Czech Consumers Continue To Support The Economy, For Now

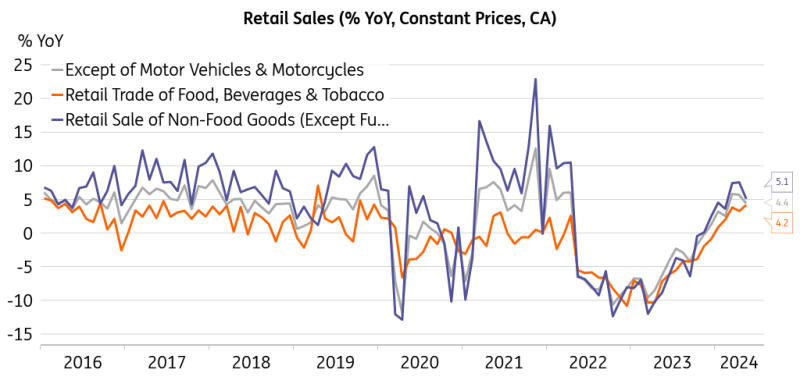

Retail sales maintained a solid annual pace of 4.4% in May yet came below market expectations and the previous reading. The outcome still suggests a positive contribution of household demand to the fragile economic rebound, but maintaining momentum ahead is far from certain.

Discretionary spending remains solid but positive trend wavers

Retail sales increased 4.4% in real terms from a year ago in May, while shedding 0.1% compared to the previous month. The annual reading came below market expectations but remains within the solid spending range. Sales of non-food goods added 5.1% annually, food sales increased 4.2%, and fuel sales gained 2.2% from a year earlier.

Growth in retail sales is solid, but momentum has stalled

(Click on image to enlarge)

CZSO, Macrobond

Discretionary spending remained strong, as sales in non-food non-specialised stores maintained a double-digit annual growth rate of 13.2% in May. Meanwhile, sales in food-dominated non-specialised stores increased by 4.9%, and spending in food-dominated specialised stores shed 2.0% from a year ago.

The supply side has to be supportive to preserve the positive outlook

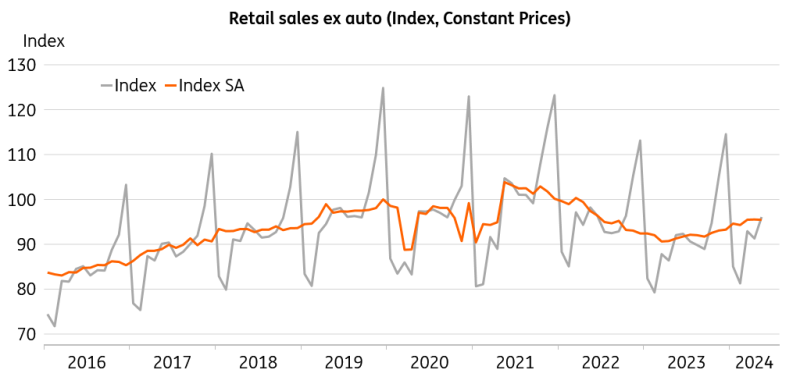

Overall, this is still a relatively solid reading of consumer spending in real terms, pointing to a positive though moderate contribution of household demand to 2Q real GDP dynamics. However, the production side of the export-driven economy is somewhat limited by only a hesitant pickup in orders from abroad. If the industrial performance fails to lend adequate support to the still fragile recovery, consumers might face challenges in the second quarter strained by doubts about the solidity of the economic outlook.

Seasonally adjusted retail sales tread water

(Click on image to enlarge)

CZSO, Macrobond

Our projection of 1.1% economic expansion for this year is rather conservative and can still be achieved. However, the recovery could come under pressure should the demand from the country's main trading partners stall and industrial performance not gain solid ground. A mediocre performance in industry would, in turn, put a lid on future wage increases, and the feedback loops would start working against the rebound.

More By This Author:

FX Daily: The Only Fireworks Are In The USRates Spark: Euro Rates Almost Back To Normality

Asia Morning Bites For Thursday, July 4

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more