the full redline below:

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more