Every Time, Debt Ceiling Impacts Collateral Producing Inevitable Deflationary Currency

Last September 28, Treasury Secretary Janet Yellen wrote to Nancy Pelosi of the House of Representatives to inform its Speaker that the government would run out of cash, and accounting tricks, by October 18. Unless Congress, starting in the House, did something about the so-called debt ceiling, Treasury would be forced to take even more restrictive, potentially destructive means to stay legal.

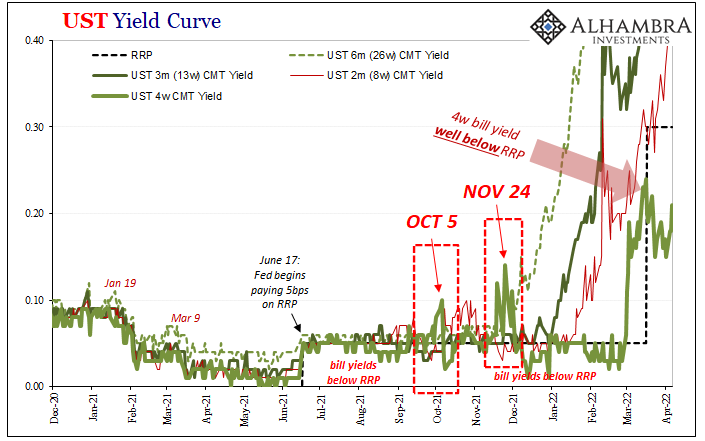

Yellen had already been scaling back T-bill issuance as one of those tricks, no different than any of her predecessors. Despite huge demand for bills – for other reasons, which I’ll get to – bill prices, therefore equivalent yields, would become wildly volatile in that first week of October. Money market funds, in particular, tend to become overly cautious, avoiding any bill maturities that might come close to a debt ceiling deadline for fear of technical default.

The day of Yellen’s letter, the 28th, the 4-week bill rate jumped to 7 bps then kept going all the way to 10 bp by October 5. These changes might at first seem inconsequential; what matter of a few bips here or there?

Yet, as we’ve seen repeatedly throughout post-GFC1 history, these kinds of debt-ceiling delusional episodes always happen right when the monetary system goes from reflation to the next pattern of deflationary currency. I’m not saying they cause the inflection, instead, they are an unnecessary reminder at inopportune times just how fragile the world’s reserve currency is and can be.

It happened in September 2017, very poignantly as perhaps the very first of what then became Euro$ #4.

Euro$ #3 had October 2013’s government shutdown to go along with that year’s drawn-out debt ceiling debacle. Eurodollar futures put the deflationary direction beginning September 2013, while the yield curve and CNY said just after by January 2014.

Before those, yep, 2011, too. Below an excerpt from the FOMC meeting in June of that year, just weeks before Euro$ #2 would become full-blown, very nearly GFC2.

MR. SACK. Some market observers are concerned that the looming debt ceiling is going to impose a substantial squeeze in the supply of Treasury bills, as the Treasury attempts to maintain its coupon issuance while its ability to borrow is limited. They believe that Treasury bill yields and GC repo rates could be driven negative in response, potentially inducing a number of unusual market issues.

Collateral, not interest rate, that’s what’s important here and bills are the best of the best of the best (of the best, at times). These debt ceiling incidents impose two problems where it comes to use as collateral: first by shortening supply, as Brian Sack alluded to and Yellen was doing by the time of her letter; then, second, once the actual ceiling draws closer, prices get volatile which repo dealers absolutely avoid.

Collateral scarcity can quickly transmute to shortage.

This is why they have often traded below an alternate rate like the Fed’s offer of RRP. Unless there was some specific, non-investment value in the instruments, as always-OTR collateral, no one ever would accept less than RRP (which, by the way, is the purpose of the RRP).

Bills do this frequently.

Before the final week of September 2021, that had been the case to a small but regular degree. But, as noted above, from there lasting into the middle of October the second part volatility.

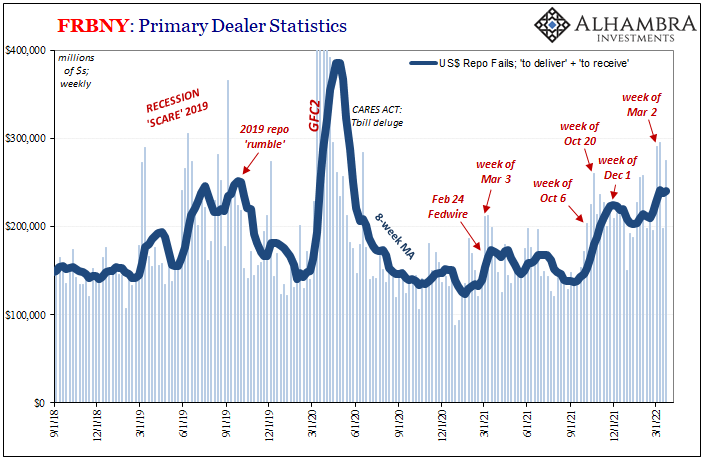

Once that happens, look at repo fails to jump, dealers start borrowing USTs from the Fed, and the rest quickly becomes deflationary currency history.

Congress would make a deal on October 12, but, as usual, by then the (monetary) damage done.

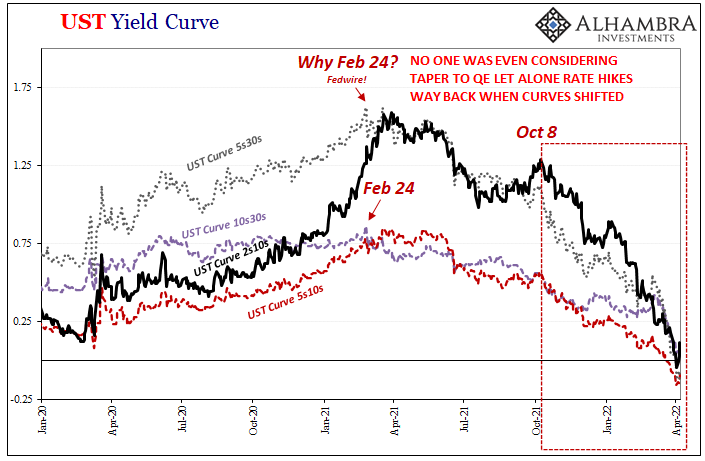

Ever since, the yield curve like the eurodollar futures curve would continue to seriously, doggedly flatten leading directly to our current situation where both are inverted to historically substantial levels.

October 8 the plainly obvious starting point for each of them; I highly doubt just random coincidence.

We have a long list of suspects for why curves had turned decidedly pessimistic right then. Inventory, real income, and most of all collateral. We can, and should, add the debt ceiling as part of the already-ironclad collateral case. History, too, sadly, is on that side.

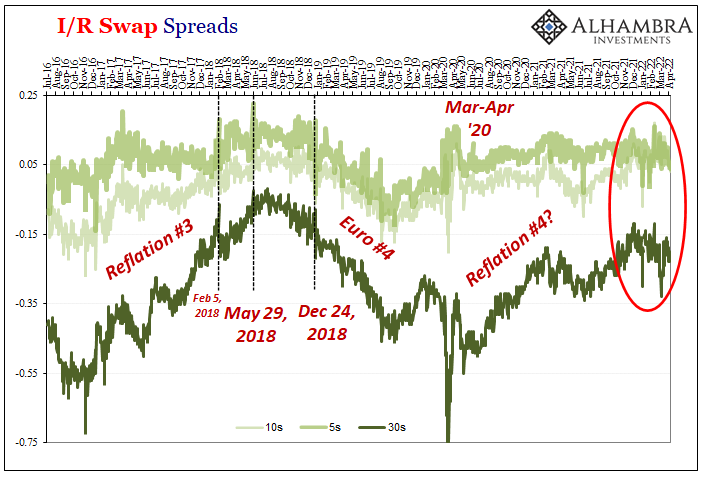

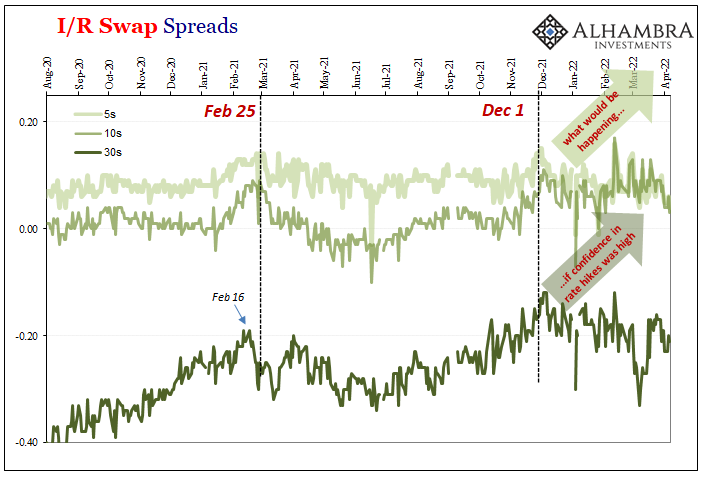

And it’s progressed in that manner like following some evil plan, or monetarily destructive template. Though the debt ceiling may have been resolved, collateral impairment has only gotten worse consistent with, first, curve behavior then alongside a bevy of corroborating market pricings, including, importantly, interest rate swaps (where are the rate hikes?)

Once set off by risk aversion for whatever reason, including this debt ceiling stupidity, collateral chains become impaired and contract, the multiplier (of reuse, repledge, and rehypothecate) shrinks and deflationary currency globally grows to a higher probability. That’s priced into curves just ike macro concerns.

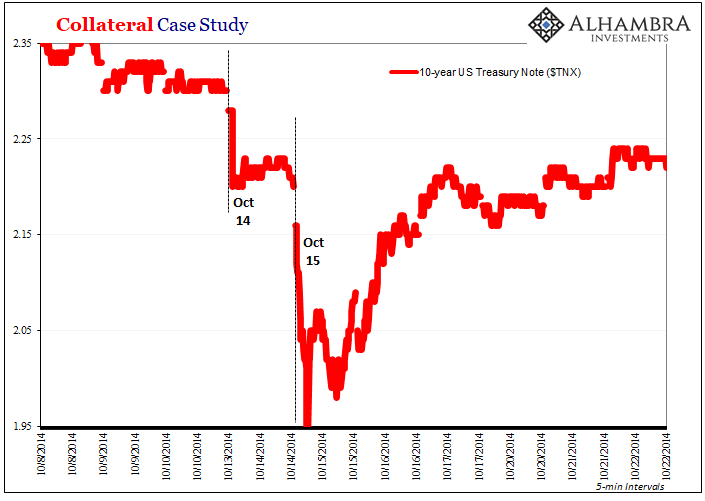

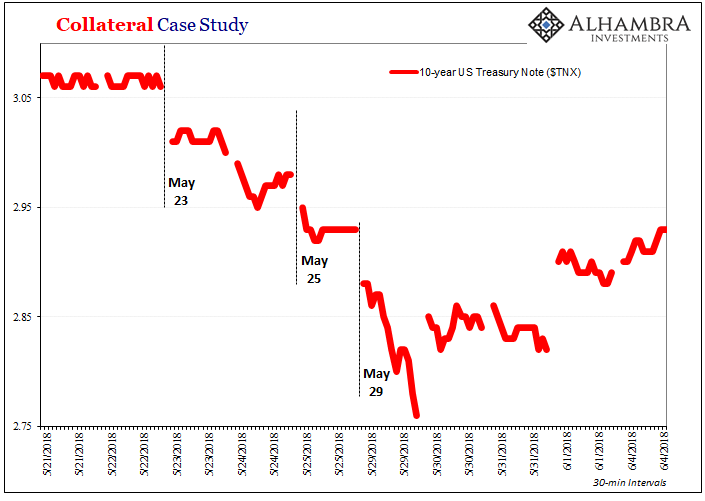

If left unchecked, it can lead to more devastating problems collateral-wise, a clear escalation in effective money/financial tightening. As October 2013 eventually became October 2014’s “collateral day”, similarly, combined with other factors, September 2017 eventually became May 2018’s collateral day.

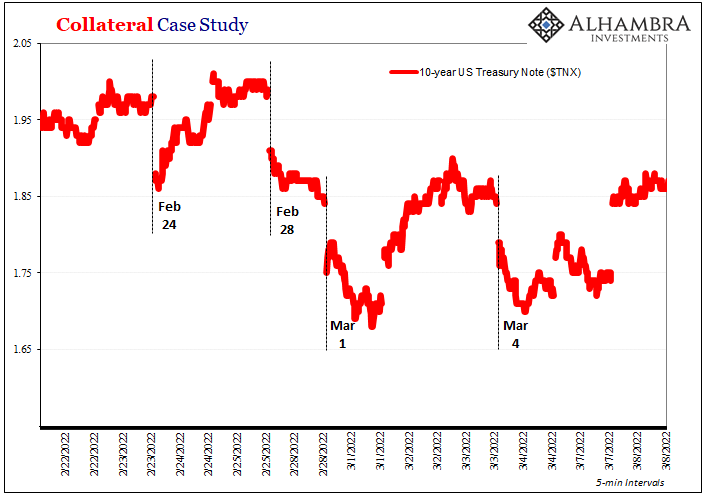

This time around, October 2021 debt ceiling leading to just five months later, right at the end of February and into the first few days of March, the world awestruck by Russian aggression, March 2022 collateral day(s).

In this latest one’s aftermath, it sure seems like collateral scarcity has been stepped up a notch perhaps two. The 4-week bill is no longer a few maybe five bps below RRP, it is often twelve to sixteen less. Yeah.

And look at repo fails (above). These jumped last October, as noted, then stepped up even more in this same first week in March right as that series of collateral days happened. Fails now the highest since 2020’s crisis.

As I wrote last August, don’t go looking to the Fed to adjust anything it might be doing (rate cuts, rate hikes, QE, QT) as a consequence of very real, and very clear, monetary thereby deflationary degradation:

The bigger problem is the other, that the Federal Reserve isn’t really a central bank at all. Instead, all it has at its disposal are interest rate targets and then bank reserves, each only parts of a program of psychological manipulation – which is really what bank reserves are largely intended for. Since they can’t fix collateral, and their proponents don’t really understand the full nature of it, it all comes down to just reserves as the sole policy choice in the vain hopes positive sentiment outweighs actual serious, systemic monetary breakdowns.

Curve inversion(s) only makes too much sense in light of those monetary breakdowns in evidence all across the financial landscape. There are any number of valid reasons why it had transitioned toward this direction back in October, too, including, yet again, stupid debt ceiling stuff. But it’s not really the debt, the ceiling, or the politics, those never change.

Unfortunately, on top of all its other unfixed shortcomings, the real currency in this eurodollar’s world just so happens to be tied to all that unnecessary noise.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

There is no debt ceiling. We own 80% of the oil in the world. It's really a collateral limit. Best part is nobody knows how much collateral there is. We got massive amounts of it in Alaska we're just sitting on.