Fed Policy Deaf To Entrenched Disinflationary Readings

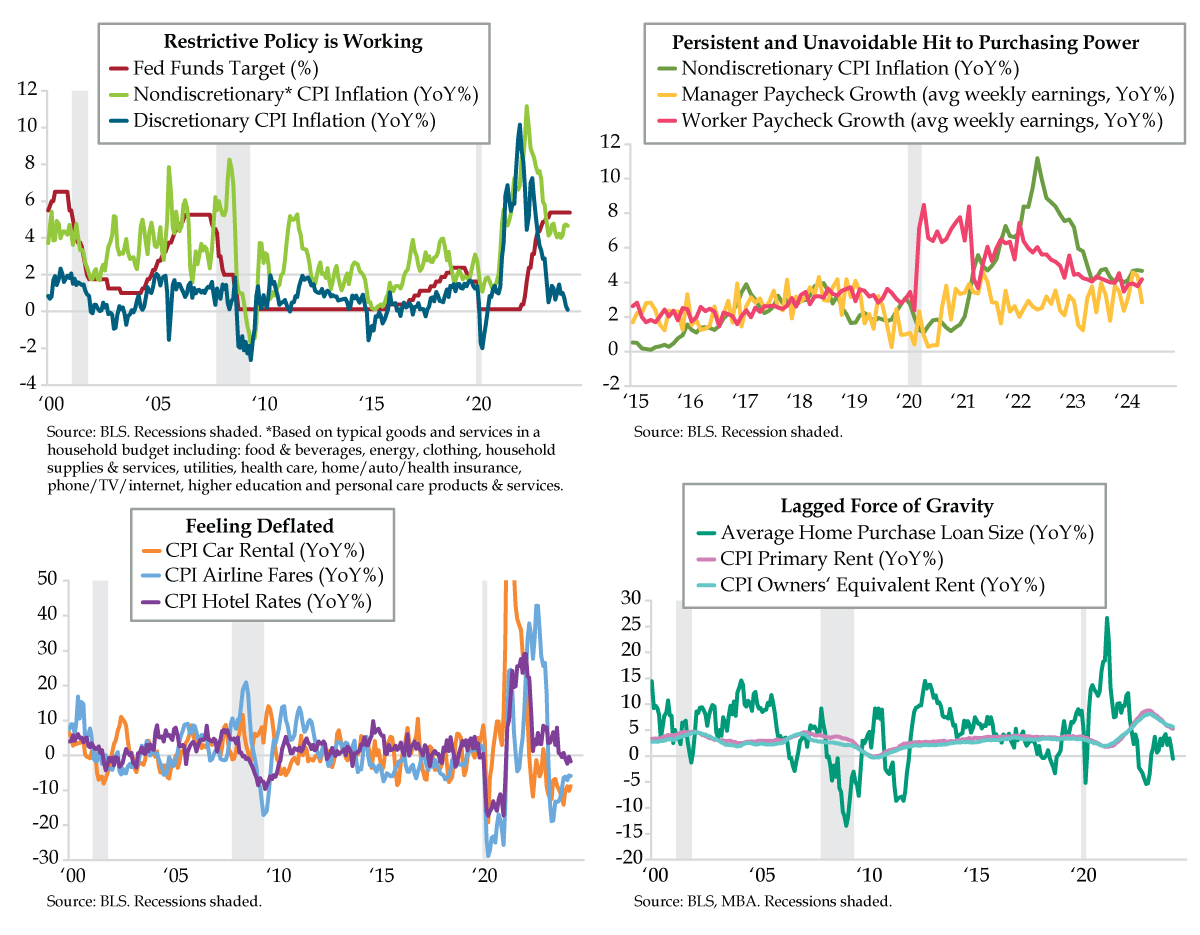

Lower-than-expected inflation initially priced the Fed’s first cut sooner. The fall in durable and discretionary inflation advertises the efficacy of the Fed’s tighter policy. Persistently high nondiscretionary inflation also has had a hand in cutting purchasing power and generating a drag on discretionary demand. Travel pricing has capitulated in 2024. Moreover, rental disinflation is well in train. Despite falling on deaf Fed officials’ ears, the inflation-unemployment convergence narrative continues to gain traction. Odds of a big Dot Plot backtrack in September are rising.

TAKEAWAYS

- Nondiscretionary inflation came in at 4.7% YoY in May vs. discretionary’s near-flat 0.1%; though nondiscretionary has eased from February 2022’s 10.1%, seen one month before Fed tightening began, it continues to outpace paycheck growth for both managers and workers

- Car rentals, airline fares, and hotel rates fell -8.8% YoY, -5.9% YoY, and -1.7% YoY, respectively, in May; notably, all three of these CPI gauges have seen deflation in five of the last six months, flagging a continued pullback in household willingness to spend on travel

- The MBA’s average home purchase loan size fell -0.5% YoY in April, the first negative print in 12 months; weakness in the MBA index suggests a continued gradual decline through 2024 is in store for the Primary Rent and Owners’ Equivalent Rent gauges in the CPI

More By This Author:

Why The U.S. Is Already In A RecessionHow An Eroding Job Market Could Cause Faster Rate Cuts

Economic Outlook - Breaking Down Recession Odds

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!