Deflationary Signposts Manifest In Hard & Soft Data

QUICK QUILL — Will bond yields break down to the next resistance level? The data will test this in weeks to come.

(Click on image to enlarge)

TAKEAWAYS

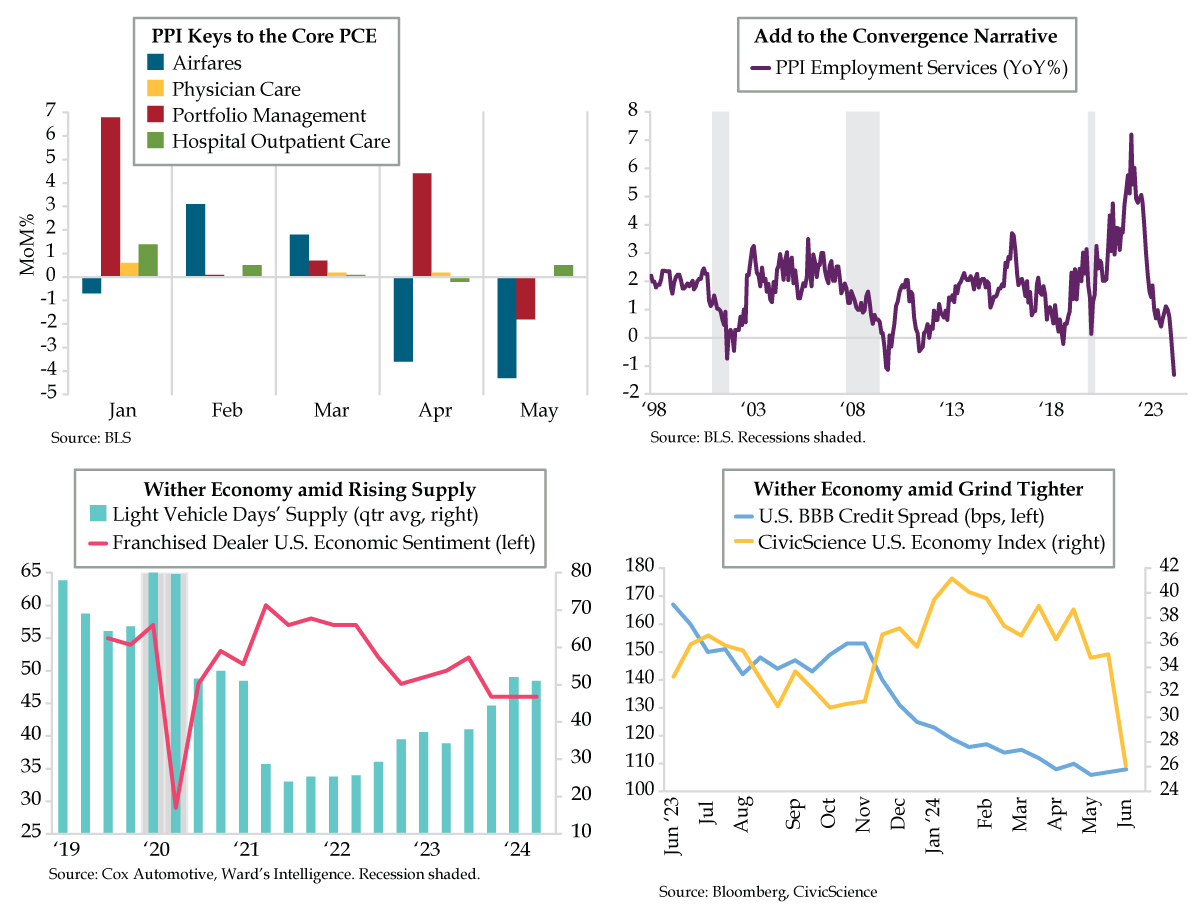

- As the Fed continues to stress the need to tackle inflation, the PPI headline cooled to a six-month low in May; PPI gauges for Airfares, Physician Care, Hospital Outpatient Care, and Portfolio Management, all of which feed into core PCE, have all slowed sharply in 2024

- PPI for Employment Services fell -1.3% YoY in May, a record low in data back to the late-90s; notably, the index peaked at 7.2% YoY in March 2022, the same month that Fed tightening began, a clear sign that higher rates have helped to curb wage pressures

- Dealer Sentiment as tracked by Cox Automotive has remained stagnant at 46 since Q4 2023, flagging revenue concerns from franchised dealers; with Light Vehicle Days’ Supply continuing to build, incentives should continue to put downward pressure on auto pricing

More By This Author:

Fed Policy Deaf To Entrenched Disinflationary ReadingsWhy The U.S. Is Already In A Recession

How An Eroding Job Market Could Cause Faster Rate Cuts

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!