Debt Catharsis

The ancient Greeks had a word κάθαρσις, which in English we now spell as “catharsis,” although it’s pronounced basically the same. It originally referred to purifying religious ceremonies, medical treatments, and so on.

Aristotle was the first we know to have used the word in a non-physical sense. He compared the emotions felt by spectators of Greek tragedy to a bodily catharsis. Tension builds until the audience feels the same intense emotions actors portray on stage. All this is released at a climactic moment, called the catharsis.

Our modern-day debt situation is a kind of Greek tragedy. A dramatic tension is certainly building. But a catharsis will come only when we, the audience, all become part of the story. We have to feel it. As of now, most of us aren’t.

After last week’s Supercycle of Debt letter I had a nice email conversation with the now-retired Martin Barnes, who as editor of The Bank Credit Analyst helped develop the debt supercycle theory. He believes the cycle changed after 2008 when focus shifted from the private sector to government. Martin expects markets to force a resolution, but not for a few more years.

On one level, delay is good. It gives us more time to prepare. The problem is “a few more years” will bring us to the late 2020s/early 2030s when the other cycles we’ve discussed (especially Neil Howe’s Fourth Turning but all the others as well) will be near their peaks, intensifying the pain.

Now, we could avoid that by getting the government debt under control sooner. That’s extremely difficult, though. Today I will show you why.

Fiendishly Hard

I have tried in various ways over the years to explain how balancing the budget, which sounds like it should be easy, is fiendishly hard—to the point even “fiscal conservatives” have mainly given up trying. They want to do it with mostly cuts in spending and progressives want to do it with mainly increased taxes. Inability to compromise (on both sides) means everyone just looks for ways to keep it from getting worse. And usually fails.

There IS a middle group that would do both (basically the Problem Solvers Caucus in the House launched in 2017, part of the No Labels movement, but they are 20% of Congress).

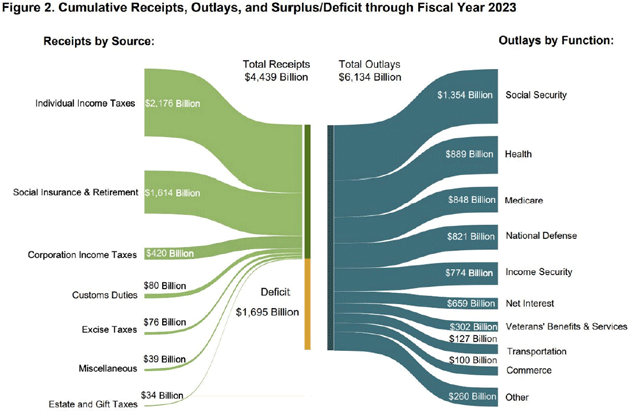

Here’s a graphic I think shows the problem. You see the different categories of tax revenue flowing in on the left and then spending categories on the right. The yellow portion of the middle bar—where there is spending but no revenue to cover it—represents the deficit.

(By the way, don’t quibble with the precise numbers shown. Their relative size is what counts. These numbers change slightly all the time. And after adjusting for the recent student loan rulings, my sources say the deficit is over $2 trillion! Lots of ways to look at this and play with the numbers.)

Source: The Kobeissi Letter

Eliminating the annual deficit—a necessary step to reducing debt growth—requires some combination of higher revenue and lower spending. And I stress “combination” because we simply aren’t going to do it with just tax increases or just spending cuts. Much of the spending is functionally off-limits, at least in the near term. Social Security and Medicare reforms might save some money over time, but they won’t do it next year. Net interest is untouchable. And is now a good time for defense cuts? Probably not.

Higher revenues are elusive, too. On paper, it may look like raising individual and corporate tax rates would close much of the gap. But not if it triggers a recession. And even without recession, taxpayers (wealthy or not) can modify their behavior. The wrong kind of tax changes could actually reduce revenue and enlarge the deficit. This has happened in the past. Incentives matter.

We Owe It to Ourselves

In less than four years total US debt will be north of $40 trillion. At 3% interest that is $1.2 trillion a year of interest payments, and at 4% that would be $1.6 trillion. Of course, debt that is owned by various government agencies of the Fed end up paying that interest to the government, so everyone focuses on net interest. Perhaps it is time to do a sidebar and talk about what I feel is the silliness of talking about debt held by the public as if that is all that matters.

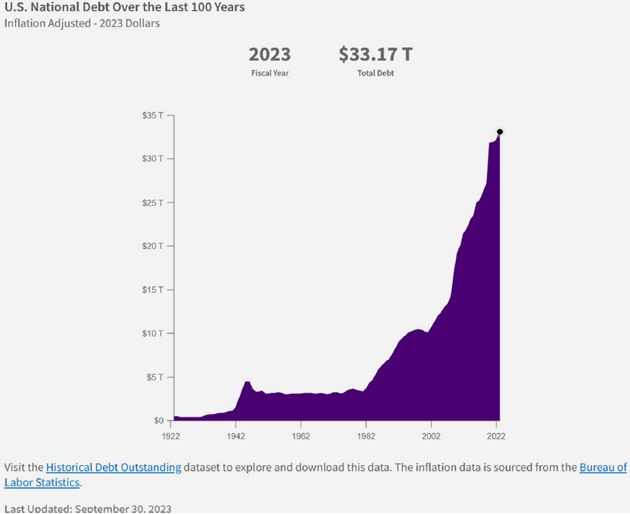

First, let’s look at the official total US debt data from the Treasury.

(Click on image to enlarge)

Source: US Treasury Department

The debt is now $33.7 trillion according to the wonderful data mavens at USdebtclock.org, or 124.4% of GDP. That number closely matches the official debt from Treasury when measured in real time. (You can see it at the top of the page on the link to the official Treasury website.)

Many economists prefer to talk about “debt held by the public,” now roughly $26 trillion, which is by definition smaller, and I assume they feel not as scary?

More By This Author:

Brushfires EverywhereSupercycle Of Debt

The Big Cycle 2