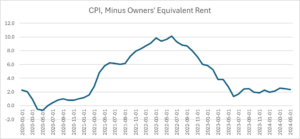

CPI Without Owner’s Equivalent Rent Has Been At Fed Target For A Year

That’s a bit of an exaggeration, but the CPI, excluding owners’ equivalent rent (OER) fell to 1.4 percent in June of 2023 and has remained pretty close, but mostly above 2.0 percent ever since. We all know the Fed targets the Personal Consumption Expenditure Deflator, where the OER has a smaller weight, but it is still worth seeing how much this one category affects the CPI.

OER is not just a major expenditure category, it is also unusual in the sense that literally no one pays it. This is the rent that homeowners would be paying themselves if they had to rent the home they lived in. For this reason, it’s probably fair to say that no one considers themselves worse off because OER has risen. (They may consider themselves poorer because the cost of buying a home has increased, but that is a somewhat different question.)

Anyhow, here is the picture since the start of 2020.[1]

Source: Bureau of Labor Statistics and Author’s Calculations.

As can be seen, just before the pandemic inflation minus OER was actually slightly above the Fed’s 2.0 percent target. With the pandemic shutdowns it plunged and even briefly turned negative. It then accelerated sharply in early 2021 as supply chain issues sent inflation soaring. OER actually dampened inflation somewhat as it was peaking in the spring of 2022. It would have scraped into the double-digits in June 2022. It then fell sharply over the next year, bottoming out at 1.4 percent in June of 2023. Since then, it has bounced around some but remained reasonably close to 2.0 percent.

Apart from the issue that no one pays OER, there is a reason to be interested in the CPI excluding both the current OER measure as well as the measure of rent proper. We know that inflation in both measures will be headed sharply lower in the months ahead, because indexes we have that measure the rents on units that change hands are showing sharply lower rents.

The CPI rental indexes are being held up now by leases signed one or more years ago. When these leases are up for renewal, they will show much lower increases, and many may report rent declines. As these new leases get incorporated in the CPI, the inflation shown in its rental indexes will fall sharply, possibly near zero. Instead of being a factor pushing up the overall inflation rate, rent may be a factor pulling it down.

More By This Author:

No, The Saving Rate Is Not Near A Record Low

The Media Are Going Nuts On Tariffs, Why Are They Fine With Government-Granted Patent Monopolies?

Productivity Growth And The Scary Stories About Rising Retiree To Worker Ratios