Cooking Oil And Trading Profits

Image Source: Unsplash

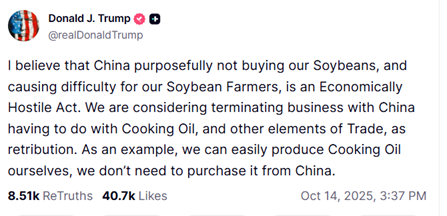

It’s not always clear what might matter to traders on a given day. Certainly, there are things that always matter, such as reports on inflation and employment, even though we’re getting precious few of them during the ongoing government shutdown. Corporate results are another, and we’re starting to get plenty of them.Imagine my surprise yesterday, when I was en route to a media visit, prepared to discuss the huge turnaround in stocks, only to find that a spurious comment about cooking oil had turned stocks lower.

First, it’s important to understand why I could miss such a thing.I vastly prefer to talk to people face-to-face, so if I have the ability to visit a TV/radio studio or address a conference in person, I take it.Yes, one can successfully chat over Zoom, Teams or whatever – and I’m glad to do so when invited to address a faraway audience – but there is something to be gained from reading the other person’s non-verbal cues that don’t necessarily show up during a remote conversation. Also, it’s easier to chat with the hosts and producers before and after the on-air discussion.The downside, of course, is that I have to take my eyes off the markets during at least part of the journey. Thus, I was in an elevator when the President threatened to terminate purchases of Chinese cooking oil.

Source: Truth Social

My comment at the time was, “who knew that cooking oil was a thing?” Of course, I know it’s a “thing” – I cook, sometimes with oil.What I meant was that I had no idea that it could turn a robust market southward. Pre-market futures were sharply lower on perceptions that there was another bout of trade friction between the US and China, but stocks mounted a steady, day-long comeback once the focus shifted once again to dip buying after generally well-received bank earnings.But this exposes a feature about market mentality.If a certain type of news item is blamed or credited for sending stocks on a sizeable move down or up, traders will be keenly attuned to any related news of that ilk until it is evident that it no longer moves prices meaningfully.Friday’s out-of-the-blue 100% tariff threat pulled the rug out from under a steady market advance, while Monday saw a relief rally based upon more conciliatory rhetoric. The cooking oil comments put that on hold, though much less vigorously than what we saw last week.

Today we opened with another robust rally, though it had faded a bit by midday. One of the reasons for the enthusiasm was another round of well-received bank earnings reports, this time from Bank of America (BAC) and Morgan Stanley (MS) among others.These followed gains from Wells Fargo (WFC) and Citigroup (C) on solid results yesterday. JPMorgan (JPM) slipped yesterday despite beating on most metrics and has recovered those declines and then some this morning.The same can’t be said for Goldman Sachs (GS), though had it recovered from a sharp early loss by about 2pm yesterday before fading in the last hour.

Faithful readers will know that I am not a fan of having banks lead the earnings parade.They are far more dependent upon the level of interest rates and the shape of the yield curve than other businesses, and very few companies outside those in commodities-dependent industries have any substantial reliance upon trading profits.As a proprietary trader at a publicly traded firm, the last part especially galled me.We would work our tails off to deliver profits to our shareholders, yet the analysts tended to view them as spurious and difficult to model, despite our admirable track record.Thus, I was surprised that media reports credited some of MS’ performance to trading profits.It’s nice for MS shareholders, and there were clearly other facets of their business that are doing quite well, but I found it notable to see that trading profits seemed to matter for at least one firm today.

This can be the trickiest part of investing and trading. Some news that seems relatively insignificant on a normal day can have an outsized effect on another. This is why we always need to be nimble, and risk managed. You never know when or where the next surprise emerges.

More By This Author:

Death, Taxes, Dip BuyingTariff Rug Pull

Forecast Traders Expect An Oct. 21 Reopening, But The Fed’s Weekly Economic Index Isn’t Suspended Tomorrow

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more