Charted: How Americans Feel About Federal Government Agencies

Chart: How Americans Rate 16 Federal Government Agencies

Come election time, America won’t hesitate to show its approval or disapproval of the country’s elected political representatives. That said, feelings about the federal bureaucracy and its associated agencies are a little harder to gauge.

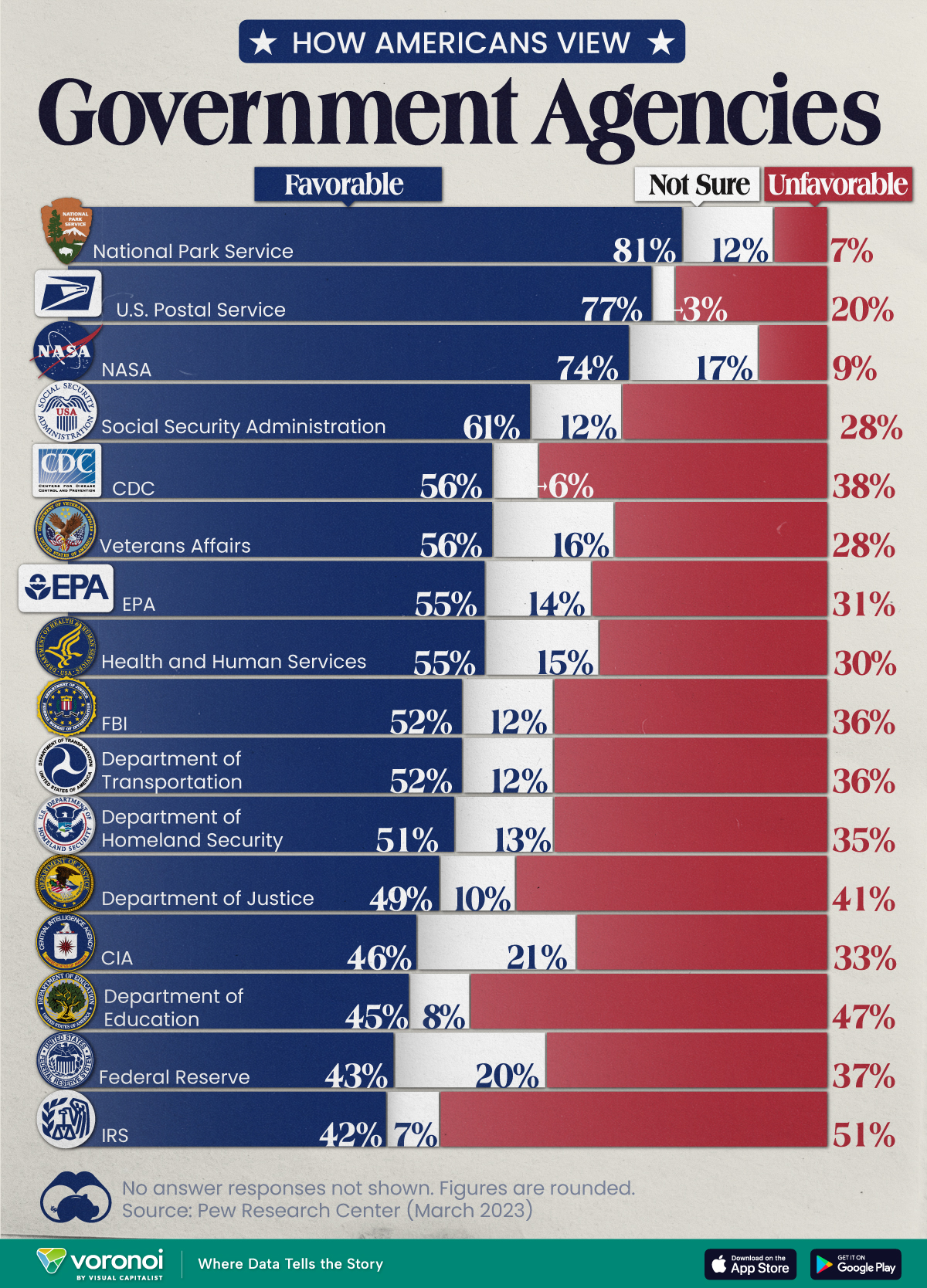

We chart the results from an opinion poll conducted by Pew Research Center between March 13-19, 2023. In it, 10,701 adults—a representative of the U.S. adult population—were asked whether they felt favorably or unfavorably towards 16 different federal government agencies.

(Article continues below infographic).

(Click on image to enlarge)

Americans Love the Park Service, Are Divided Over the IRS

Broadly speaking, 14 of the 16 federal government agencies garnered more favorable responses than unfavorable ones.

Of them, the Parks Service, Postal Service, and NASA all had the approval of more than 70% of the respondents.

| Agency | Favorable | Unfavorable | Not sure |

|---|---|---|---|

National Park Service National Park Service |

81% | 7% | 12% |

U.S. Postal Service U.S. Postal Service |

77% | 20% | 3% |

NASA NASA |

74% | 9% | 17% |

Social Security Social SecurityAdministration |

61% | 28% | 12% |

CDC CDC |

56% | 38% | 6% |

Veterans Affairs Veterans Affairs |

56% | 28% | 16% |

EPA EPA |

55% | 31% | 14% |

Health & Human Health & HumanServices |

55% | 30% | 15% |

FBI FBI |

52% | 36% | 12% |

Department of Department ofTransportation |

52% | 36% | 12% |

Department of Department ofHomeland Security |

51% | 35% | 13% |

Department Departmentof Justice |

49% | 41% | 10% |

CIA CIA |

46% | 33% | 21% |

Department Departmentof Education |

45% | 47% | 8% |

Federal Reserve Federal Reserve |

43% | 37% | 20% |

IRS IRS |

42% | 51% | 7% |

Note: Figures are rounded. No answer responses are not shown.

Only the Department of Education and the IRS earned more unfavorable responses, and between them, only the IRS had a majority (51%) of unfavorable responses.

There are some caveats to remember with this data. Firstly, tax collection is a less-friendly activity than say, maintaining picturesque parks. Secondly, the survey was conducted a month before taxes were typically due, a peak time for experiencing filing woes.

Nevertheless, the IRS has come under fire in recent years. As per a New York Times article in 2019, eight years of budget cuts have stymied the agency’s ability to scrutinize tax filings from wealthier and more sophisticated filers.

At the same time poorer Americans are facing increasing audits on wage subsidies available to low income workers. According to a Transactional Records Access Clearinghouse report, this subset of filers was audited five-and-a-half more times the average American.

More By This Author:

Visualizing Copper Production By Country

Mapped: Southeast Asia’s GDP Per Capita, By Country

Charted: What Southeast Asia Thinks About China & the U.S.

Disclosure: None