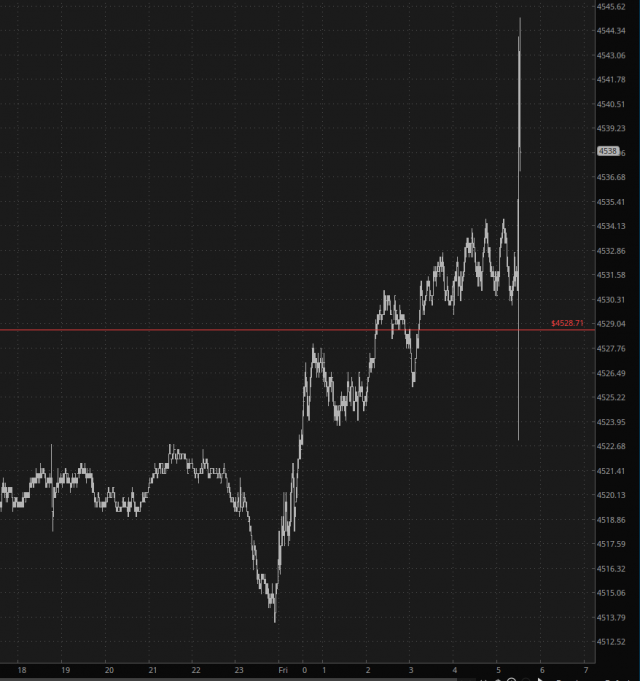

Employment Weakens

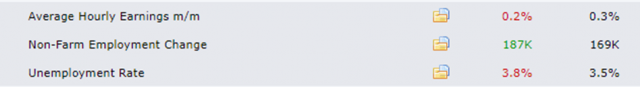

The monthly jobs report came out, and it has created exactly the kind of start that the bulls wanted. Weaker earnings. Weaker employment. High probability that the Fed is going to stop cranking rates.

(Click on image to enlarge)

Thus, the screen is all green .The S&P, NQ, and RTY are all spiking.

(Click on image to enlarge)

Bonds are also up, although not even above yesterday’s high, so it’s rather muted.

(Click on image to enlarge)

And the US dollar is in a free-fall.

(Click on image to enlarge)

It’s tough to know (impossible, really) where we’ll wind up at day’s end, since the market has to digest this news. Longer-term, the item I’ll be watching is the peak we saw on the /ES a month ago. If we push above that, it’ll add a lot more fuel to the bullish fire.

(Click on image to enlarge)

More By This Author:

Stop Playing Games, XLU!Annoyingly Sticky

It’s Time To Short META