CPI And PCE Deflator Differential And Differences

The interesting thing is that since the PCE runs consistently 2pp below CPI.

This struck me as a surprising stylized fact, at variance with what I knew from various analyses I’d conducted. I wrote that the difference was about 0.45 ppts over 1986-2019. Mr. Hall then cited a MorningStar report notes:

at its peak in the summer of 2022, CPI inflation was almost 2 full percentage points higher than PCE inflation (9.0% vs. 7.1%).

Well I certainly can’t deny this is the case. However, then one has to wonder about the statement:

The interesting thing is that since the PCE runs consistently 2pp below CPI.

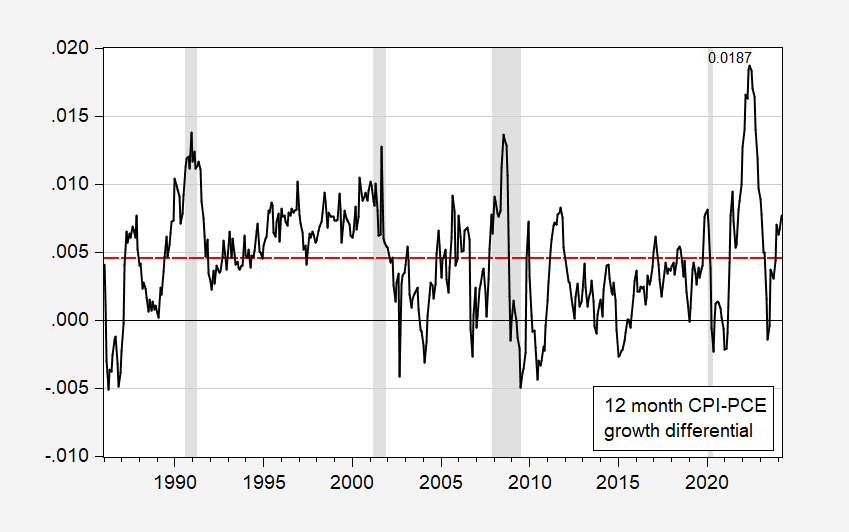

I do not think one month of inflation differential at 1.87 ppts constitutes “consistently”.

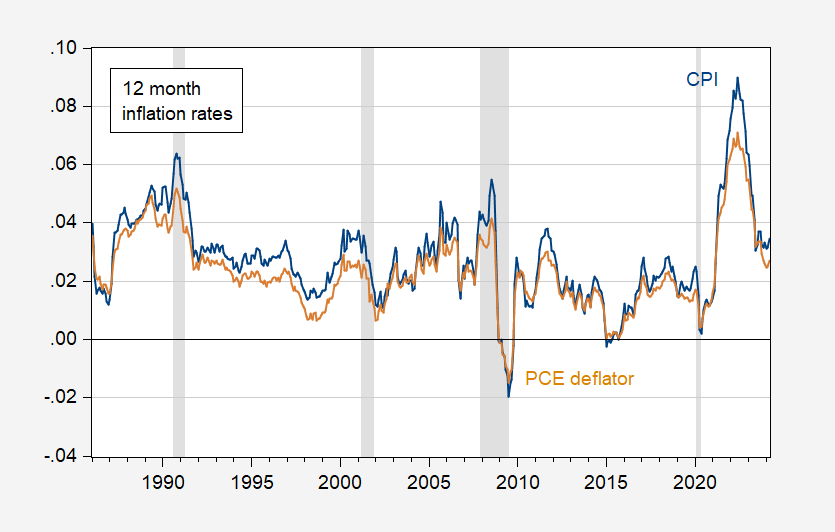

To confirm, here are 12 month inflation rates, 1986-2024 (Great Moderation onward):

Figure 1: CPI 12 month inflation rate (blue), PCE deflator (tan). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, BLS via FRED, NBER, and author’s calculations.

Doesn’t look like “consistent” is the appropriate adjective to me. By the way, the difference is 1.87 ppts at maximum (one month). It’s 1.83 the subsequent month.

What does the differential look like over time? This is shown in Figure 2, with a red dashed line at the (average) differential value for 1986-2024M03. The red dashed line is obtained using a regression of the CPI inflation rate minus PCE deflator inflation rate.

Figure 2: CPI-PCE deflator 12 month differential (black). Red dashed line at average value for 19986-2024M03. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, BEA, NBER and author’s calculations.

Now, is it true that CPI is a “better” measure of consumer goods and services costs? Yes, probably for the costs that consumers face, as opposed to the cost of goods and services households consume (keeping in mind that for some things, e.g., health care, the consumer does not face all the costs). On the other hand, we know that CPI is quasi-Laspeyres (while PCE deflator is chain-weighted). This base-weight issues is somewhat minimized as CPI has gone to annual changes in some weights, making it closer to the chain-weighted CPI.

More By This Author:

Monetary Policy Rates Around The WorldDoes The Fed Deserve Credit For The Disinflation?

Market Expectations On Fed Funds, Spreads, Inflation Post-CPI Release

Disclaimer: This information is presented for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy any investment products. None of the ...

more