China/US Trade – Finding A Signal Amidst The Noise

The celebration of the Trump/Xi dinner in Buenos Aries lasted about three hours. What went wrong? This reaction was not a complete surprise, but the size and rapidity were attention-grabbing.

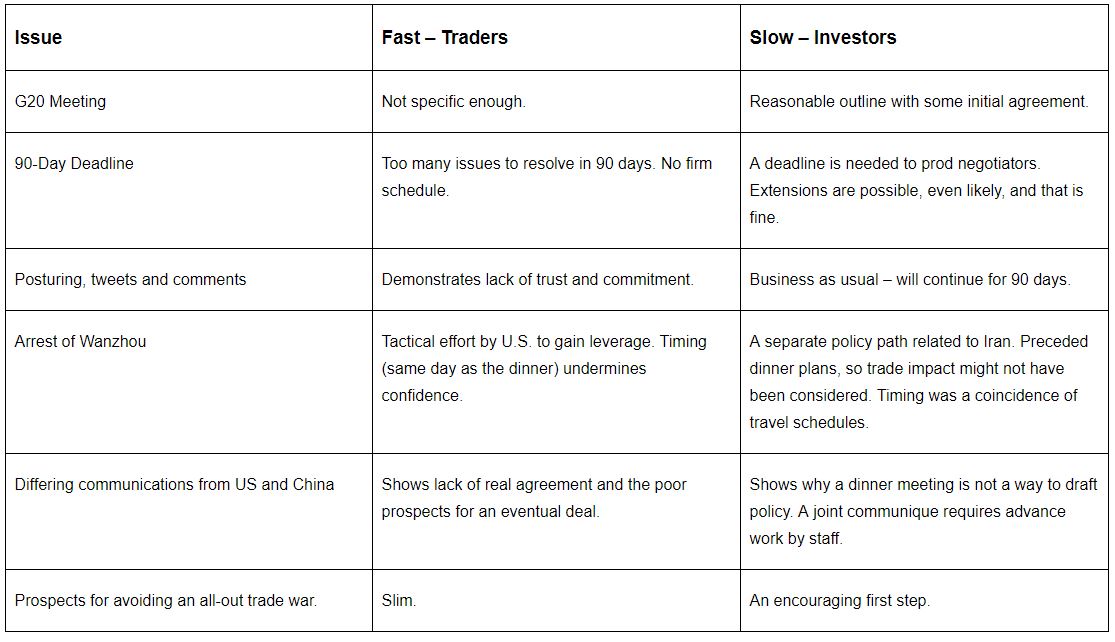

The market reaction fits the description I suggested in May: Trading, Fast and Slow. A small piece of news leads to a cascade of trading – algorithms trained to watch for key words, humans making a short-term directional play, technicians noting the “violation of key support or resistance,” and the subsequent media explanations. This confers an undue legitimacy on noise – tidbits of news without any context.

Here is how it plays out on the China/US trade story. In each case let’s try to separate trading “fast” reactions from trading “slow.”

(Click on image to enlarge)

Conclusion

This is a typical example of the trading community’s failure to understand politics, negotiation, and compromise. I have highlighted this before on issues like Greece and the asserted collapse of Europe and concerning various US policy debates.

Here is what we should expect:

- Decades of history will not be reversed in a few months. Be happy for some progress.

- The outcome will be a compromise. It will not be a complete success for either side, but each will trumpet what they have accomplished.

- Nothing big will happen until the last minute. This is the way that partisans demonstrate they have accomplished as much as possible.

- Eventual relief on the most important reciprocal tariffs.

- Some progress on the intellectual property issues.

- Some immediate relief on existing boycotts, e.g. soybeans.

I expect significant improvement from current expectations for two reasons:

- It is in the interest of all. Political processes gravitate toward these outcomes.

- Trump supporters are feeling pain and will exert increasing pressure for a deal.

Long-term investors should emphasize legitimate signs of progress or failure, avoiding the false drama of the daily “explanations.”

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each ...

more