CPI Cools But Inflation Far From Whipped

The Federal Reserve got just the news it needed to plausibly go forward with a soft pivot in its monetary policy and begin to slow its pace of rate hikes. But while price inflation appears to be retreating, it’s far from beat.

The Consumer Price Index (CPI) for November came in lower than expected, according to the latest data from the Bureau of Labor Statistics.

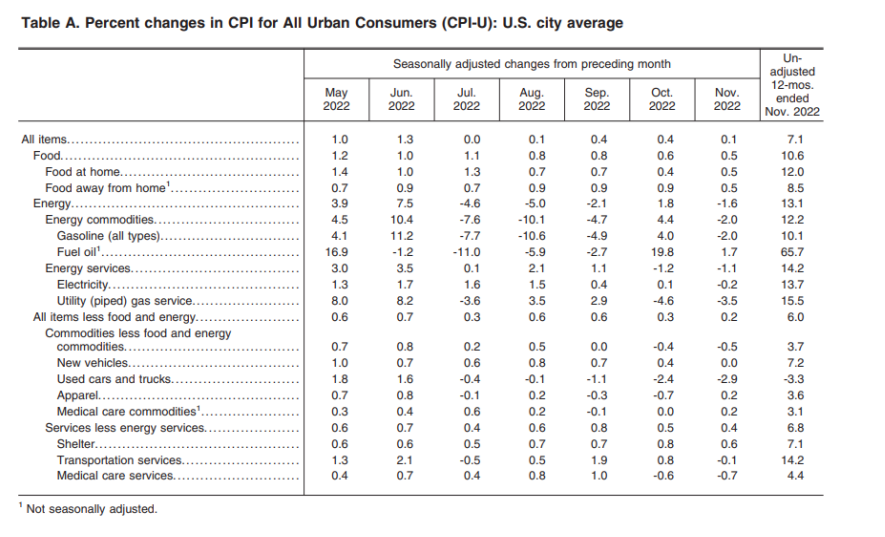

CPI rose a modest 0.1% month-on-month in November. The consensus was for a 0.3% increase. On an annual basis, CPI rose 7.1%, below the 7.3% expectation. To put the number into perspective, CPI in November 2021 was up 6.8%. That means over the last 2 years, CPI has risen 13.9%.

Core CPI, stripping out more volatile food and energy prices, rose 0.2% on the month. Year-on-year, core CPI was up 6%. Those numbers were also lower than expected.

Keep in mind, inflation is worse than the government data suggest. This CPI uses a formula that understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers — a historically high number.

Food prices remain stubbornly high. The food price index was up 0.5% on the month and 10.6% on an annual basis. Shelter costs were up 0.6% on the month.

A big 1.6% drop in energy prices helped push the overall CPI downward. There was also a significant 0.5% decrease in commodity prices, driven by a falling dollar.

Stocks immediately rallied on the news. The Nasdaq rose just over 1% on the day, despite some late selling. Gold pushed back above $1,800 an ounce. Meanwhile, the dollar index plunged from around 104.9 to 103.8 when the CPI data came out. The markets clearly think inflation has peaked and the Fed will seize on this news and slow monetary tightening.

An economist quoted by CNBC summed up the giddiness in the mainstream.

“Stick a fork in it, inflation is done.”

Peter Schiff summed up the market reaction in a tweet.

The salient point is not whether #inflation has peaked (it hasn't), but the unpleasant reality that inflation will not return to levels anywhere near 2% during the foreseeable future. This is the game changer for the #Fed. Most investors have no clue how to play by the new rules.

— Peter Schiff (@PeterSchiff) December 13, 2022

Schiff makes a salient point. While price inflation is trending downward, it isn’t anywhere near the mythical 2% Fed target. Meanwhile, producer prices rose more than expected in November, meaning there could still be some more consumer price increases in the pipeline as businesses pass those costs on. Saying inflation is “done” is clearly a bit premature. Nevertheless, the markets seem to believe the war on inflation is nearing an end.

It’s important to remember that an end to the war on inflation means more price inflation.

When the Federal Reserve goes back to rate cuts and ends balance sheet reduction, that means a return to accommodative monetary policy and money creation. Money creation is inflation. Price inflation is a symptom of monetary inflation. In effect, the markets are begging for a return to inflation because they think the Fed has beaten inflation.

It is reasonable to think that the CPI will continue to cool. The math works in its favor. We have big month-on-month increases from 2021 rolling out of the annual average. That pushes the yearly increase lower. Meanwhile, the economy is slowing. Make no mistake, high interest rates are subduing economic activity. An economy built on easy money and credit can’t function in this high-interest rate environment.

But the bigger problem is that this “high” interest rate environment is high enough to break the economy but still not high enough to truly tame inflation.

Two things need to happen in order to beat inflation. We need positive real interest rates — an interest rate above the CPI. And we also need the US government to cut spending and stop running huge budget deficits. A Fed paper admitted that it can’t tame inflation with monetary policy alone, saying, “When the fiscal authority [the federal government] is not perceived as fully responsible for covering the existing fiscal imbalances, the private sector expects that inflation will rise to ensure the sustainability of national debt.”

I think it’s just a matter of time before something breaks in this debt-riddled, bubble economy. When that happens, the Fed will likely shift from a soft pivot to a hard pivot. To use a favorite Fed term, any cooling of the CPI is likely to be “transitory.”

More By This Author:

Budget Deficit: Is The Surge In Tax Revenues Over?

Producer Prices Rise More Than Expected In November

American Consumer Debt Continues Its Relentless Climb